From the November 2021 Issue.

Technology changes constantly. We must make decisions about what works for our clients, our firms, and ourselves. Additionally, we must make the effort and take the time to update our skills on products we use regularly and on solutions that we should consider for our practices. This education is beyond our mandatory continuing professional education (CPE) training.

While forty hours of CPE is the minimum requirement, that is the hardly the education required to maintain competency in the profession. But you already know that even if you may have extensive knowledge in a specialty area, it is challenging to keep up with all aspects of accounting.

Further, you may prefer tax, audit, client accounting services (CAS), Advisory, wealth management, or XX (plug in your favorite area of accounting), and you spend all your efforts in that single area. Add to accounting knowledge management skills, people skills, or technology skills, and you quickly realize you could focus on just one of these areas and not have enough time in the day.

Continuous Learning

Depth of knowledge is undoubtedly a benefit for compliance and consulting. The breadth of knowledge is a benefit for Advisory work. Lack of knowledge for using technology is a time-waster. Expansive knowledge of technology can help your firm and your clients. While many accountants have an excellent working knowledge of compliance, this excellence can be offset by clumsy or ineffective delivery of results. So how do you address these issues? By developing a continuous learning attitude.

Consider the curriculum that you and each team member should follow to expand their skills and document that in a learning matrix or ladder. While using productivity software properly sounds mundane, you’d be appalled at how much effort is wasted running software like email, word processing, spreadsheets, or presentation software.

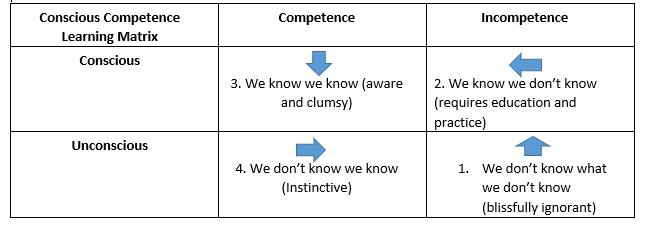

Consider the skills you require in a variety of areas and build a long-term learning plan. The Conscious Competence Learning Matrix looks like this:

How do you stay up? Reading trade publications, attending events, and listening to podcasts are a great start. Our weekly podcast, The Technology Lab, provides background on a variety of products. You can search for podcasts related to your favorite topics. Still, CPEToday regularly has fresh content, as do a variety of pundits on tax, audit, CAS, QuickBooks, Xero, Zoho, and Advisory services. We have provided CPE via our K2 courses for over 35 years in almost 20 categories. You can produce your own CPE or license in-house courses through your State Society or many CPE providers.

Most of you have chosen a focus or specialty and are well on your journey to becoming an expert. In his popular book from 2008, Outliers, Malcolm Gladwell stated that 10 years or 10,000 hours of study is needed to become an expert. But if your profession changes notably, how do you protect your future? For example, leaders in the profession has been concerned that compliance work will become less profitable and more competitive.

If your skills are in compliance, and you are comfortable that things won’t change during your career, then you are all set! However, if you see a different future, you can begin charting a new path now and building your skillset. For example, many professionals have chosen Client Accounting Services (CAS) while others have chosen Advisory or both.

We are All Advisers, Aren’t We?

There remains a lot of confusion in the accounting profession about Advisory. Few firms are clear about what Advisory is and how they can deliver advisory services successfully and scale the delivery to ensure great client service and a great return on investment for the firm. But this is not the same as not “doing advisory.”

You have probably read online about some accountants claiming that they are not typical accountants. They’re smashing it, changing the world, and “doing advisory.” Really folks? Well, I’ve got news for you – every accountant I have ever met is advising clients. But often, they don’t recognize that they are doing so, and therefore they don’t always charge for it. When a client calls or emails you with a question, and you answer that question, you are advising them. And you probably do this a lot, don’t you?

What would you do if I were to knock on your door and tell you that I was setting up in business and would like you to be my accountant? First, you’d probably ask me lots of questions about me and my new business. Then you’d advise me whether it should be formed as a sole proprietor, partnership, an LLC, a Sub S-Corp, or C-Corp.

Once that decision was made, we’d talk about all the regulatory requirements, and then we’d move on to the year-end, compliance documentation requirements, and so on. And you’d want to know what my plans are. Where will it operate, what are my sales and profit aspirations, and will I employ people? And all this time, you are advising me. And then there would be my personal affairs and how these interact with the new business.

Salaries, bonuses, dividends, will family members be involved and what this means. Do I own my own home, is there a mortgage, other sources of income, and so on? And all this time, you are advising me—advice, advice, advice.

So, when you hear or read something about accountants not really “doing advisory,” take it with a grain of salt. However, the advisory services outlined above are very reactive, ad hoc, and unstructured. Further, as stated earlier, the advisory services are often not recognized and rarely charged for appropriately.

The choice is yours – you can carry on the way you are. Or if you can begin to build more structure into how you deliver advisory services, which can provide your clients with proactive help and advice and generate more fees for you. There is no right and wrong – it is up to you.

Part of the confusion about Advisory is that few firms are clear about what it is. A good starting point is to put ourselves in our clients’ shoes. What are they looking for, and what does it mean to them? Well, you don’t walk up to a client and say, “do you want some advisory services?” Advisory is intrinsic to us as advisers, not something you overtly sell

Here is a great definition of Advisory – simple but powerful. Advisory for clients is about helping them do better. Each individual client’s own definition of “doing better” is personal to them. Advisory is helping them do better. It’s that simple.

To do better might mean build a bigger and more profitable business. Alternatively, to do better might be to maintain the current level of business performance but not work as many hours. Finally, to do better might be to build a fund to put down a deposit on a house, education for their children, or a combination of all these and many others.

So Advisory starts with the clients’ dreams, goals, aspirations – their vision – in other words, what “do better” means to them. Once you have helped a client be really clear about this, you can begin to help them plan to achieve their vision. These are your primary advisory services. And don’t forget you are helping them with their personal aspirations as well as their business goals – personal and business.

The planning process will help the client and you identify which areas of their personal affairs and business require focus and attention and, therefore, the services they need from you and others. The services beyond planning that you then choose to provide yourself are your secondary advisory services. These will often include tax advice, financial and management reporting, and many others. Your tertiary services are the services you choose not to provide but that you can refer to others. These will often include marketing, HR, financial and legal services.

You are in control. The services you provide are your choice. Some firms provide specialist tax advice such as Research and Development credits, which is one of their secondary services. Some firms choose not to do so but can introduce a specialist Research and Development provider, and this is delivered as a tertiary service.

In Summary, If You Choose Advisory As Your Continuous Education

Ignore the background noise and confusion about Advisory

- Take what the “I’m not your typical accountant” group are saying with a grain of salt

- Accountants are all “doing advisory,” but they have a choice

- Follow the ad hoc, unstructured, reactive, and often unrecognized path OR

Begin to build structure and process and be more proactive and create real value for your clients and yourself

- Help clients do better

- Help clients be very clear about what is important to them

- Help clients improve their personal positions and their businesses

- Help then put their personal and business plans together

The planning process will reveal what services the client needs

- You decide which services you want to provide

- You can refer others to provide the services you don’t want to provide

- Use the Primary/Secondary/Tertiary Model

- The client’s plans will be the focus for the client relationship and create a central relevance for how you deliver recognizable value

And finally, just as you have delivery platforms for your compliance services, you need a delivery platform for your advisory services to give you consistency and quality control and the ability to leverage and scale – and make your life easier while impressing the client.

What Should Your Client Experience be With Your Continuous Education?

Your team will become greater experts. Their skills will grow in all areas of focus. Satisfaction with your firm and value should increase. You are more likely to avoid the great resignation and lose people because they believe they are taken for granted and undervalued.

Clients should be able to recognize your increased expertise and focus on their needs. They should quickly understand that you have their best interests in mind while providing superior service. You will have the techniques to support your strategies. Clients should also see greater value in your expertise and be willing to pay for it too.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: CAS