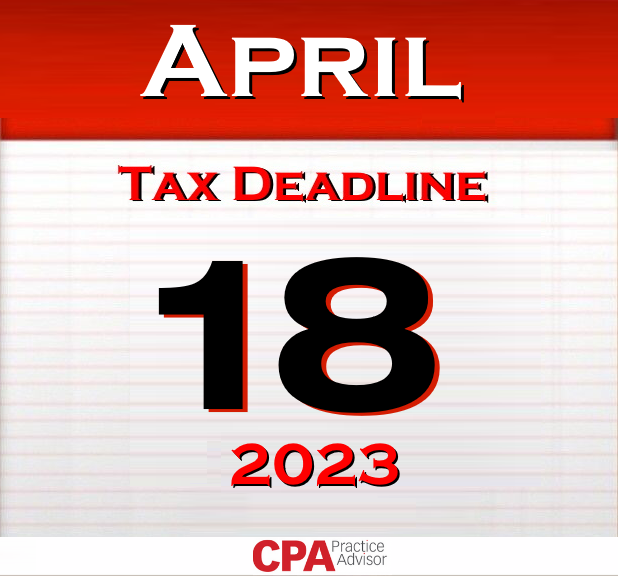

Income Tax

April 18 is IRS Tax Deadline for 2023

The deadline for filing federal income tax returns (generally Form 1040), will be Tuesday, April 18, 2023, and most states usually follow the same calendar for state income tax returns.

Oct. 30, 2022

The deadline for filing federal income tax returns for income gained in 2022 will be April 18, 2023. For clarification, the weeks leading up to the April 18, 2023, deadline is when most Americans file tax returns reporting the income they received during the 2022 calendar year. Taxpayers not quite ready for that deadline can file an automatic extension, which gives them an additional six months to file.

Why is the 2023 tax deadline April 18 instead of April 15?

Because April 15, the standard deadline, falls on a Saturday in 2023. When the deadline falls on a weekend, the IRS moves the deadline to the next business day. However, that Monday, April 17, 2023, is Emancipation Day, a holiday recognized in Washington, D.C., where the IRS is headquartered. April 17 is also Patriot’s Day, a state holiday in Maine and Massachusetts.

Thanks for reading CPA Practice Advisor!

Subscribe for free to get personalized daily content, newsletters, continuing education, podcasts, whitepapers and more...

Already registered? Login

Need more information? Read the FAQ's

As a result of all of this, the deadline for filing federal income tax returns (generally Form 1040), will be Tuesday, April 18, 2023, and most states usually follow the same calendar for state income tax returns.

In other words… be ready to have your taxes filed (or an automatic extension filed) by April 18. Depending on when a taxpayer files, they can often receive their tax refund payments (check or direct deposit) within only 2-3 weeks.

Will the 2023 tax filing season be normal? It will likely be closer to normal than it has been since 2019, the last tax filing season before COVID caused widespread office closures, even at the IRS, which delayed the 2020 tax filing deadline by several months, and even the 2021 filing season. The pandemic also ushered in many tax credits and deductions for businesses, as well as stimulus payments for most Americans. These were also sometimes given as a credit on a taxpayer’s taxes, if they did not receive payment directly. Most individual and married tax filers will not have pandemic or stimulus-related issues on this year’s tax filings.

W2s and 1099s Due by January 31

For business owners, another important deadline to remember is that forms W2 and 1099 must be filed by January 31, 2023.

-=====-

— See an estimated chart of when taxpayers may anticipate their 2023 income tax refunds: https://www.cpapracticeadvisor.com/2022/10/31/when-to-expect-2023-irs-income-tax-refunds-estimated-date-chart-for-tax-refunds/72498/

— See more federal tax deadline dates at https://www.kiplinger.com/taxes/tax-deadline/603992/2022-tax-calendar-tax-due-dates-and-deadlines