Should Employees Share Their Salary Information With Peers?

By Isaac M. O’Bannon, Managing Editor

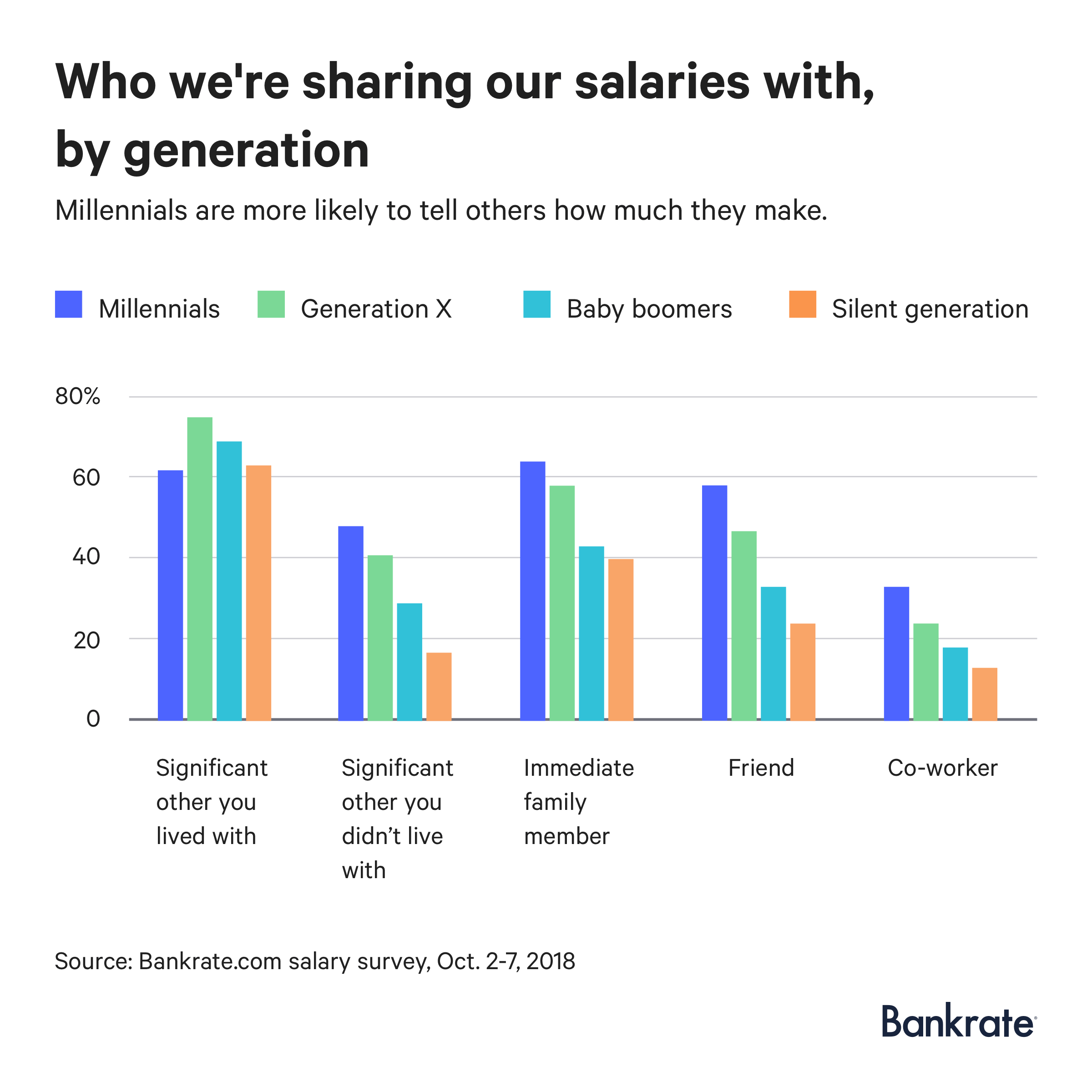

Millennials (ages 18-37) are more likely than other generations to share their salary information with others, including coworkers, friends outside of work, romantic partners who they don’t live with, and family members other than their spouse, according to a new Bankrate.com report.

The contrast is especially stark when compared to Baby Boomers (ages 54-72):

- One in three Millennials have shared their salary information with a coworker, compared to 18% of Baby Boomers.

- Nearly half (48%) of Millennials have told their salary to a romantic partner who they didn’t live with, versus 29% of Baby Boomers.

- Fifty-eight percent of 18- to 37-year-olds have told a friend how much they make, compared to 33% of Baby Boomers.

- Almost two-thirds (64%) of Millennials have told a family member other than their spouse their salary, compared to 43% of Baby Boomers.

“Sharing your salary information has long been considered taboo, but that notion could be changing, especially among young adults,” said Bankrate.com analyst Amanda Dixon. “When you’re ready to ask for a raise or negotiate your salary at a new job, knowing how much you’re earning relative to others can be helpful.”

Overall, just under 1 in 4 Americans (24%) has divulged his or her pay to a coworker. Men are more likely than women to have done so (29% vs. 20%), as well as those with higher income and education levels.

Shockingly, 31% have never told a live-in romantic partner how much money they make. This includes nearly 1 in 5 (19%) who are currently married or living with a partner. Lower earners and the less educated are the most likely to have withheld this information in a serious relationship.

Meanwhile, 38% have disclosed their salary to a non-live-in romantic partner, 44% have told a friend and 54% have shared with a family member who is not their spouse.

“Not telling your friends how much you make is one thing, but failing to share that information with a significant other could be a bad idea,” added Dixon. “When you’re setting short-term or long-term financial goals, it’s impossible to be on the same page if you’re not open and honest about how much money is coming in.”

This study was conducted for Bankrate via landline and cell phone by SSRS on its Omnibus survey platform. Interviews were conducted from October 2-7 among a sample of 1,017 respondents. The margin of error is +/- 3.72% at the 95% confidence level. SSRS Omnibus is a national, weekly, dual-frame bilingual telephone survey. All SSRS Omnibus data are weighted to represent the target population.

===========www.cpapracticeadvisor.com/12435378

Top Payroll Social Media:

How to Negotiate Salary Without Sounding Entitled. AFWA blog.

https://bit.ly/2T6IdrP

101 Ways to Make More Money. Forbes.

https://bit.ly/2DkRjeY

Why Gender Pay Inequality is Holding Businesses Back. ADP Spark.

https://bit.ly/2z7Q4wY

7 Ways to Improve Employee Relations. SwipeClock blog.

https://bit.ly/2DGnxCD

7 Ways Women Can Advance Their Careers. AFWA blog.

https://bit.ly/2qOAamh

Top Payroll News:

Why Tech Needs More Women Leaders. Women hold more than half of the accounting and auditing positions in the U.S., but just 12.5 percent of CFO positions in Fortune 500 companies.

www.cpapracticeadvisor.com/12435664

ADP Enhances Integration with QuickBooks. The new feature also enhances the interface with many other popular accounting software platforms.

www.cpapracticeadvisor.com/12435378

401(k) Limit Increases to $19,000. In 2019, the limits increase for participants in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan.

www.cpapracticeadvisor.com/12435437

ScaleFactor Partners with Gusto for Payroll and HR. The partnership delivers an integrated and automated accounting experience, enabling businesses to sync Gusto payroll and benefits data.

www.cpapracticeadvisor.com/12435517

Square Payroll Adds Benefits Offerings for SMBs. Allows small businesses to integrate health insurance, retirement savings and other benefits into payroll system.

www.cpapracticeadvisor.com/12436708

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs