Accounting professionals know that maintaining the books is just one aspect of running a small business. There are many more areas that today’s accountants must advise on in order to help their clients succeed and stay competitive. This includes advising clients about insurance benefits to protect their businesses as well as benefits they can offer employees in order to help retain current staff and recruit new talent.

Intuit recently announced two new offerings — QuickBooks Insurance and separately, 401(k) powered by Guideline — that can help you and your clients protect your businesses with comprehensive insurance coverage and also offer employees a 401(k) retirement plan, a benefit traditionally offered only by large companies. These expanded capabilities can help you and your small business clients succeed, and employees thrive.

The need is now for insurance

Obtaining business insurance can be time consuming and overwhelming. Many agencies require several forms to be filled out to initiate a quote, and the purchase process that can take several days to weeks to complete.

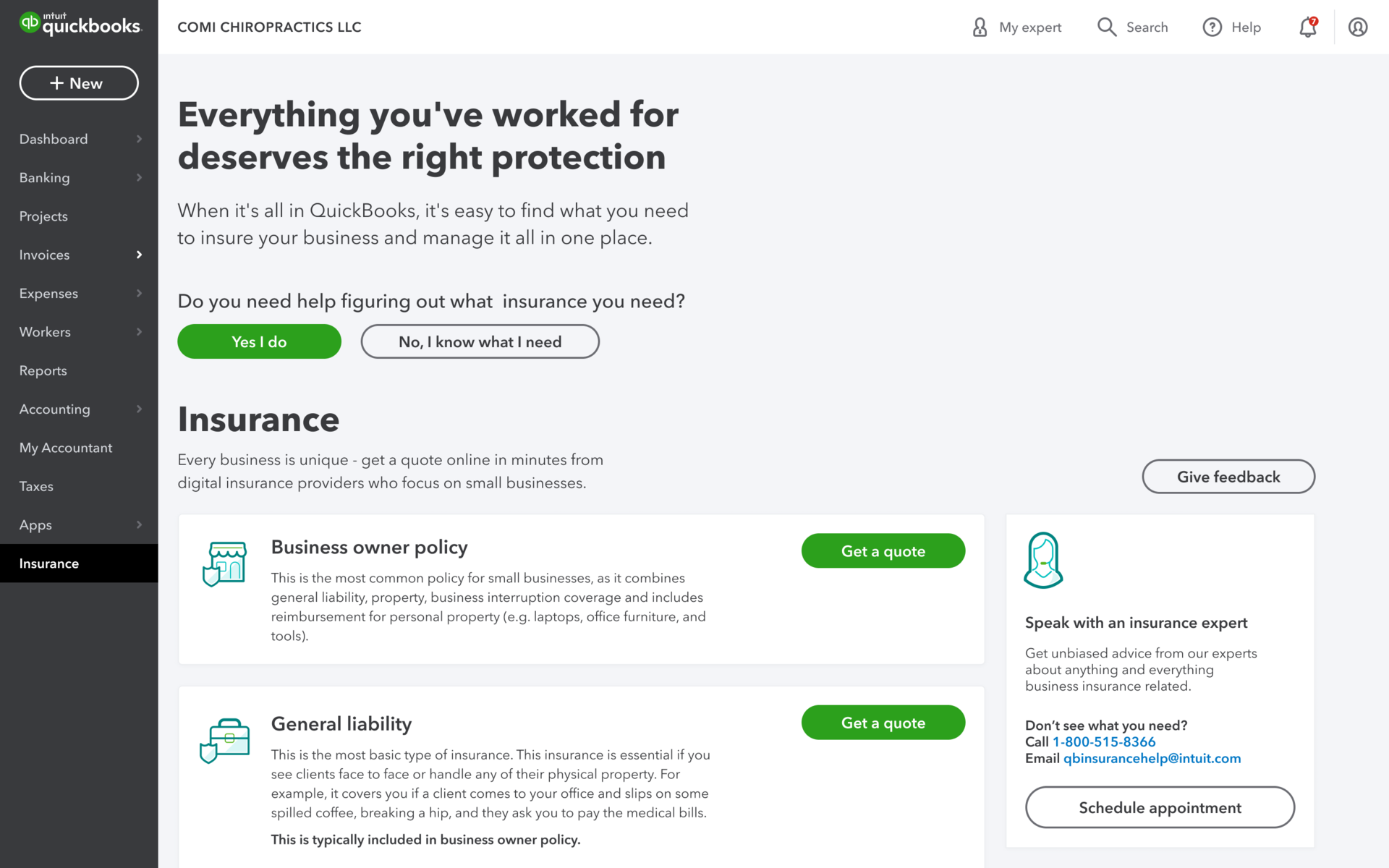

To expand the benefits of QuickBooks and help customers manage their overall business, QuickBooks Insurance has launched an affordable, customizable and easy-to-use alternative. A small business can get a quote online and be insured in minutes, starting from within QuickBooks.

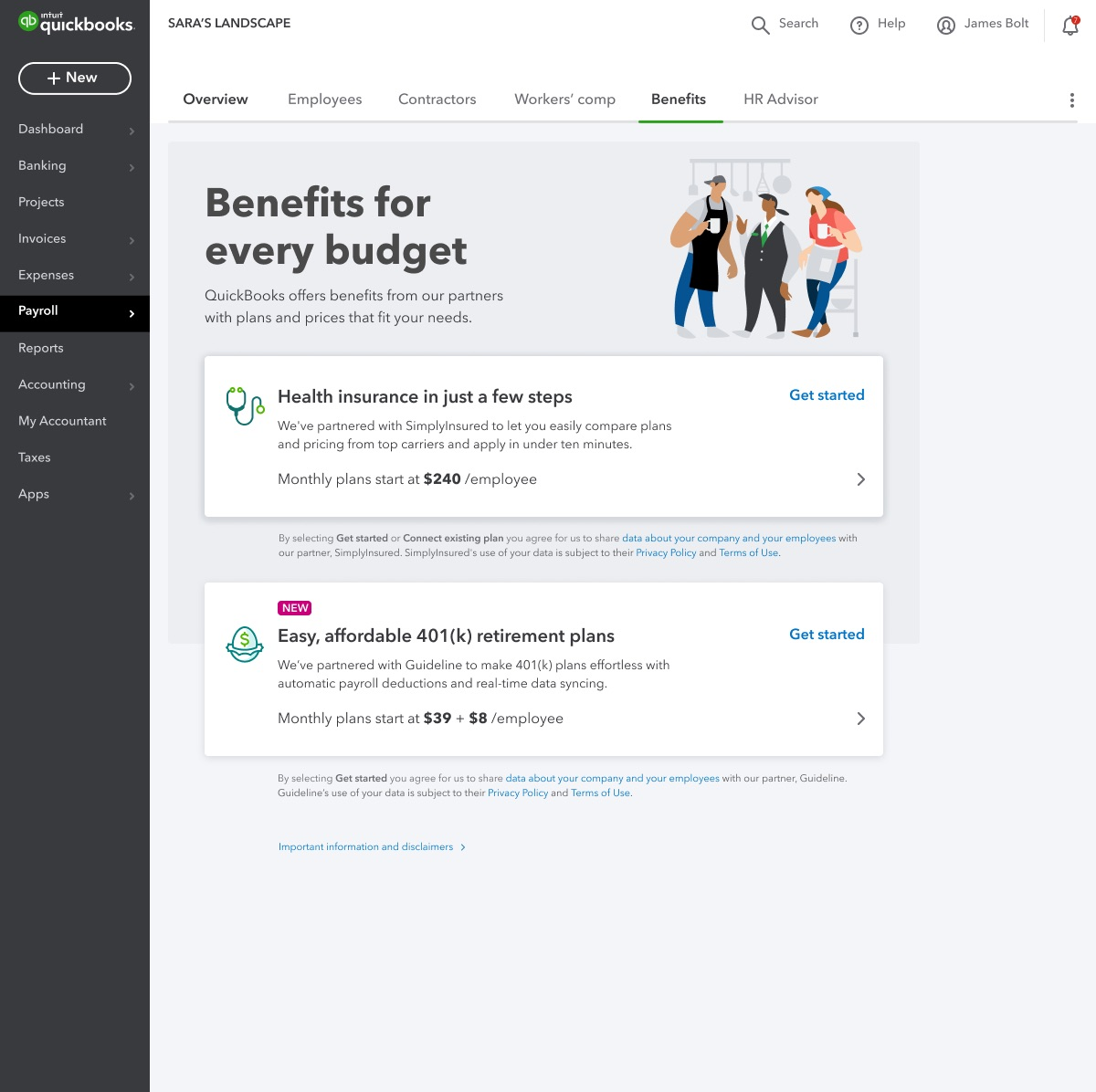

Accessible via the Insurance tab in QuickBooks Online and QuickBooks Online Accountant, businesses can apply for general liability, professional liability (particularly applicable for accountants and accounting firms), employment practices liability, workers’ compensation, commercial auto, cyber, earthquake insurance, and many other types of policies through four highly-rated providers: AP Intego, Coterie, Cover Genius and Next Insurance.

QuickBooks uses artificial intelligence (AI) to recommend the best insurance provider to customers based on relevant information that already exists within QuickBooks in addition to their unique needs. This information helps find the right provider and expedite the application process. Once customers purchase an insurance policy, they can view key details of the policy and provider in their QuickBooks account.

If a small business owner needs help choosing a policy, QuickBooks Insurance has an online recommendation tool or they can connect with certified small business insurance experts to guide them through the process, giving owners the confidence that the policy they choose is right for them.

Several of the insurance providers offer policies with smaller monthly installments, rather than one big annual payment, allowing small businesses to conserve cash.

(Click for larger view of screenshot.)

401(k) powered by Guideline

QuickBooks Online Payroll customers now have access to an affordable benefit that helps attract and retain employees, while also providing employees a secure place to save for retirement through the new QuickBooks 401(k) powered by Guideline offering.

You can help your clients set up their company’s 401(k) plan in minutes and automate both company and employee payroll contributions, all within their QuickBooks account using Guideline’s single sign-on integration with QuickBooks Online Payroll. Data is securely synced automatically, so updates and changes will be reflected in both places without any additional steps. Click “401(k) retirement plans” from the Benefits tab in QuickBooks Online Payroll. Clicking on “Get Started” will direct users to 401(k) options powered by Guideline.

The cost for a 401(k) plan through Guideline is $39/month base, plus $8/month for each employee, and is designed for businesses of any size. As a QuickBooks Online Payroll customer, this cost includes full-service 401(k), 3(16) and 3(38) fiduciary, live U.S.-based support, employee onboarding, low-cost mutual funds, and simple employee and employer dashboards.

Contributions are automatically deducted each pay run, with no need to maintain deductions or manually re-enter payroll data. Small businesses can also offer to match contributions.

These services transform QuickBooks into a small business hub, providing tools and resources in one place that helps inform smarter financial decisions and protection. Put on your advisory hat and help your clients explore these options, today.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Artificial Intelligence, Benefits