The results are in from the 2018 Intuit Rate Survey. They not only indicate shifts in how accountants and bookkeepers bill clients but also hint at new, emerging methods for finding new clients. The Intuit Rate Survey takes an in-depth look at trends affecting accounting professionals, from technology adoption to billing rates, value pricing, credentials & certifications, and more. The survey was done with Intuit partners, Michelle Long, CPA, and Heather Satterley, EA, and asked more than 1,000 participants from around the world questions about their practice, use of technology, how they find clients and billing, among other topics – and yielded many interesting findings.

Notably, for example, hourly billing is becoming less popular among accountants, with value pricing/billing and fixed fee pricing on the rise. Only 57% of respondants bill by the hour for monthly accounting/bookkeeping services, down from 68% from the 2016 survey.

Value pricing is based on the maximum amount a given client is willing to pay for a service, typically set before the work begins. Conversely, value billing is usually marking up – or more frequently marking down – the invoice to the client after the work has been performed. While the survey confirmed the ongoing trend among accounting and bookkeeping professionals is toward fixed and value pricing/billing, and away from hourly billing, the service tenured, does impact the billing method used. According to the survey, fixed fee pricing was the most popular method to bill clients for payroll (55 percent), individual (57 percent) and corporate (54 percent) tax preparation services, but hourly billing remained the most popular for advisory services (70 percent) and technology consulting (72 percent).

Other interesting findings around billing focus on the impact of certification and credentials. Satterly noted, “It’s profound the difference that investing in education makes.” As you’d expect, the higher the certification or credential, the more an accountant professional charges. For example, the survey found that while a bookkeeper charges on average $64/hour, and CPA charges on average $88/hour. This trend holds true for Intuit certifications as well, with the break down as follows:

- Non-certified accountants and bookkeepers – $56/hour

- Core certification for QuickBooks Desktop or Online – $66/hour

- Advanced certification for QuickBooks Desktop or Online – $82/hour

In addition to certification levels, the region in which an accounting professional lives also has a strong impact on their rates. The survey found that the areas with the highest hourly rates were the Atlantic and the northern regions, while the lowest rates seemed to vary depending on the type of service. The central region was lowest for accounting/bookkeeping and QuickBooks troubleshooting, and the southwest region was lowest for third-party app consulting, IT consulting, training and other services. This year’s survey also features an interactive tool including a map that allows users in the U.S. or Canada to hover over a specific state or region and see what their peers are charging for different services.

In addition to rates, the survey also looked at how accounting professionals are using technology. The survey showed that the majority of respondents are getting online, with 62% having placed their accounting records in the cloud. Interestingly, however, only 25% of respondents have placed their clients’ data in the cloud. Satterly observed, “Accountants, as a rule, are really careful when we recommend things for our clients. I want to try things out before I expose my clients to it. The practitioners that are recommending cloud to clients went there first.”

She continued, “Successful consultants are leveraging technology and billing, which makes firms profitable and ready to scale.”

Finally, the survey asked accounting professionals where and how they scale and source new clients. Not surprisingly, referrals were overwhelmingly the best source of new clients for survey participants. Percentages edged up over 2016 for referrals from existing clients, peers, and others. Social media referrals fell by half, but local networking groups jumped, while local chamber of commerce meetings edged up slightly. Direct mail, radio, and print ads only slightly register as sources for new clients.

Counterintuitively, participants gleaned more new clients from Facebook than LinkedIn, despite the business-to-business focus of the latter. Twitter and Instagram barely registered as sources for new clients, and although new clients were gained in 2016 from YouTube, Google+, and Yelp, the channels did not generate any new clients among survey participants in 2018.

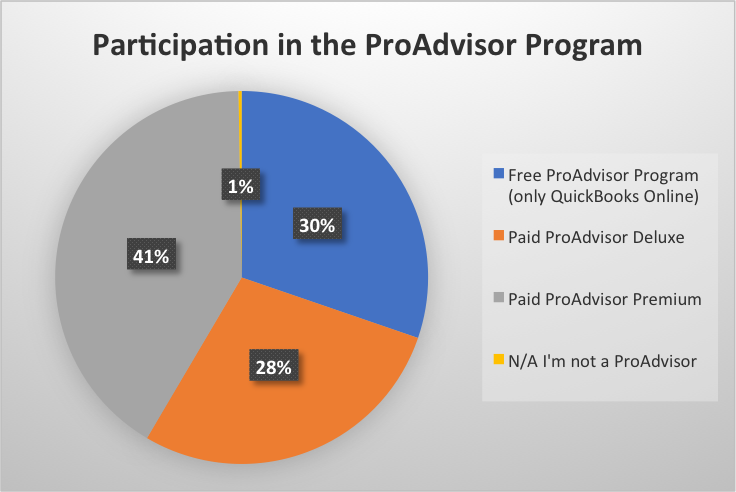

Demographically, 54% of survey respondents were from single-person firms, followed by 32% comprising firms of 5 employees or less. Almost every respondent was a member of the QuickBooks ProAdvisor program: 30% belong to the free QuickBooks Online program, 28% subscribe to the ProAdvisor Deluxe program, and 41% opt for the ProAdvisor Premium level.

The survey is part of Intuit’s Firm of the Future initiative that is designed to help accountants make the next steps in the ever-changing world of technology. To receive periodic email updates, visit www.firmofthefuture.com, enter your email address at the bottom of the page, and then click Subscribe.

While you’re there spend some time in the sections that center around client relationships, efficiency and growth, training, and news about the accounting industry and Intuit products.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs