Benefits

Outsourcing is a Tool Being Used More by Corporate Tax Executives

83% of chief tax officers are planning to use outsourcing, cosourcing, or managed service alliances this year.

Feb. 02, 2023

The majority of chief tax officers recently surveyed by Big Four firm KPMG said they are turning to some form of outsourcing or cosourcing to help navigate talent and skill shortages in their tax departments.

According to KPMG’s 2023 Chief Tax Officer Outlook, more than eight in 10 (83%) CTOs said they are planning to use targeted/strategic outsourcing, cosourcing with one or more advisors, or managed service alliances within the next three years.

For its fourth annual report, KPMG surveyed 300 CTOs at large public and private U.S. companies in fall 2022 about how they are leading their organizations’ tax function through a period of vast change. Ninety percent of CTOs came from companies with revenue of $2 billion or more. They represented all major industries with the biggest groups being from banking and finance (7%), conglomerates, engineering and industrial products, and metals (7%), and retail (6%).

Thanks for reading CPA Practice Advisor!

Subscribe for free to get personalized daily content, newsletters, continuing education, podcasts, whitepapers and more...

Already registered? Login

Need more information? Read the FAQ's

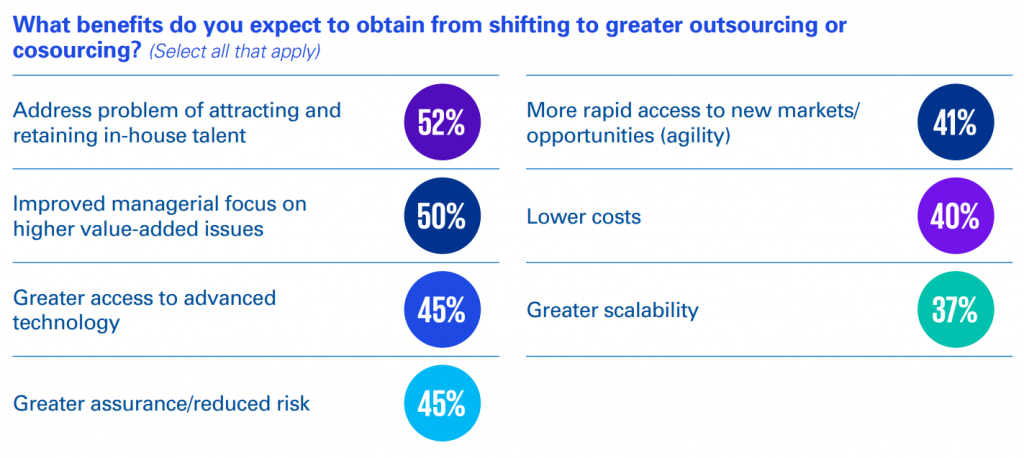

Of those CTOs, the top benefit they expect from shifting to a more aggressive outsourcing or cosourcing plan is addressing the problem of attracting and retaining in-house talent (52%).

In some instances, CTOs leverage outsourcing to deal with more complex areas of tax that demand specialized subject-matter expertise, according to KPMG. Outsourcing time-intensive compliance processes can also help tax departments overcome human resource shortages, especially in foreign jurisdictions where tax may not have local people and expertise.

Cosourcing can yield similar benefits, while allowing the tax department to maintain more control, KPMG said.

“The change that chief tax officers must grapple with is rapid, relentless, and coming from all directions,” said Greg Engel, vice chair for tax at KPMG LLP. “It makes perfect sense for CTOs to ramp up their interest in outsourcing models given the current economic, regulatory, and talent environment. In fact, it’s best practice for companies to periodically reassess their need for these models to address changing dynamics in the market and equip themselves with the right resources to compete and succeed.”