By David Woodworth.

Before early 2024, tax teams must learn how to balance the additional requirements of the Base Erosion and Profit Shifting (BEPS) 2.0 Pillar Two agreement, while prioritizing strategic, value-add activities. BEPS 2.0 Pillar Two will impose new data reporting requirements and additional global tax compliance challenges for multinational business with turnover greater than 750M EUR. In an environment where tax planners already spend too much time cleansing and manually entering data, it’s critical to find ways to shift focus to analysis and prepare for the next tax year.

Tax teams should be able to focus on collaboration, preparations, and forecasting for the upcoming tax season, while promoting flexible solutions. To accomplish this in today’s volatile economy, teams need to establish proper best practices to get ahead of their own data, reduce silos, and improve analytics. But nearly 60% of organizations with 1000+ employees are still reliant on spreadsheets in the tax process.

This results in siloed, error-prone data, and means teams that are already juggling inefficient data management strategies will have yet another addition to think about in the new year once BEPS Pillar Two takes effect. Setting yourself up for success looks like tax managers focusing on continued innovation, and ultimately overcoming larger challenges in the industry when it comes to their data. Organizations should aim to remove inefficient and time-consuming processes associated with tax reporting, while empowering tax managers to collaborate with the executive team and prioritize strong policies.

Why BEPS?

BEPS 2.0 aims to create a more level playing field for global taxation, making it increasingly difficult for corporations to benefit from shifting their profits to low-tax countries. BEPS 2.0 consists of two broadly defined provisions, known as “pillars.” The goal – address tax avoidance, establish consistency among international tax rules, and provide a more transparent tax environment for all international businesses. Pillar One pertains to the allocation of business profits to various countries based on actual business activities in each of those nations. Pillar Two will affect a much larger number of companies, establishing an effective global minimum tax rate of 15%.

Each of these pillars pose a significant challenge for tax calculations. Tax advisors and planners will be handling more data, with more complexity and accuracy required than ever before. Further, teams need to adapt to a shifting landscape of rules as the framework evolves over time.

BEPS also requires that companies itemize their revenues by country, and as taxation bodies develop more sophisticated models that compare BEPS data with corporate tax return data, there may be an increase in investigations. Inconsistent data leads to errors in tax reporting and forecasting, which could result in enormous financial and legal costs if data and process are not aligned.

Based on recent surveys, 71% of IT departments say that operational reporting currently costs at least one day per week (on average). As made clear by this statistic, corporate tax accounting teams already spend an enormous amount of time and money cleansing and manually rekeying data before it is integrated with finance systems. This influx of data from BEPS 2.0 will have a wide-reaching impact on manual processes, slowing time-to-insight even further and preventing organizations from realizing the full impact of their financial data.

Prep for BEPS 2.0 Pillar Two

Tax teams need to make sure they have the most up-to-date and accurate data in their reporting to to reduce risk of potential penalties. Integrating new technology and prioritizing the right data initiatives before 2024 can better align teams and will play an essential role in seamlessly transitioning into this new era of regulation and improving tax reporting.

There are four specific steps leaders can take today to prepare for the implementation of Pillar Two, while providing the support their tax teams need:

1. Identify the current state of business – Tax team leaders should work with their executive team to grasp the top factors that may impact business operations and align that list of drivers around corporate strategy.

Teams need to identify what their goals around incorporating new technology will be, such as removing data silos or minimizing Excel workbook use. Integrating a new technology and data strategy provides an important opportunity for tax teams – with the right tools they can demonstrate the strategic value of tax accounting to others in the organization, including executive management.

2. Assess and select the best data strategies – Once teams understand where improvements can be made and how they can begin to make those changes, they can start researching solutions for both tax compliance and data organization.

By implementing automation in their data strategy, such as the elimination of manual processes built on large collections of spreadsheets, teams can prepare for BEPS new data gathering, calculation and reporting requirements while also organizing disconnected data across the enterprise.

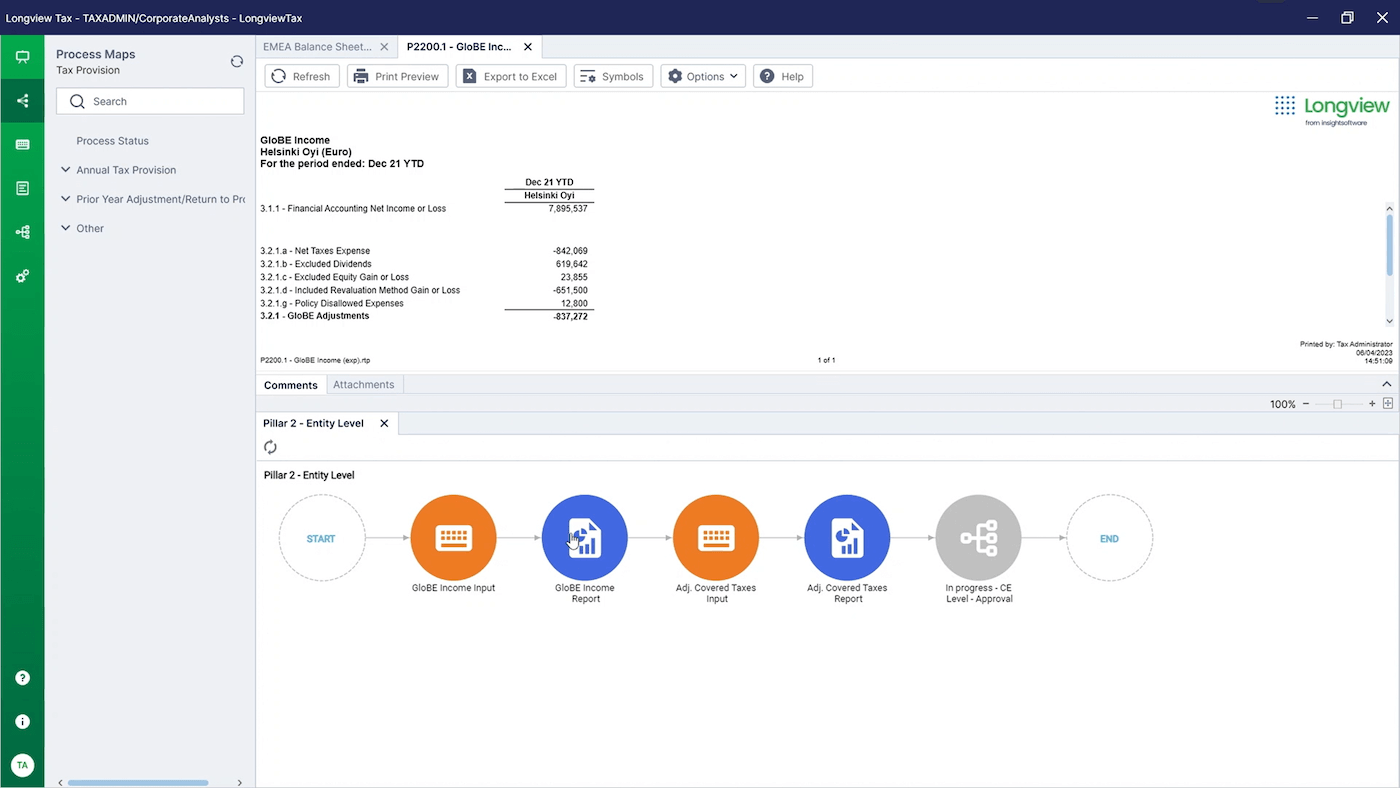

This also means teams need to define their long-term vision for Pillar 2 reporting and find a strategy that can expand and grow as company needs change. This can be supported by identifying the right technology that can natively support and incorporate the new framework, while integrating with multiple ERP, EPM, and other systems to ensure they are collecting the most accurate data and results.

3. Implement and test any chosen solution – By organizing data now, before the implementation of Pillar Two, tax teams will have enough time to guarantee whatever strategies they choose are the best ones for their organization and begin to draw valuable analytics. This timeline should include IT procurement, a configuration period, and plenty of time to test any invested solution to meet company needs.

4. Roll out initiatives company-wide – Once solution and data initiative testing is complete, teams can move on to training and rolling out to a wider user base. The ultimate goal is to allow tax teams to do more with less and save time on tedious data-entry tasks. From there, teams need to constantly monitor and maintain their technology to stay updated and flexible with BEPS, and other tax regulations. When every member of the team uses the same tools in a collaborative way, the team can shift its attention to high-value activities.

The future of BEPS

BEPS 2.0 is just the beginning, and we can expect to see many adjustments to this framework, as well as new regulations in the coming year(s) as the world continues to adjust post-COVID. Finance leaders can’t wait until the last minute to understand and manage their group company’s effective tax rate. Under Pillar Two, this will become even more of a liability as we see an increase in government audits to ensure compliance.

Companies that want to make sense of their options, and stay ahead of changes, should consider what smart data systems will be best for the organization now, to benefit from continued smart corporate tax strategies in the years ahead. This will become essential for tax teams so that they can proactively develop more agility and resilience to respond to changing market dynamics.

====

David Woodworth is the CFO of insightsoftware, a global provider of reporting, analytics, and performance management solutions. A proven transformational business leader, David has focused on driving value in both publicly traded and privately held companies with ambitious growth goals requiring strategic redirection, operational reorganization, and/or financial recapitalization.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Firm Management, Taxes