By John Paek, Michael Spencer and Sherfon Coles-Williams

State income tax systems typically require the computation of a state income tax base largely based on federal taxable income, subject to certain state-specific modifications, and then layer on a system of allocation and formulary apportionment to attribute income to the relevant state. Accordingly, states generally require taxpayers to report changes in their federal taxable income within a certain timeframe so state taxing authorities can make appropriate adjustments.

While these reporting requirements are not new, reporting federal changes resulting from audits conducted pursuant to the Internal Revenue Service (“IRS”) Large Business & International Division’s (“LB&I”) Tax Cuts & Jobs Act (“TCJA”) and Transition Tax audit campaigns may be particularly complex for multi-state taxpayers.

The TCJA, enacted in December 2017,[1] is generally considered the most significant overhaul of the federal income tax system to date since the Tax Reform Act of 1986.[2] Its impact has rippled through the state corporate income tax systems to varying degrees, depending on: (1) each state’s conformity date for its definition of the Internal Revenue Code (“IRC”); and (2) for the states with an IRC conformity date on or after the enactment of the TCJA, the extent to which the state has adopted the TCJA provisions. A similar analysis applies when evaluating the state tax impact of the federal Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”), enacted in March 2020.

In November 2019, LB&I announced its Transition Tax campaign, aimed at promoting compliance with IRC Section 965 and conducting examinations “with a focus on identifying and addressing taxpayer populations with potential material compliance risk.”[3] In May 2020, LB&I launched its TCJA audit campaign “to closely monitor issues on a select pool of returns and share information learned throughout LB&I and the IRS.”[4] The stated goal of the TCJA audit campaign is to “identify transactions, restructuring and technical issues and better understand taxpayer behavior under the new law,” and LB&I considers “the impact of the [CARES] Act on these returns as well as any other examined.”[5]

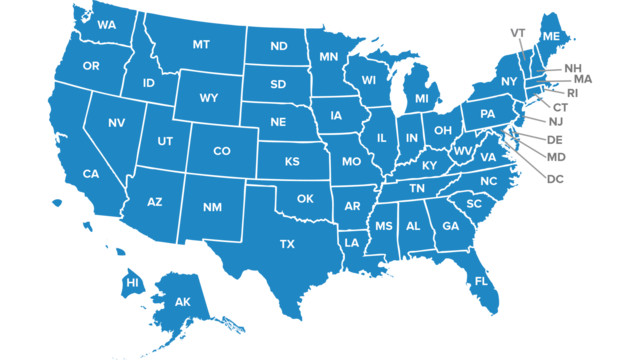

Audits under these LB&I programs may result in adjustments to Transition Tax, global intangible low-taxed income (“GILTI”), the Section 163(j) interest expense limitation, and/or NOLs. Such final determinations may trigger state tax notification requirements, typically satisfied by filing amended state tax returns. This process may be onerous for a corporate taxpayer doing business throughout the U.S., given the varying state income tax treatment of these federal items and the varying state notification requirements. States such as California require corporate taxpayers to report federal changes “[i]f any item required to be shown on a federal tax return . . . is changed or corrected by the Commissioner of Internal Revenue . . . ”, regardless of whether the tax liability would increase.[6] Other states like Maryland may only require corporate taxpayers to report the federal change if it results in an increase in state taxable income.[7]

As a result, determining which states would require notification after a federal TCJA audit could require an understanding the relevant state’s tax treatment of such federal adjustments. Reporting federal changes to Transition Tax or GILTI may require revisiting these issues and considering the anticipated effect on the state income tax base, the state dividends-received deduction, and the apportionment factor in all relevant states. While a taxpayer would have dealt with these issues on its original state income tax returns, these are still relatively novel issues, and failing to properly notify a state may have consequences, such as an extended statute of limitations or penalties.

The extended statute of limitations for assessment may be particularly problematic in states that permit the audit of issues unrelated to the specific underlying federal adjustment. While this risk existed before the Transition Tax and TCJA audit campaigns, the CARES Act NOL carryback rules, which permit the 5-year carryback of losses incurred in 2018 and 2019, expand the universe of otherwise closed years for which state adjustments may be required on account of federal changes.

Taxpayers with Transition Tax or TCJA audit adjustments should know that the completion of the federal audit could trigger reporting requirements and additional examination at the state level. The mult-istate reporting of the resulting federal changes can be complex and may require significant effort to complete, due to varying and sometimes uncertain state tax treatment of these federal tax issues.[8]

========

[1] Tax Cuts and Jobs Act of 2017, Pub. L. No. 115-97, 131 Stat. 2054.

[2] Tax Reform Act of 1986, Pub. L. No. 99-514, 100 Stat. 2085.

[3] Large Business & International Active Campaigns, IRS, https://www.irs.gov/businesses/corporations/lbi-active-campaigns, last checked on July 14, 2020.

[4] Id.

[5] Id.

[6] Cal. Rev. & Tax. Code § 18622(a). See also California Franchise Tax Board Publication 1008 (May 2020) (noting that corporate taxpayers “must report all changes or corrections to gross income or deductions, even if the changes or corrections do not result in an increase in tax payable to California for any year”).

[7] Md. Code Ann. Tax-Gen. § 13-409. See also Md. Regs. Code 03.04.03.06(B)(1).

[8] As used in this document, “Deloitte” means Deloitte Tax LLP, a subsidiary of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description of our legal structure. Certain services may not be available to attest clients under the rules and regulations of public accounting.

=======

John Paek is a Principal in Deloitte Tax LLP’s Multistate Tax Services group.

Michael Spencer is a Manager in Deloitte Tax LLP’s Washington National Tax Multistate Tax Services group.

Sherfon Coles-Williams is a Senior Associate in Deloitte Tax LLP’s Washington National Tax Multistate Tax Services group.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs