The Financial Accounting Standards Board released a proposed Accounting Standards Update (ASU) on Wednesday that addresses requests from investors for improved income tax disclosures.

During the FASB’s 2021 agenda consultation process and other stakeholder outreach, investors—including lenders, creditors and others that use financial statements to make capital allocation decisions—expressed concerns that existing income tax disclosures do not provide sufficient information to understand the tax provision for an entity that operates in multiple jurisdictions. Investors currently rely on the rate reconciliation table and other disclosures, including total income taxes paid in the statement of cash flows, to evaluate income tax risks and opportunities, according to the FASB.

While investors said they generally find these disclosures useful, they suggested possible enhancements to better:

- Understand an entity’s exposure to potential changes in jurisdictional tax legislation and the ensuing risks and opportunities;

- Assess income tax information that affects cash flow forecasts and capital allocation decisions; and

- Identify potential opportunities to increase future cash flows.

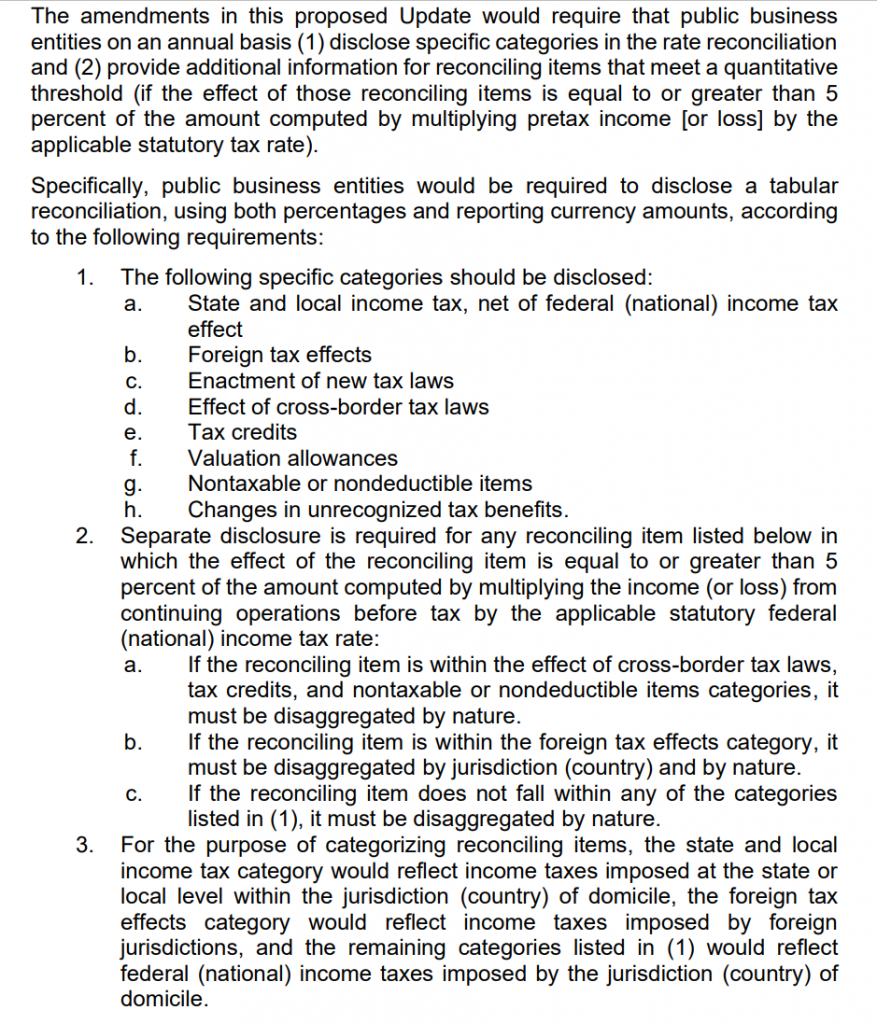

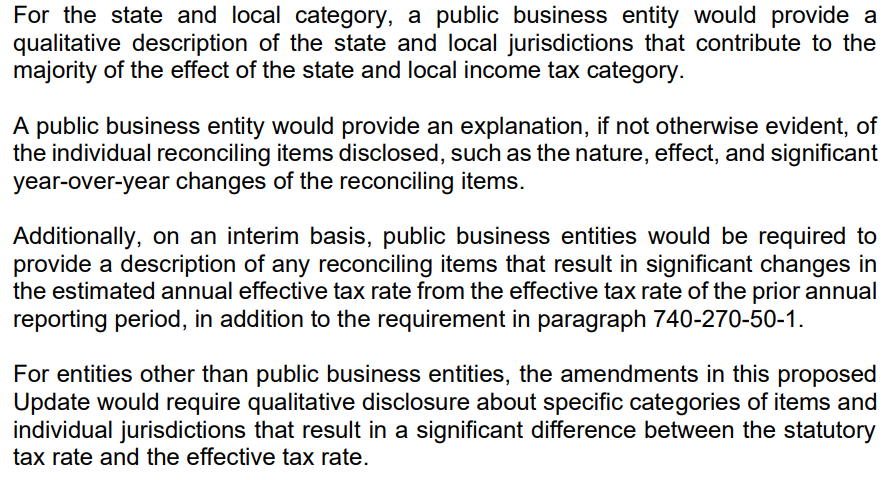

The amendments in the proposed ASU would address investor requests for more transparency about income tax information, including jurisdictional information, by requiring:

- Consistent categories and greater disaggregation of information in the rate reconciliation, and

- Income taxes paid disaggregated by jurisdiction.

The proposed ASU states:

“The FASB’s proposed enhancements to income tax disclosures, primarily related to the rate reconciliation and income taxes paid information, are intended to help investors better assess how an entity’s worldwide operations and related tax risks and tax planning and operational opportunities affect its tax rate and prospects for future cash flows,” FASB Chair Richard Jones said in a statement. “We encourage all stakeholders to review and share their views on the proposed changes and whether they believe those proposed changes would improve this important area of financial reporting.”

Comments on the proposed ASU should be submitted to the FASB by May 30.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting Standards