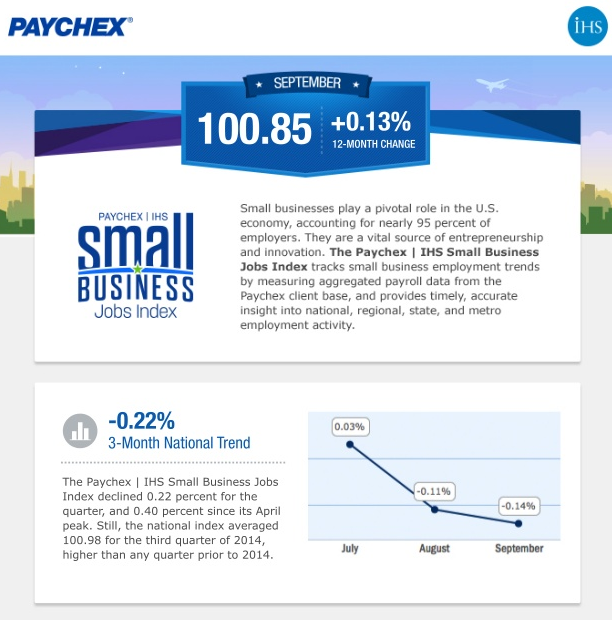

While the Paychex | IHS Small Business Jobs Index grew 0.13 percent in the past 12 months through September, the national index decreased to 100.85 with the pace of small business employment growth continuing to slow slightly. Coming off its April peak of 101.26, the index is still trending higher than any quarter prior to 2014, indicating consistent employment growth conditions persist. An increase in small business job growth drove the East South Central region into the lead among regions. Wisconsin continues to lead the state index, and Seattle claimed the top spot among metro areas.

“Though still performing stronger than in 2013, the small business job market has cooled a bit in the second half of 2014. At 100.85, the Paychex | IHS Small Business Jobs Index contracted again in September, remaining below the 101 level it exceeded from January through July. Year-over-year gains continue to trend positively, 0.13 percent, as the index is higher than at any time in the second half of 2013,” said James Diffley, chief regional economist at IHS.

“For the second consecutive month, the Paychex | IHS Small Business Jobs Index is showing a mixed story for small businesses employment growth,” said Martin Mucci, president and CEO of Paychex. “While the growth rate has slowed in four of the past five months, the index continues to show positive year-over-year gains.”

National Index

The pace of employment growth continued to slow slightly as the Paychex | IHS Small Business Jobs Index fell 0.14 percent in September, marking the fourth decline in the last five months. However, at levels near 101, strong employment conditions persist.

Regional Employment

The East South Central moved to the top spot at 102.16 and was the only region to see improvement in employment conditions in September. The South Central regions now have the highest index values, edging ahead of the Mountain region. At 99.52, the South Atlantic remained the lowest regional index, as Georgia dropped 0.61 percent in September, consistent with the state experiencing the highest unemployment rate in the nation in August.

State Employment Trend

Wisconsin posted its third consecutive large index gain, 0.45 percent, increasing its margin as the top performing state index. Monthly gains in New Jersey and Maryland merely offset large August declines as both states continue to trend below 100 and rank near the bottom of the state index. Analyzing long-term growth rates for the top 20 states, only nine states advanced during the past 12 months, while eleven declined.

Metropolitan Employment Trend

Reaching 103.10, Seattle rose to the top metro index spot, gaining 0.32 percent during September. Despite declines this month, Houston and Dallas trail Seattle closely near the top. Baltimore saw a huge 1-month gain, 1.02 percent, though its index remains below 100 with the Maryland economy slumping this past summer.

Launched on April 1, the monthly index from Paychex, Inc., a leading provider of payroll, human resource, insurance, and benefits outsourcing solutions for small-to medium-sized businesses, and IHS, Inc., a leading global source of critical information and insight, provides analysis of small business employment trends across the U.S.

The index analyzes same-store, year-over-year worker count changes to identify and track small business employment trends using real small business payroll data from the Paychex client base. The index is based on aggregated data from approximately 350,000 small businesses with fewer than 50 workers across the United States, one of the largest sample sizes of any small business index or report in the country, and provides timely, accurate insight into national, regional, state, and metro employment activity. The index uses a base year of 2004, a period of expansion before the start of the economic downturn. When the index trends up it is a sign of a strengthening job market, and when it trends down it is a sign of a slowdown.

More information about the Paychex | IHS Small Business Jobs Index is on the jobs index website.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Small Business