Taxes

Democrat and Republican Representatives Introduce Bill to Simplify Tax Extensions

The bill would allow taxpayers to automatically qualify for an extension without fear of penalty by paying a simple, easily-calculated amount of 125 percent of their prior year’s tax liability.

May. 25, 2023

On May 22, 2023, Reps. Judy Chu (Dem. – CA-28) and Mike Carey (Rep. – OH-15) introduced the Simplify Automatic Filing Extensions (SAFE) Act of 2023, new bipartisan legislation to simplify and streamline the tax filing extension process.

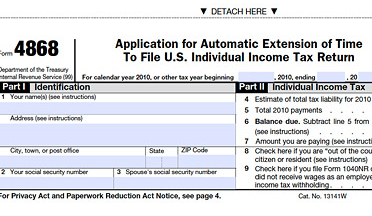

Each year, millions of individuals file for a six-month extension on their federal tax return, and that number is at record highs and growing every year. However, complying with the rules for an automatic extension is burdensome for both taxpayers and for the Internal Revenue Service (IRS). Under current law, the Internal Revenue code requires taxpayers to pay “properly estimated” tax liability for the current year along with their extension request. If this estimated payment is inaccurate, there is a risk that the extension could be deemed inaccurate, and the taxpayer will owe penalties. Therefore, in order to comply, filers must perform time-consuming calculations of the taxes they owe by the April filing deadline, just to get an extension. This often means that individuals put hours of work into their initial estimation, only to repeat the process again in six months to meet the extension deadline.

Instead of relying on the current rule of calculating a percentage of the current year tax liability, the Simplify Automatic Filing Extensions Act would allow taxpayers to automatically qualify for a filing extension without fear of penalty by paying a simple, easily-calculated amount of 125 percent of their prior year’s tax liability.

“Requiring taxpayers who need an extension to calculate their often-complicated taxes twice in a year is repetitive and burdensome,” said Rep. Chu. “Rep. Carey and I are partnering on this commonsense bill to create a simple and easy way to pay estimated taxes while filing for an extension so we can make tax filing season less of a hassle for the IRS and taxpayers. Making it easier to comply with tax law will mean more taxpayers pay what they owe, and government can continue providing essential services.”

“Filing for an extension does not have to be stressful, nor should it,” said Rep. Carey. “By simplifying the tax filing extension process and removing the fear of penalty, both taxpayers and the IRS will be better off. I’m proud to partner with Rep. Chu on this bipartisan legislation to make government work better for taxpayers.”

““Millions of American taxpayers file for federal income tax extensions every year. The additional time is necessary for people who, for a variety of good reasons, are not able to file by the original due date,” said Association of International Certified Professional Accountants (AICPA) Vice President of Tax Policy & Advocacy, Edward Karl, CPA, CGMA. “Reducing the stress and work associated with attempting to calculate a current year tax liability estimate for the purpose of filing an extension should improve taxpayer compliance and help practitioners better manage work during the tax busy season. We appreciate the leadership of Representatives Chu and Carey to simplify automatic filings of extensions and we strongly support this legislation.”

Click here for the full bill text.