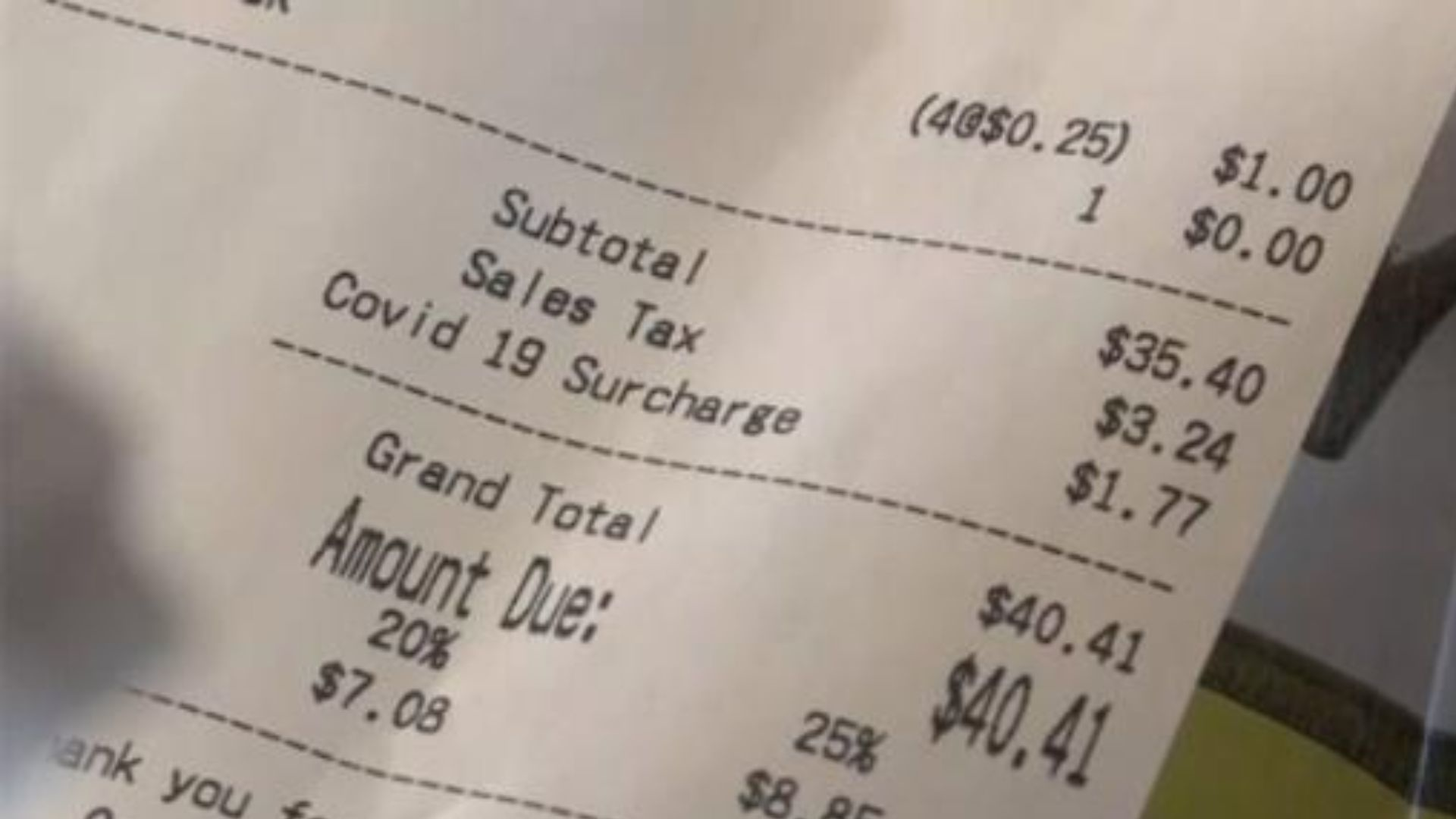

Small business owners, especially restaurants and bars, and doing their best to keep cash coming in during 2020 and the COVID-19 pandemic. One way some owners are trying to bring in more cash, and make up for the additional cleaning expenses, take-out containers and reduced capacity is by adding a “COVID-19” or “Sanitation” surcharge to their customers’ receipts.

Their customers, who are also likely strapped for additional cash during the pandemic, are not taking these new charges lightly, and it is to be expected that neither will their state tax authorities.

[Related article: A Covid surcharge may be coming to a receipt near you.]

So, what should small business owners know about the tax implications behind COVID-19 surcharges?

Business Owners Should Anticipate a Sales Tax Audit

What business owners may not realize is by adding a COVID-19 surcharge to purchases, they may unknowingly be adding expenses that may consume part of the additional revenue the surcharge is intended to generate.

This is because a COVID-19 fee may trigger a sales tax audit, one that many state tax authorities are relying on to generate the tax assessments they need to make up for any budget shortfalls during the pandemic. This is the last thing a struggling small business owner needs for their business.

Why would a business charging a COVID-19 fee be an easy target for a sales tax audit?

To start, many owners and customers may be unaware a COVID-19 surcharge is subject to sales tax, and thus do not calculate it in the total cost. Based on the questions BPM’s State and Local Tax team receives, and due to the state tax laws not clearly stating rules around COVID-19 fees, this is likely the case.

But even if some owners are aware of this, they may not have properly programmed their point-of-sales (POS) terminal to do the correct tax calculation before generating receipts.

The state tax authorities are very attentive to these facts, and may flag small businesses with these fees on their tax records.

Restaurants and bars, the likely majority of small businesses instituting new COVID fees, are already targets for state tax audits, as they take in more cash than other businesses and may often miscalculate the necessary taxes on that income.

For example, tax auditors know bartenders usually make several cash sales on any given night, but on weekends or during busy happy hours, they may get busy and forget to run the cash sales through their registers correctly. Even the most tireless efforts by owners to report 100% of cash sales may not be enough to avoid audit assessments, when an auditor uncovers some circumstantial evidence in the taxpayer’s operations that not all cash sales have been reported.

Since sales tax authorities searching for businesses to audit can openly see the correct amount of tax is not being charged on COVID-19 fees, a quick cost/benefit analysis could green light the business for an audit.

Online Retailers May Be the Exception

Online sellers who want to include COVID-19 fee may have an added advantage over brick-and-mortars, because they can ask the buyer if they are willing to pay the surcharge during the checkout process. If buyers do not want to pay, the COVID-19 fee would not be charged to the buyer’s credit card at checkout. An added benefit to this process is because the COVID-19 surcharge is paid voluntarily by the buyer, it is not mandatory to collect sales tax. Voluntarily paying means the surcharge is more like a tip at a restaurant, which is also not subject to sales tax.

How to Avoid an Audit and Cover Additional COVID Expenses

For the small business owners selling goods and services offline, it may be clear that there are several potential downsides of a COVID-19 surcharge. If these new fees can be taxed appropriately and accurately, then most definitely do so. But instead of adding an additional, possibly mistreated, charge at the end, a seller may be better off just raising their prices to get the additional revenue they need. Long-time customers may see the increase and say something, but those are the same customers that may be put off by the COVID-19 surcharge at the bottom. Training employees to kindly explain the additional expenses and hardships created by the pandemic are the reason for the increased prices will likely be better than the tax audit or potential public relations nightmare tacked on to a COVID-19 surcharge.

=========

John Hayashi is a Managing Director at BPM, a California-based accounting and advisory firm ranking among the 50 largest in the country, where he helps lead the Firm’s state and local taxes (SALT) practice. With nearly 30 years of public accounting and private industry experience in SALT, John helps his clients respond to SALT issues, particularly sales tax and use tax related to the Supreme Court’s 2018 decision in South Dakota v. Wayfair, Inc. A leader in BPM’s SALT group, he listens to client needs to plan and implement strategies that minimize identified liabilities.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Sales Tax