Auditing

Accounting Firms Are Messing Up on Audits at an Unacceptable Rate, Says PCAOB Chair

A new report shows a year-over-year increase in the number of audits with deficiencies at firms that the PCAOB inspected in 2022.

Aug. 08, 2023

Champions of audit quality will not be happy with this news from the Public Company Accounting Oversight Board (PCAOB). A staff report released by the audit regulator late last month shows a year-over-year increase in the number of audits with deficiencies at audit firms that the PCAOB inspected in 2022.

The report, “Staff Update and Preview of 2022 Inspection Observations,” presents aggregate observations from the PCAOB’s inspections of certain public company audits conducted by 157 audit firms in 2022.

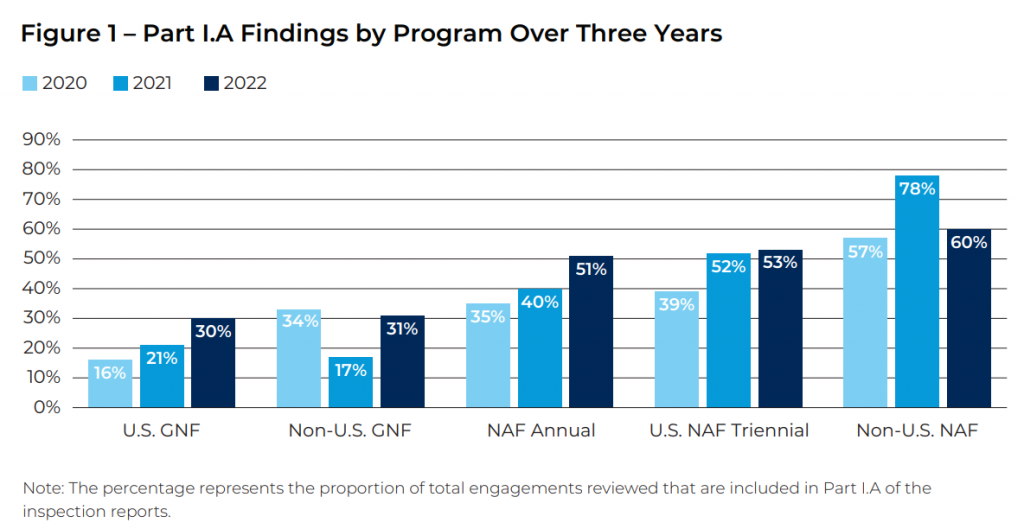

According to the report, PCAOB staff expects approximately 40% of the audits reviewed will have one or more deficiencies that will be included in Part I.A of the individual audit firm’s inspection report, up from 34% in 2021 and 29% in 2020.

Part I.A of the PCAOB’s inspection reports discusses deficiencies, if any, that were of such significance that PCAOB staff believes the audit firm, at the time it issued its audit report(s), had not obtained sufficient appropriate audit evidence to support its opinion on the public company’s financial statements and/or internal control over financial reporting (ICFR).

The most significant increase in audit deficiencies was among inspections of large audit firms with global networks, like the Big Four, BDO, RSM, Grant Thornton, and Mazars, for example. U.S. member firms saw their collective error rates rise from 21% in 2021 to 30% in 2022, while non-U.S. global network firms had deficiency rates that increased from 17% in 2021 to 31% in 2022.

PCAOB Chair Erica Williams called the report’s findings “absolutely unacceptable” and said audit firms “must make changes to turn things around and live up to their responsibility to investors.”

“The PCAOB will continue demanding firms do better, conducting transparent inspections, and bringing strong enforcement actions where appropriate,” she said.

The 2022 update and preview report also notes the following:

- PCAOB staff continued to see the same financial statement deficiency areas (excluding ICFR), such as revenue and related accounts, business combinations, inventory, and long-lived assets.

- PCAOB staff expects that approximately 46% of the audits reviewed will have one or more deficiencies discussed in Part I.B of the individual firm’s inspection reports, up from 40% in 2021 and 26% in 2020. In Part I.B of the PCAOB’s inspection reports, PCAOB staff provides observations regarding instances of noncompliance with PCAOB standards or rules that do not relate directly to the sufficiency or appropriateness of evidence the audit firm obtained to support its opinion(s), such as critical audit matters, Form AP, and certain independence related deficiencies.

- Some audits have both Part I.A and Part I.B deficiencies, so PCAOB staff expects that approximately 61% of the 710 audits the PCAOB reviewed in 2022 will have one or more Part I.A and/or Part I.B deficiencies, up from 55% in 2021 and 44% in 2020.

- In their inspections, PCAOB staff observed positive practices that the staff believes may be effective in enhancing a firm’s quality control system and audit quality generally. The report discusses these good practices, particularly in the context of risk assessment, use of practice aids, use of individuals with specialized skill or knowledge, and supervision and review.

The PCAOB recently unveiled six new search filters that allow investors, audit committee members, and other stakeholders the ability to analyze and compare data from more than 3,700 inspection reports.