Taxes

PayPal, eBay Seek IRS 1099-K Relief for Online Sellers

The 1099-K Fairness Coalition wants Congress to ensure that casual online sellers aren’t burdened with the 1099-K form.

Mar. 16, 2023

By Kelley R. Taylor, Kiplinger Consumer News Service (TNS)

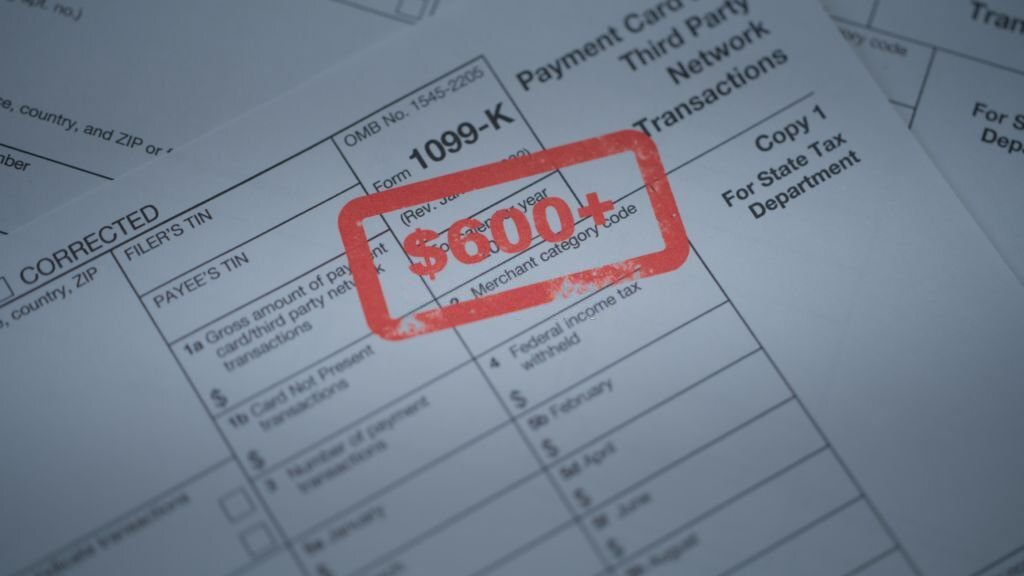

Online shopping sites like Etsy, and eBay, and payment network PayPal, among other companies, want Congress to change the new $600 reporting threshold for IRS Form 1099-K. The rule which currently applies for 2023, affects millions of people who sell on sites like Airbnb, and Poshmark, and get paid through third-party networks like PayPal, Square and CashApp.

Previously to receive a 1099-K, you had to have at least 200 third-party payment network transactions totalling more than $20,000 in gross payments. Now, in 2023, a single transaction on a payment network of just $600 can trigger a 1099-K. Some people call this the “600 rule.” Implementation of the rule was delayed last year by the IRS, but the change and the delay continue to cause confusion.

Thanks for reading CPA Practice Advisor!

Subscribe for free to get personalized daily content, newsletters, continuing education, podcasts, whitepapers and more...

Already registered? Login

Need more information? Read the FAQ's

Now, the Coalition for 1099-K Fairness (a group of online marketplaces that oppose the new rule) is urging Congress to get involved. The goal is to have bipartisan legislation that raises the 1099-K threshold, giving relief to “casual sellers”—millions of people who are paid smaller amounts through third-party networks who haven’t received 1099-K forms in the past.

Is the IRS unfairly targeting casual sellers?

PayPal, eBay, and Etsy are among several members of the 1099-K Fairness Coalition that want Congress to ensure that casual online sellers aren’t burdened with the IRS 1099-K form. The organization cites a 2022 national survey of sellers where:

- 70% of respondents said they would be deterred from selling online because of the $600 IRS 1099-K reporting requirement.

- 85% percent of those surveyed didn’t think that the IRS should be “targeting people who only occasionally sell online,” according to the survey.

Members of the Coalition for 1099-K Fairness include: Airbnb, Bikelist, eBay, Eventbrite, Block Inc. (for Square and CashApp), ETA, Etsy, Goldin, Kidizen, Mercari, Noihsaf Bazaar, OfferUp, PayPal, Poshmark Inc., Reverb, Rover, Sports Fan Coalition, StubHub, TechNet and Tradesy.

According to the coalition, many of the transactions that casual sellers have “involve the sale of used goods that do not create any tax liability.” (Some of those goods are often sold for less than what the seller initially paid.) The organization says on its website that the new IRS $600 rule would disproportionately burden some taxpayers, who could be at risk of over-reporting their income or “forced to hire a tax professional” to ensure compliance with the reporting requirement.

The coalition also points out that economic hardship is another factor for nearly 40% of online sellers. The vast majority (nearly 75%) said that they sell online to help pay for necessary personal expenses.

1099-K: What could Congress do?

The Coalition for 1099-K Fairness wants Congress to pass legislation that would increase the 1099-K reporting threshold. If Congress doesn’t act, the organization says that millions of people with relatively small online businesses will receive 1099-Ks for the 2023 tax year. The coalition says that could cause significant confusion and administrative challenges—not only for networks and sellers, but for the IRS as well.

In Congress, the Saving Gig Economy Taxpayers Act has recently been reintroduced in the U.S. House of Representatives with bipartisan sponsorship.

- The legislation would repeal the IRS 1099-K $600 rule and restore the previous $20,000/200 transaction threshold.

- It’s unclear right now what will happen with the legislation, which is similar to proposals that circulated in Congress last year but failed to gain enough support to pass.

For now? The $600 1099-K reporting rule doesn’t apply for the current 2022 tax filing season. But keep in mind that the IRS expects you to report all taxable income on your federal return, whether you receive a 1099-K or not.

_____

All contents copyright 2023 The Kiplinger Washington Editors Inc. Distributed by Tribune Content Agency LLC