Imagine the time accounting professionals could save if every system they or their clients used all communicated with each other. Now, picture accountants being able to access one single solution to handle all of their clients’ accounting needs. Thanks to Intuit, QuickBooks ProAdvisors and their clients no longer have to rely on their daydreams. Over time, Intuit has worked hard to lift QuickBooks Online Accountant to the next level so that it is the single place to manage all clients as an accountant. As such, the financial solutions developer recently announced two new integrations into QuickBooks Online: ProConnect Tax Online and QuickBooks Self-Employed. Announced at this year’s QuickBooks Connect, both integrations will be rolled out before year’s end.

ProConnect Tax Online

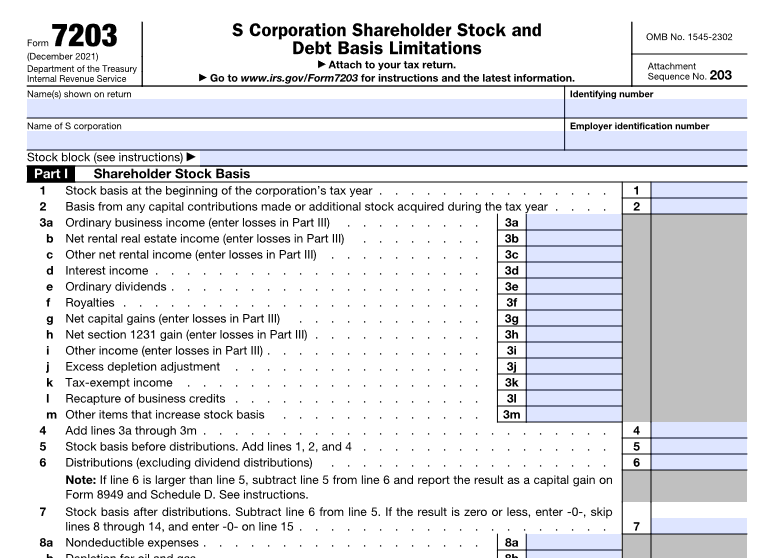

The ProConnect Tax Online integration builds upon last year’s Trial Balance feature. When Intuit rolled out Trial Balance, accountants spent an average of five and a half hours finalizing books, and preparing and filing tax returns for one client, much of which is manual data entry. The goal was to help eliminate the time spent on manual data entry and while that goal was accomplished, Intuit continues to see more ways they can help solve pain points for accountants, particularly around tax season.

Content Sponsored by Intuit.

With the new integration between QuickBooks Online Accountant and ProConnect Tax Online, users can view, manage and access their tax clients in QuickBooks Online Accountant. Users will see a new Tax column in QuickBooks Online Accountant: if they have ProConnect Tax Online clients, they will now see those clients in the QuickBooks Online Accountant Client Dashboard for the first time. The tax column will also display statuses selected in ProConnect Tax Online, including e-file status and user-selected statuses.

For business tax returns, the Trial Balance feature inside QuickBooks Online Accountant accelerates the year-end process of finishing the books and completing a tax return. Using Trial Balance, accountants can view changes year-over-year, drill down to transaction detail and make adjustments directly in QuickBooks Online. While reviewing, users can make and save notes and attachments, and also see alerts whenever there is any client activity. Trial Balance auto-maps to ProConnect Tax Online, making it easier for users to prepare a tax return using clients’ QuickBooks Online information. Once the information has auto-populated, users can edit mappings, save mappings year-over-year and carry over the previous year’s balances.

“Accountants are huge influencers, so it’s important that Intuit works to create products that will help them flourish,” said Tom Palfreyman, Product Manager, Intuit. “Everything we do is in service of saving accountants time so they can actually do their work and add their unique value to clients.”

QuickBooks Self-Employed

The QuickBooks Self-Employed and QuickBooks Online Accountant integration makes it easier for QuickBooks ProAdvisors to connect with and serve the self-employed workforce, which has more than quadrupled in the past 27 years from six percent in 1989 to nearly 34 percent today. Intuit estimates that by 2020, 43 percent of the workforce will be self-employed – amounting to approximately 60 million individuals. These 60 million potential clients will need software and professionals to manage their accounting needs in a world where many self-employed workers use their personal finance accounts for both personal and business-related transactions. Accounting professionals who serve this workforce may find themselves sifting through boxes of receipts to separate clients’ personal and business expenses in order to prepare their tax returns and find potential tax savings.

“When clients have a shoebox of receipts that have been stored all year, it’s not always easy for them and their accounting professional to navigate through their transactions efficiently and error-free,” said Harsha Jagadish, Product Manager, QuickBooks Accountant. “We’ve also found that most of the self-employed workforce are mainly “Do-It-For-Me” clients, and want their accountants to handle expense classification and cleanup in preparation for tax season. This integration between QuickBooks Self-Employed and QuickBooks Online Accountant helps to eliminate a lot of barriers that prevented accounting professionals from serving their self-employed clients to the fullest. Now, accounting professionals can work seamlessly within their clients’ QuickBooks Self-Employed file to help them realize true time and tax savings.”

QuickBooks Self-Employed users can invite their accountants to access their QuickBooks Self-Employed file – a feature already present for QuickBooks Online users. Once the accountant accepts the invitation, they will be able to see their QuickBooks Self-Employed clients inside QuickBooks Online Accountant, right along with the rest of their clients. Inside QuickBooks Online Accountant, professionals can directly access and manage clients’ books, and view key reports and uncategorized transactions, as well as quarterly and annual tax information. Since launching in January 2015, QuickBooks Self-Employed has helped over 100,000 self-employed customers identify an average of more than $4,000 in potential tax savings.

The integrations with ProConnect Tax Online and QuickBooks Self-Employed are just the latest proof that Intuit is working to help accounting professionals become Firms of the Future by taking very concrete steps to make the QuickBooks Online ecosystem the one place where accountants can manage their clients without having to access various systems.

“It all comes down to the fact that every day we want to continue to deliver as much customer benefit as we can,” said Palfreyman. “The less time accounting professionals spend performing data entry, the more time they have to really embrace their role as a trusted advisor.”

Current QuickBooks Online Accountant, QuickBooks Self-Employed and ProConnect Tax Online users will receive more information as the integrations are rolled out.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs