The Texas Senate unanimously passed a bill on Tuesday that would lower the eligibility requirement for CPA candidates to sit for the CPA exam from 150 semester credit hours to 120. The bill now advances to the Texas House of Representatives for a vote.

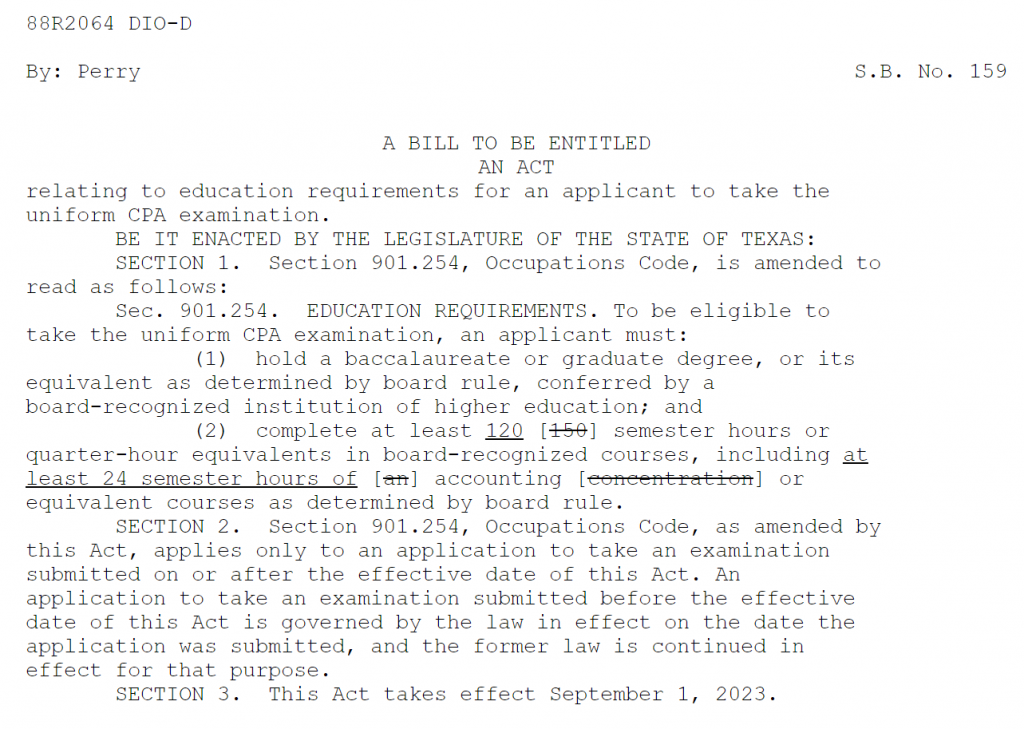

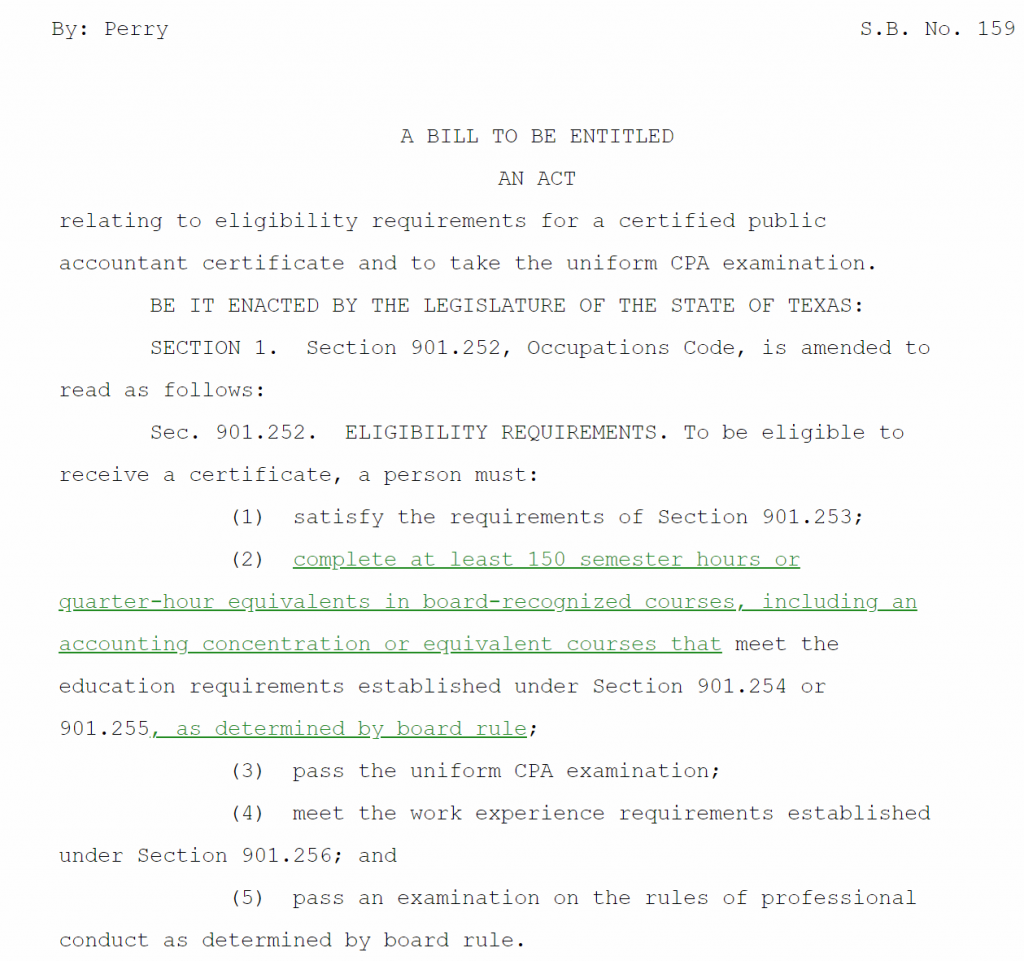

Currently, before a CPA candidate is eligible to sit for the exam in the state of Texas, applicants must meet the state’s CPA education requirements, which include having 150 semester hours of college credits, including 30 semester hours of upper-level accounting courses, 24 semester hours of upper-level business courses, and three semester hours of ethics courses.

The bill, introduced by Republican Sen. Charles Perry who is a practicing CPA, would lower the semester credit hours requirement from 150 to 120.

However, the 150-credit-hour rule for an individual to become licensed in Texas after passing the CPA exam would remain intact.

There has been much debate in certain corners of the accounting profession lately about whether the 150-hour rule for CPA licensure has contributed to the pipeline of accountants drying up in recent years—that and the subpar starting pay in public accounting and the long hours required to work, especially during busy season. Because CPA candidates must complete 150 semester credit hours of education—30 credits beyond the typical 120 credit hours earned in a four-year undergraduate degree—many CPAs end up spending five years in college instead of four.

But the National Association of State Boards of Accountancy (NASBA) recently reaffirmed its support for the 150-hour education requirement by a unanimous vote from its board of directors, so that expectation is not changing anytime soon. NASBA President and CEO Ken Bishop told the Journal of Accountancy earlier this year that NASBA and the American Institute of CPAs “are aggressively looking at options and alternatives that have the potential to increase the number of CPA candidates applying for licensure without disrupting substantial equivalency and practice privilege mobility.”

According to the JofA article, Bishop said this about NASBA’s support of the 150-hour rule:

“Should any state or jurisdiction lower the licensure requirement to 120 hours, their CPAs would no longer be automatically substantially equivalent and would no longer enjoy the mobility and reciprocal practice privileges they currently are afforded. Lowering the bar to 120 hours is only one of the alternatives we have heard that has been discussed and considered. Others, including lowering the cut score for passing the CPA Exam, have the potential and risk of creating the perception of dumbing down the profession. No one is talking about, for example, lowering the bar to become an attorney, and they’re also suffering from lack of entry.”

Bishop said the NASBA board vote was prompted by “a few state society staff members but not the profession in general” considering action that would create different pathways to CPA licensure. Bishop understands the sentiment behind the consideration but stressed that any changes on the state level that don’t align with the UAA would be counterproductive for the profession.

“If I was a society CEO and I had some members who were having trouble hiring CPAs knocking on my door, I would be trying to react. We’re not saying don’t react; we’re saying let’s do it in a uniform way,” Bishop said. “What really gets our attention is something that has an opportunity to disturb or completely adulterate the substantial equivalency, mobility, reciprocal licensure — things that we’re working to protect and maintain.”

But in an article for Accounting Today that was published earlier this month, Blake Oliver, a CPA who specializes in accounting technology and is the founder of Earmark CPE, estimated that the cost of the 150-hour rule is more than $2 billion. He wrote:

Many accounting students choose to obtain the additional 30 semester credit hours through a master of accounting degree, or “MAcc” for short. I estimate the cost of obtaining a MAcc to be slightly more than $100,000.

[…]

[T]he total cost for an individual to obtain the additional 30 semester credit hours through a masters in accounting is approximately $103,000: $30,000 for tuition, $12,000 for books and supplies, $1,000 for fees, and $60,000 for living expenses.

The cost of a MAcc for a single student is reported above. But how much money do all students spend each year? According to the AICPA’s 2021 Trends Report, 20,442 students completed a master’s of accounting program during the 2019-2020 school year.

Multiplying the $103,000 average cost by the 20,442 students results in a total cost of $2.1 billion per year. This figure does not account for CPA candidates who choose alternative paths to fulfill the 150-hour requirement.

Oliver referenced a recent academic study that “indicated the 150-hour rule actually decreases the number of entrants to the profession,” he wrote and added, “the study found ‘no difference between 150-hour rule CPAs and the rest’ in terms of quality.”

Oliver concluded his article by writing:

That’s right — there is no evidence to suggest that an additional year of education leads to more qualified CPAs or better-prepared CPAs for working in accounting firms. All available evidence indicates that it makes no difference. This is what makes the 150-hour rule particularly frustrating: It incurs a cost without providing any benefits.

If we are going to live by our principles, we should eliminate it.

Illinois recently reduced its eligibility requirement for CPA candidates to sit for the CPA exam from 150 semester credit hours to 120, and the Minnesota CPA Society is pushing for legislation that would create alternative pathways, allowing candidates to replace the fifth year of education with additional work experience, or work experience and CPE.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Benefits