What’s old is new again – in the tax filing world, anyway. If you’re accustomed to filing Form 1099-MISC to report nonemployee compensation, you’ll need to reorder your IRS alphabet for your 2020 returns. The government is now bringing back Form 1099-NEC for that purpose, a form that was last used in 1982, during the Reagan administration.

The 1099-NEC is being reintroduced to address confusion created by the PATH (Protecting Americans from Tax Hikes) Act of 2015. That Act established different due dates for the various types of income reported on the 1099-MISC, leading to undeserved penalty notices for filers. The renewed 1099-NEC form separates out nonemployee compensation from other sections of the 1099-MISC and imposes a filing deadline of Feb. 1, 2021.

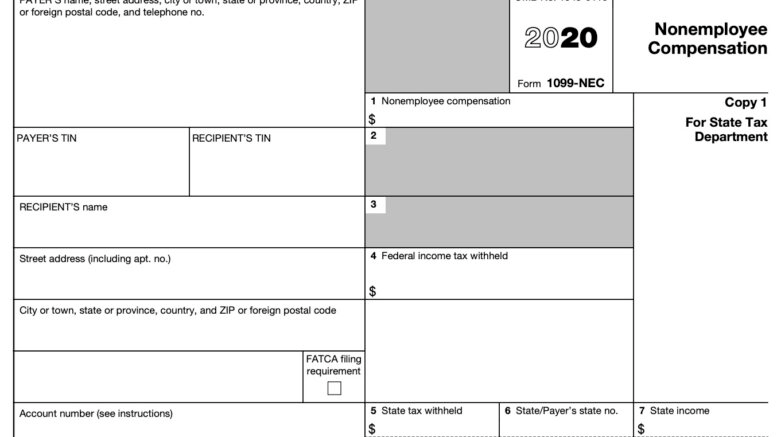

To be clear, you may still need to use both forms. The 1099-NEC is used strictly for reporting independent contractor payments of $600 or more in the course of your trade or business. You will still be required to use the 1099-MISC for such items as royalties, rent, and healthcare payments. You’ll also find that the boxes have been rearranged on the 1099-MISC; Box 7, where nonemployee compensation was once reported, now hosts the check box for direct sales of $5,000 or more. The deadline for filing the 2020 tax year’s 1099-MISC is March 31, 2021 if filing electronically.

WHO SHOULD FILE A 1099-NEC?

Any business that pays people for services who are not employees will be affected by this change. The form will cover payments to consultants like attorneys, architects, and accountants, for instance, as well as nonemployee sales commissions. It will have particular relevance for those employing so-called gig economy workers, like rideshare companies or food delivery associates if these workers are classified as independent contractors.

Here are some examples:

- A small office that hires a freelance contractor to design and build individual workstations and upgrade common areas

- A company that keeps a rideshare service on retainer for monthly airport pickups

- A firm that hires a benefits consultant on a project basis to evaluate its HR function

- A business that hires an outside attorney to defend against a lawsuit

NOTE: IRS WILL NOT FORWARD 1099-NEC DATA TO STATES

Businesses should note that – unlike the 1099-MISC – the 1099-NEC will not be included in the IRS 1099 Combined Federal/State Filing Program (CF/SF). Under the CF/SF, the IRS forwards data from a number of key forms to the appropriate states, but will not do so for the 1099-NEC.

This means that businesses will need to find a way or vendor to file the form electronically with the appropriate states in addition to filing it to the IRS.

HOW TO PREPARE

With the year-end filing season fast approaching, it’s not too early for businesses to acquaint themselves with the coming change and to update their software and filing systems in anticipation of the new form. A sample form is available now on the IRS website – it may be worth downloading and reviewing it in advance. Also, most states that support Form 1099-MISC have indicated that they also plan to require Form 1099-NEC to be filed to their state.

The IRS offers detailed instructions and information about both forms on its website.

https://www.irs.gov/forms-pubs/about-form-1099-nec

=============

Janice Krueger is a Subject Matter Expert at Greatland Corporation.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Benefits