Intuit is introducing major new improvements to Projects in QuickBooks Online in order to better serve small businesses. Coming later this month, project-based businesses will be able to see at a glance how their time and labor costs affect their projects’ profitability. “In the past, users could create a project, track income and expenses, and run reports inside Projects, but what was missing was the real picture of their job’s profitability,” says Pawandeep Singh, senior product manager for QuickBooks Online. “Labor and payroll costs are the biggest expenses for many small businesses, but breaking down these costs by project is also really time-consuming and difficult. As a result, owners were flying blind on how their expenditures were affecting a specific job’s profitability.”

As Singh mentioned, updating these costs inside spreadsheets can be error-prone and tedious. But with the power of the QuickBooks ecosystem behind them, small businesses will have a seamless, integrated experience connecting QuickBooks Online, QuickBooks Payroll and TSheets® by QuickBooks. With this integration, accountants can now give their small business clients an end-to-end view of a job’s income compared to labor and other costs to ensure their pricing is appropriate and they’re maximizing profitability.

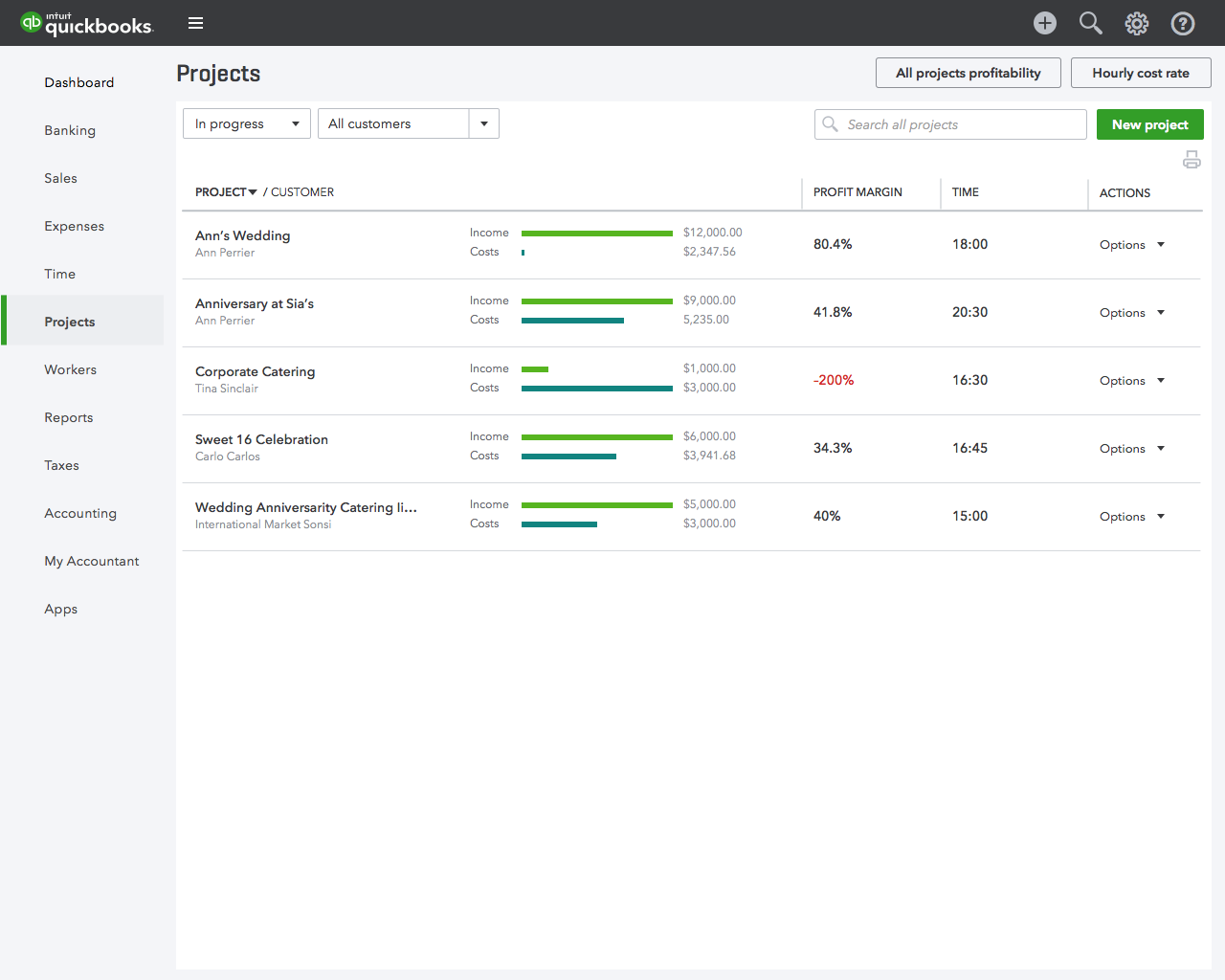

Job costing can be a complex process especially when businesses are juggling multiple projects. Intuit is making it simple and easy for businesses to track and see how their projects are doing at any point. While Projects integrates tightly with payroll and time tracking, Intuit® is also aware that not all customers use QuickBooks Payroll and/or TSheets – so if that’s the case for your clients, no worries; QuickBooks can still show your job’s profitability by giving customers the ability to enter cost rates for their team. Projects generates the job’s profitability view by using these cost rates to calculate time costs. Bottom line: they can still track and view their project’s profitability in QuickBooks Online.

Often businesses have indirect costs or overhead costs that may go beyond traditional payroll expenses. These can sometimes be big expenditures and if businesses focus only on payroll costs they can end up underestimating the costs toward their projects. Cost rates within projects can help you capture and report these expenses for your clients.

The key benefits to accountants and their clients include the following:

- More opportunities to provide advisory services. You can create another touchpoint with your clients by advising them on how to use the Overview tab in Projects to analyze their information.

- See where profit is trending and focus on areas that need more attention. Your clients will know – before it’s too late to make changes – whether they are losing or making money on a specific project or job. For example, if a caterer has an event coming up, would there still be profit if the event required one more server? The Project dashboard provides an at-a-glance view without rekeying information or comparing external, manual reports.

- More detailed reports. Links on the Project dashboard also provide deep dives into separate reports; you can help your clients produce, review, and use these reports regularly to know on a continuous basis what their profit would be at any given time.

- Putting an end to spreadsheet madness. No more populating 200 links with formulas and developing your own calculations; Project Profitability automates the process and takes the heavy lift off you and your clients by eliminating mistakes made by rekeying information inside spreadsheets.

Heidi Maghran, senior customer specialist on the team, says Project Profitability frees up Class Tracking in QuickBooks. Many accountants and their clients used Class Tracking to track jobs, but it wasn’t as helpful for tracking projects.

“Unlike class tracking for jobs, viewing the profitability and status for any of your projects only takes one click, rather than up to 10 clicks to create a class report. Within payroll, employees are not just tied to one class, and their paychecks can easily be allocated to multiple projects,” Maghran says. “Now you can use class tracking to understand broad areas of your business and determine which is most profitable: services, such as remodeling or new construction; various types of projects, like kitchen remodels vs. additions; or business divisions or departments.”

These new updates will launch in late February to QuickBooks Online Plus and QuickBooks Online Advanced customers in the United States, the United Kingdom, Australia and Canada.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: CAS