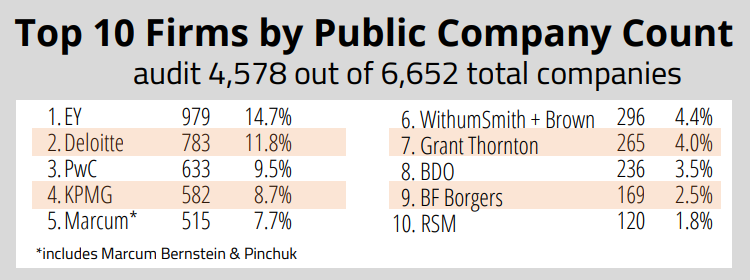

Ten public accounting firms audited 68.8% of all public companies registered with the Securities and Exchange Commission from March 2021 to May 2022, with EY having the most SEC public registrant audit clients, according to a recent analysis by Audit Analytics.

As of May 10, 252 firms conducted audits for 6,652 SEC registrants—a 10.3% increase in population compared to 2021. That increase can be attributed to the record high number of initial public offerings and special-purpose acquisition companies flooding the market in 2021, Audit Analytics said.

The top 10 firms by SEC registrant count are the same as last year: EY, Deloitte, PwC, KPMG, Marcum, Withum, Grant Thornton, BDO USA, BF Borgers, and RSM US.

However, if you remove the approximately 700 SPACs from the equation, the top 10 SEC registrant count changes, according to Audit Analytics:

SPACs have limited operations until they conduct a business combination. Therefore, audits of these entities, while requiring certain expertise, are less complex than the audits of operational public companies.

Without SPACs or blank check companies, the top ten firms consist of the Big Four, followed by Grant Thornton, BDO, Marcum, BF Borgers, RSM, and Crowe. Collectively, when SPACs are excluded, those firms audit 67.0% of the public company market. This mirrors the concentration seen with the top ten firms for the entire public company population, albeit with a slightly different roster of firms.

Withum drops out of the top 10 and Crowe moves in when SPACs are excluded because Withum has specialized in SPAC audits the last couple years. Of the 612 SPAC IPOs last year, Withum and Marcum audited 83% of them, and since 2019, the two firms combined have audited more than 80% of all SPAC IPOs, according to Audit Analytics.

With 632 clients, EY also audits the most large accelerated filers (28.4% of market share), including companies that identified as both a large accelerated filer and a smaller reporting company, Audit Analytics said. The Big Four firms audit nearly all large accelerated filers (88%). Deloitte is the top audit firm of both accelerated filers (17.8% of market share) and non-accelerated filers (17.5% of market share).

You can find out more results of the Audit Analytics analysis here.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs