Getting takeout used to entail phoning a restaurant or placing an order in person. Then it became possible to order online. Today, where available, delivery apps facilitate takeout sales for more and more restaurants. In fact, orders through delivery apps were reportedly on track to surpass direct orders by the end of 2021.

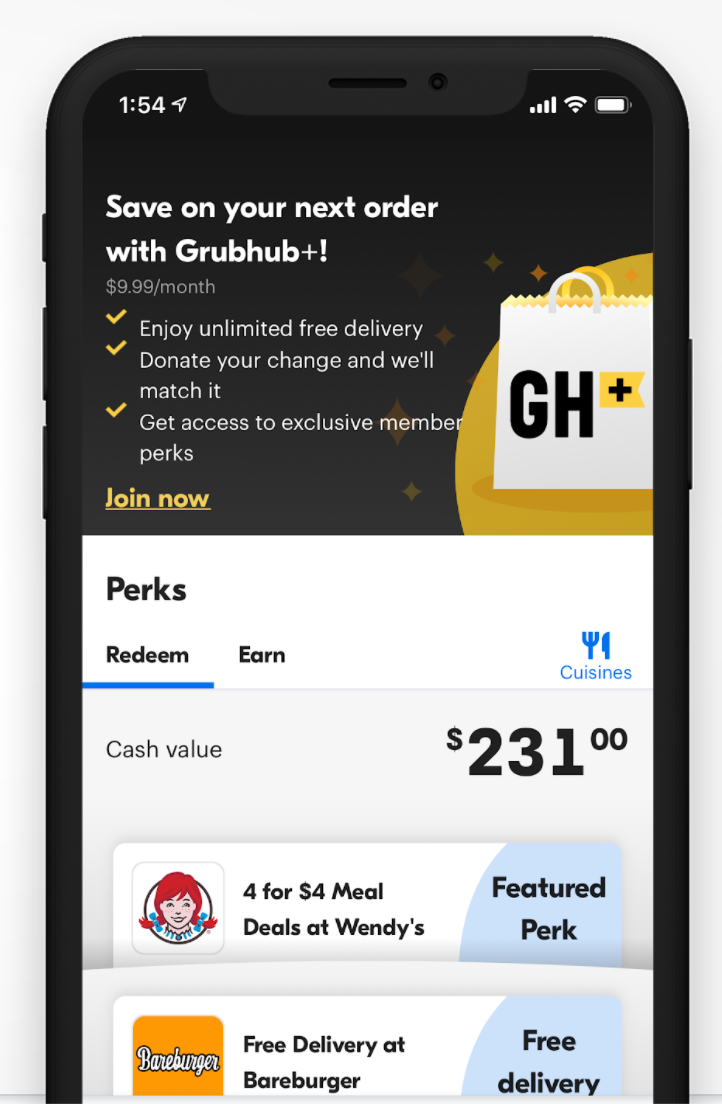

COVID-19 certainly accelerated adoption of delivery apps, but the use of DoorDash, Grubhub, Uber Eats, and similar platforms was on the rise even before restaurants had to suspend or limit in-person service. Food delivery mobile apps are now an enormous industry worth more than $150 billion worldwide, and they’re still growing.

There are pros and cons for restaurants. On the positive side, delivery apps may help restaurants advertise and expand their customer base. Yet restaurants pay a premium for the services provided; commissions tend to run 15% to 30%. According to McKinsey & Company, “a typical restaurant would have to increase its total sales significantly to stay at the same profit margin it enjoyed without delivery.” Meanwhile, the delivery platforms themselves are “struggling to make a profit.”

The restaurant–mobile app relationship can also complicate tax compliance.

When restaurants handle their own to-go sales, they’re in charge of collecting payment and collecting, remitting, and reporting applicable taxes. When a third party gets involved, who’s responsible for the tax isn’t necessarily clear. Another question that frequently arises is whether the fees a delivery app charges to a restaurant are subject to sales tax.

Taxability rules vary by state, as always with sales tax, but some state laws don’t yet specify the taxability of mobile delivery app fees. The more taxpayers seek to understand their responsibilities, the more states are being forced to weigh in on this issue. One of the latest states to do so is Texas, in a letter ruling requested by a mobile ordering and payment platform provider.

Texas rules on taxability of mobile delivery app fees

As explained by the Texas Comptroller, the mobile delivery application accepts orders from customers on behalf of restaurants, collects payments from customers on behalf of restaurants, collects applicable taxes from customers, remits payments (minus fees) to restaurants on a weekly basis, and uses a third party to process payments. It also charges restaurants the following fees:

- Setup fee to cover initial installation and configuration

- Service fee (percentage of weekly gross sales)

- Credit card fee (percentage plus a fixed dollar amount per transaction)

- Optional offers fee for featured placement and other strategies to attract new customers

- Optional “earn plus” fee to incentive customers to visit a restaurant

- Optional monthly subscription service that’s separate from the fees charged for the mobile application

Each of the fees above needs to be considered separately for tax purposes. Accordingly, the mobile app provider asked the Texas Comptroller to rule on whether each fee is an exempt charge for a nontaxable service or a taxable charge for a taxable data processing service.

Per Section 151.0035, data processing services include “word processing, data entry, data retrieval, data search, information compilation, payroll and business accounting data production, and other computerized data and information storage or manipulation.” Rule 3.330(a)(1) further defines data processing services as “the processing of information for the purpose of compiling and producing records of transactions, maintaining information, and entering and retrieving information.”

The Comptroller ruled as follows:

- The setup fee is a taxable data processing service charge.

- The service fee is a taxable charge for a data processing service, but unlike the other fees charged by the mobile app, the service fee qualifies for a 20% exemption for information services and data processing services under Section 151.351. The mobile app is therefore responsible for collecting and remitting sales and use tax on 80% of the service fee charged to restaurants.

- The credit card fee is a taxable data processing service charge. Although the “settling of an electronic payment transaction by a licensed money transmitter” is excluded from the definition of data processing (Senate Bill 153, 2021), the “settling of an electronic payment transaction” doesn’t include charges by a marketplace provider — and the mobile delivery app is a marketplace provider. Consequently, the mobile delivery app’s credit card fees are a taxable charge for data processing services. See Section 151.007(a)(2); Rule 3.330(d)(3).

- The optional offers fee is a nontaxable service charge. It’s akin to an advertising service, and advertising services generally aren’t taxable in Texas. Furthermore, the rewards points provided by the mobile app are equivalent to gift certificates, and sales of gift cards or gift certificates aren’t taxable.

- The optional “earn plus” fee is a charge for a nontaxable service.

- The optional monthly subscription fee is a taxable data processing service charge (see Section 151.0035).

Note that restaurants contracting with the delivery app are responsible for remitting to the state the tax due on meals.

======

Gail Cole is a Senior Writer at Avalara. She’s on a mission to uncover unusual tax facts and make complex laws and legislation more digestible for accounting and business professionals.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs