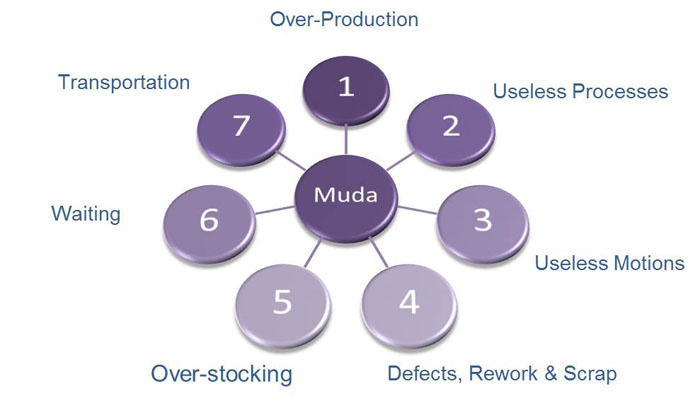

Eliminating Muda is one of the most effective byproducts of Lean Six Sigma analysis techniques which make any process more efficient and profitable. So what exactly is Muda? It is the Japanese term for waste, which is defined as “any human activity which absorbs resources but creates no value.“

Not surprisingly, the haphazard adoption of various technologies, accounting applications, and workflow processes without training or follow-up on new features has created a significant amount of Muda in firms, so the lull before yearend provides a great opportunity to take an objective look at your production processes and see where waste can be eliminated to make your more efficient.

In accordance with Lean Six Sigma thinking, “any action or resource expenditure that does not contribute directly to the goal of creating value should be eliminated to the greatest extent possible.” So where to begin? Below we list the eight most common categories of Muda and examples of production waste we discover during our consulting within accounting firms:

- Appropriate Skills: Does your firm have the right level of staff doing appropriate level tasks needed by the firm? Today’s workflow tools allow for stratification of tax returns so that complex returns are routed to the optimal reviewer, whereas there is no need for the simplest returns to follow that same route when they can be prepared, reviewed, and billed by a seasoned four year person in one pass. Setting up different workflows targeted towards the complexity of the return minimizes the wasted resource of having partners doing simple returns allowing them to focus on those returns that are more in line with their higher billing rates.

- Minimizing Errors/Rework: For any step to be considered value added from a lean perspective it must be done correctly the first time. This means that preparers should be trained and mandated to do a quality control review of any return prior to submitting it for review. This can be done with an express review checklist covering the most common reasons that returns are being sent back for corrections. Today’s workflow tools have the ability to store this checklist and require staff signoff before submission for review. Mandating that every return be pre-reviewed by the preparer will teach that preparer to one day be a reviewer and at the same time produce the return at a lower overall cost as the reviewers should have fewer returns sent back for correction and “re-review.”

- Transportation: Manually moving tax source documents from one location to another takes time and is considered Muda when compared to the alternative of having the documents scanned and available in a digital format to any preparer from their desktop, regardless of their location. Today’s digital workflow tools can link the source documents to the return workflow so they are retrieved when the return is pulled up. Even with front end scanning, many firms continue to move the physical documents with a tax lead sheet even though the data has been digitally captured. This is often a direct result of preparers not trusting that all items have been properly scanned in, pointing to the requirement of firms to have adequately trained scanning personnel that also must adhere to quality control processes to verify the scanning is done consistently and completely. Organizing the scanning workspace so that inbound physical documents are organized, processed, and stored in close proximity with a dedicated scanner instead of moving them to a duplicator in one room to be scanned and to another room to be reviewed is another example of wasted transportation.

- Inventory Backlogs: Excessive WIP (stacks of returns) slow down production compared to efficiently producing smaller batches by personnel at the appropriate level. Usually the first inventory backlog occurs in firms that require all source documents received from clients be sent to the partner in charge of that client to review the file for completeness, which can add days to the process. Workflow tools can direct those documents immediately to an appropriate level production pool, leaving only the most complex returns to those partners for review. We also see a large backlog when returns stagnate at the review level, which can be alleviated by re-assigning work to appropriate level staff.

- Excessive Waiting: Another backlog is producing tax production invoices after busy season instead of billing and collecting with every stand-alone return. Today’s practice management and workflow tools allow for the previous year’s amount and the projected current bill to be always available onscreen (with today’s triple or dual oversize monitors) so the reviewer can make a billing amount determination. This can then be documented in the workflow tool, processed by administration and provided to the signer with the return for final approval.

- Wasted Motion: Movement of people or workpapers that add no value constitutes wasted motion such as when a client calls in to check on the status of a return and the only way to know is to yell down the hall or search each person’s desk to see who has the file, instead of using a digital workflow tool that tracks this information onscreen. Another significant waste is re-shuffling or organizing source documents and workpapers to each partner’s specific preference instead of mandating a firmwide standard. We have been in firms where staff had spreadsheets that stated how each partner specifically liked their tax files organized. Utilizing a digital bookmarking tool will organize each client’s source documents to a single firm standard which all personnel can learn and work with consistently, and which makes future review and retrieval faster.

- Over-Production: Organizer creation is an area where traditional processes often lead to over production. We see firms generate physical organizers for every client, sorting them by partner, and then having the partner manually pulling out those that are not be sent to clients (and sometimes stored or scanned in to be used for a preparation guide). Virtually every tax program today has the ability to identify which organizers should be suppressed or printed and the latest versions also include the ability to publish a digital version directly to a client portal (and automatically notifying the client that the organizer has been sent). Updating the suppression status on screen assures that only the necessary manual organizers are processed.

- Over-Processing: Unnecessary procedures that do not add value from the customer perspective are considered over-processing, which can be a situation where firms require a second review for returns. Some firms do this as a normal course of action for all returns over a specific AGI or based on previous issues with a client where the risk was high (but may not be the case with the current return). Today’s digital workflow tools can allow for re-adjustments to tax production steps as the work is being produced so that they follow the appropriate steps based on that return’s risk. Another example of over-processing is when firms publish engagement letters in word processing and collates them manually with printed organizers. Virtually every organizer program has a transmittal capability allowing the engagement letter and organizer to be produced concurrently which saves administrative time.

One of the most fruitful exercises a firm can go through is the post-busy season debrief where staff are asked about sharing what they see as inefficient production processes, backlogs, and wasted efforts and then taking a fresh look at today’s solutions that address those items. By focusing on where wasted effort and resources can be eliminated, firms gain a fresh perspective on improving their production processes.

————

Roman H. Kepczyk, CPA.CITP is Director of Consulting for Xcentric, LLC and works exclusively with accounting firms to optimize their internal production workflows within their tax, audit, client services and administrative areas. His Quantum of Paperless Guide (Amazon.com) has been updated with 2015 paperless benchmark statistics and outlines 32 digital best practices all accounting firm partners need to understand today.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs