Taxes

Notable Tax Proposals in Biden’s 2024 Budget

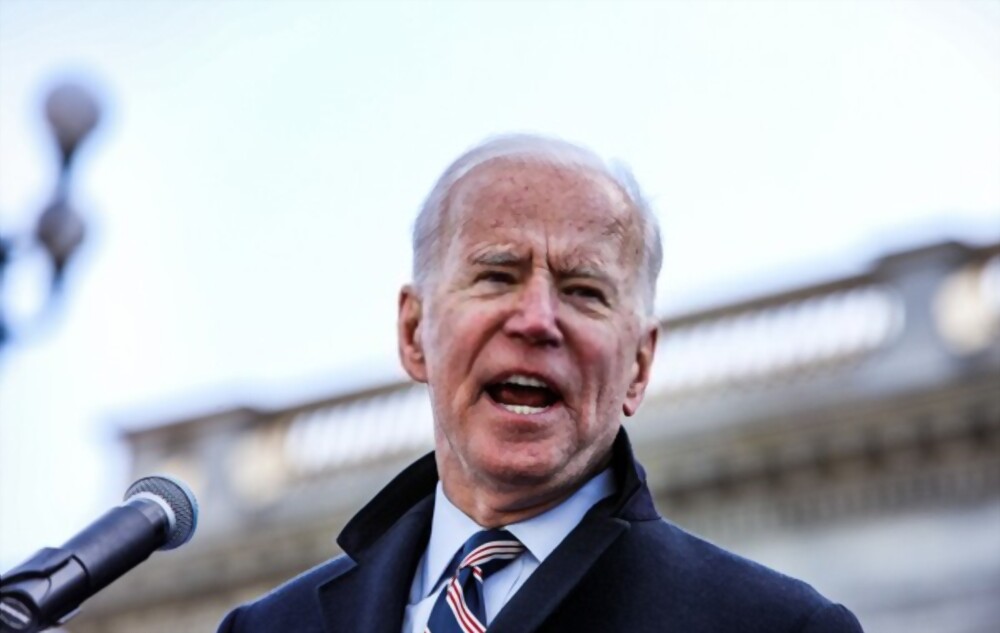

President Biden’s FY 2024 budget—released today—proposes several tax changes aimed at wealthier taxpayers.

Mar. 15, 2023

By Kelley R. Taylor, Kiplinger Consumer News Service (TNS)

President Biden’s FY 2024 budget—released today—proposes several tax changes aimed at wealthier taxpayers. Among the tax proposals, which will likely stall in a divided Congress, are notable tax rate increases for Medicare and capital gains. Biden is also proposing a minimum tax on billionaires. The White House says that the president’s budget reduces deficits by nearly $3 trillion over 10 years.

Biden capital gains tax rate

Thanks for reading CPA Practice Advisor!

Subscribe for free to get personalized daily content, newsletters, continuing education, podcasts, whitepapers and more...

Already registered? Login

Need more information? Read the FAQ's

Capital gains are essentially the profit you make from selling or trading a “capital asset.” The tax rates that apply to a particular capital gain (i.e., capital gains tax rates) depend on the type of asset involved, your taxable income, and how long you held the property before it was sold.

Currently, the capital gains tax rate for long-term capital gains (assets held for more than one year) is at most 20%. Biden’s budget proposal would nearly double that rate to 39.6%. That proposed capital gains tax rate increase would, under Biden’s proposal, apply to investors who make at least one million dollars a year.

Medicare tax rate proposed increase

To help shore up Medicare, President Biden is proposing a tax increase for people making more than $400,000 a year. That income threshold would be based on wages, salary, and capital gains.

In a New York Times op-ed published just ahead of the administration’s budget proposal release, President Biden described Medicare as a “rock-solid guarantee that Americans have counted on to be there for them when they retire.”

According to federal data, more than 60 million people use Medicare, which provides health insurance for people over age 65. The number of people using Medicare is expected to grow, which has caused concern over the long-term viability of Medicare and other programs like Social Security.

Biden proposes to increase the Medicare tax rate to 5% from the current 3.8%. The goal of the increased tax rate would be to extend the solvency for the Medicare program. Tax Policy Center data suggest that Biden’s proposed Medicare tax rate increase could bring in $117 billion in tax revenues to bolster the program. However, like the capital gains tax proposal, the Medicare tax rate increase is not likely to find enough support to pass, given congressional divides.

Top income tax rate: Proposed increase

In addition to proposed increases for capital gains and Medicare tax rates, President Biden wants to increase the top income tax rate for wealthier taxpayers. Under Biden’s budget proposal, taxpayers making $400,000 would be taxed at a top rate of 39.6%. The current top tax rate, which is tied to inflation adjusted tax brackets, is 37%. The proposed tax rate change would be a reversal of the so-called Trump tax cuts.

Note: The Biden budget is merely a proposal that given the state of play on the Hill is not likely to gain sufficient congressional support to pass. So, the seven tax rates that you are familiar with for the 2022 tax year (i.e., 10%, 12%, 22%, 24%, 32%, 35% and 37%) apply for 2023. (The income tax brackets associated with those rates are adjusted yearly for inflation.)

Billionaire minimum tax proposal

President Biden also wants to impose a minimum tax on billionaires. Some of the rationale behind this “wealth tax” is that wealthier taxpayers are often able to shield a good portion of their income from tax. That’s partly because the wealthy usually grow their wealth through investments, which are taxed at lower rates than earned income. Earned income (which includes wages and salaries) is typically the main source of money for lower- and middle-income taxpayers.

The billionaire tax in Biden’s budget proposal would be a minimum of 25% for households with net worth exceeding $100 million. For comparison, the wealthiest taxpayers in America reportedly pay an average 8% tax rate, so President Biden is essentially proposing about a 17% tax increase for the wealthiest taxpayers.

Note: Several states have proposed so-called “wealth taxes” and Massachusetts enacted a “millionaires tax” this year.

Biden’s budget also proposes restoring the corporate tax rate to 28%, which is currently 21% because of the 2017 Tax Cuts and Jobs Act.

_____

All contents copyright 2023 The Kiplinger Washington Editors Inc. Distributed by Tribune Content Agency LLC