Bill.com today announced it will offer integration of its cash flow-centric banking platform for banks. This integration will allow banks to offer accounts payable and accounts receivable services to their small and mid-size business customers, enabling banks to increase revenue and customer retention. Bill.com provides integrated bill payment, invoicing, and cash management solutions for businesses and accountants.

“Bill.com has already revolutionized how small and mid-sized businesses work and now we are transforming how they bank,” said René Lacerte, founder and CEO, Bill.com. “We built the Bill.com Banking Platform based on direct feedback from banks, who told us that their current systems just couldn’t meet their business customers’ needs. We are glad to be helping banks turn the old banking paradigm on its ear, by making banking solutions cash flow-centric. The result will be banking solutions that work the way businesses do.”

Currently, SMBs have to use separate bill payment and accounting solutions as the available banking solutions only handle transactional payment processes. With Bill.com’s integrated banking solution, banks will be able to offer their SMB customers control of the complete cash flow management process. From the bank’s platform, customers will have access to a bank-branded version of Bill.com’s solutions. The integration with Bill.com’s cash flow-centric banking solution will also allow banks to leverage their own unique services, creating a personalized experience for their customers.

“Just as CheckFree helped banks revolutionize the consumer payments industry, Bill.com is now enabling banks to do the same for their business customers’ cash flow management and payments processes,” said Mark Johnson, former Vice Chairman of CheckFree Corporation and current Bill.com board member. “Bill.com understands the problem banks have faced trying to cobble together a business solution from their consumer offerings. Bill.com has fixed the problem via an integrated, efficient platform that helps banks win customer loyalty and brings them the ability to earn additional revenue.”

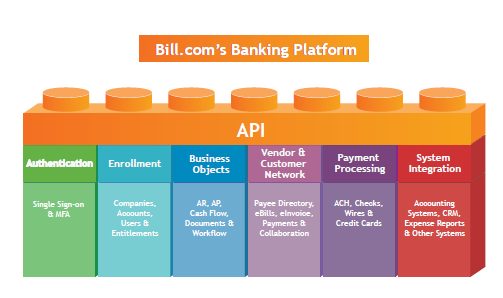

Bill.com’s banking solution offers six components and API access to each component has been enabled for banks to seamlessly integrate their banks’ SMB offerings with the solution. The six components include:

- Authentication: Customers can access their cash flow management control center anytime they log into their bank’s online system using single sign-on and multi-factor authentication capabilities. MFA uses the highest levels of security to ensure financial information remains secure.

- Entitlements: Access and authority can be granted and limited, making it easy to assign roles and permissions to SMB employees and accountants. Bill.com features roles and permissions that users can set or they can create their own for payees and customers.

- Business Objects: Bill.com’s platform also integrates seamlessly with the bank’s business banking services, allowing banks to offer payables, receivables, cash flow management, document management and workflow solutions to their customers. Using Bill.com’s business objects, banks can create a tailored experience for their customers.

- Business Systems Integration: Bill.com integrates with the most common accounting solutions for accurate and synchronized data. Two-way synchronization ensures that customers’ data is always up-to-date and increases efficiency while saving time.

- Payment Processing: With the Bill.com platform, SMB customers can send, receive and reconcile payments right from the bank’s payment system. The platform handles various payment methods including ACH, checks, wire transfer and credit card payments.

- Payment Network: Bill.com offers a secure business network that features cloud-based portals and a payee directory. Through the network, businesses can interact with customers and vendors by exchanging business documents, notes, eBills, eInvoices and other information.

“Bill.com was built for accountants and small businesses and we offer very accountant-friendly services,” said Mark Orttung, President and COO of Bill.com. “Integrating that service into the offerings from their bank will be a huge advantage for accountants and SMBs. Their banks can now offer them tools tailored to them and how they do business.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs