From the September 2012 Issue.

Let’s face it, payroll isn’t sexy. It isn’t a task that most small business owners get excited about. Most consider it a “time-suck” – something that sucks up an entrepreneur’s time when they should be focused on growing their business. And it certainly hasn’t been something that small to mid-size accounting firms looked to as a means to grow their revenue. Handling payroll manually means countless hours of administrative work and keeping a keen eye on ever-changing tax laws – on the state, federal and local level. Considered tedious and time consuming, payroll offered little in the way of return on investment.

“To be quite frank, I hated payroll. However, if my clients need help with payroll services it’s my job to help them,” notes Robert Clayton, CPA.

Of course Clayton and others also know that there are many advantages for accountants when it comes to providing payroll services. Handling a client’s payroll can open a window of opportunity. To a small business owner, payroll is not just numbers and bank accounts. There is an emotional tie to the owners’ business and employees. There is a sense of contribution to families and society. Payroll can build a relational bond that lends to a true loyalty between accountant and client. Not to mention that an accountant has a constant window into the financial health of the business which offers opportunity to cross-sell other services or see potential issues before they become a problem.

Like scores of his peers, Clayton needed to find a way to reap the advantages of providing payroll that wouldn’t eat into his profits. “I realized that unless I chose the right solution for my firm and my clients, I might risk my firm’s profitability if I had to add staff to manage the process.”

Technology Ushers in Convenience and Profitability

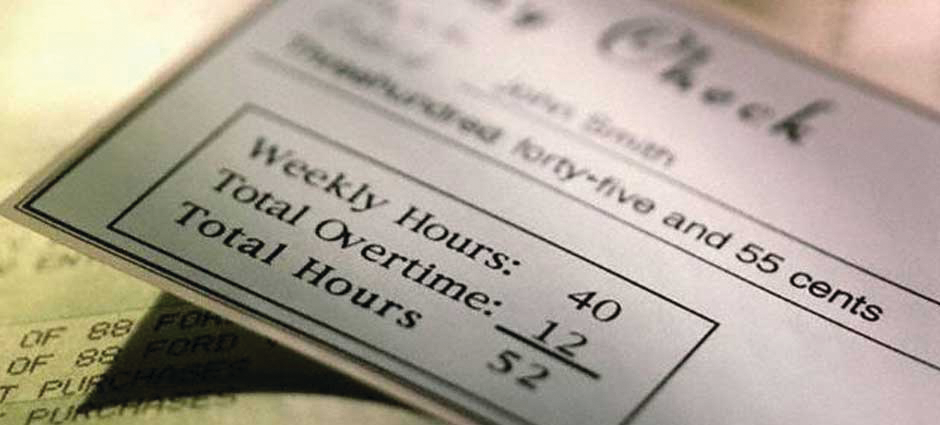

In today’s digital age, rapidly advancing technology is changing the way people do business. Research shows that the majority of small business owners run payroll on their own. Many turn to software and some even do it the old fashioned way – calculators, ledger books and paper checks. It’s a lot of work – even using software requires constant updates and often causes frustration when the program cannot accommodate a specific need or there is an unexpected glitch.

Clayton saw some red flags with common software applications that clients might purchase to manually run payroll. “Because QuickBooks can go into a client’s accounts and make automatic changes, I had serious concerns about recommending this software for clients.”

Technology is constantly changing the way small business owners operate. In the case of payroll, there are online providers that offer an easy, convenient and efficient means to handle payroll.

An online provider with technology that automates tax calculations, filings and payments can reduce errors and alleviate much of the traditional workload. Accountants and small business owners don’t have to be tax experts. After set-up, the whole process can be as simple as logging in to a secure website portal, entering hours, previewing payroll and then approving it. Many online providers also offer direct deposit, which is a tremendous convenience for everyone involved. The entire process can be done from anywhere with Internet access at any time. Some providers even offer mobile apps making the process even more convenient.

Some payroll service providers, like SurePayroll, have added an extra layer of technology allowing accountants to take advantage of the online product while growing the accountant’s reputation as a trusted payroll advisor. A customized portal allows the accountant to label the product with his/her business name and logo, as well as host the product from their own website. These online products offer accounting software integration that also makes the transfer of data immediate and seamless. Thousands of accountants are taking advantage of this technology today to resell the payroll service at a profit.

Clayton is one of them. After doing his research, he discovered that becoming a payroll reseller was a flexible and profitable option.

Of course not all solutions are equal and as accountants are looking for a payroll provider there are many items that should be considered, including:

- Integration with existing software.

- Automation of processes including information backup.

- Accuracy in data processing.

- Flexibility and scalability.

- Security of client data.

- Disaster recovery.

- Service and support.

- And overall costs.

There is no better time to look at payroll as a viable option to grow your business. I’ve seen thousands of accountants grow their brands and become more profitable by taking advantage of the easy automated online payroll systems available today.

– ——-

Michael Alter is President and CEO of SurePayroll, where he is responsible for the overall business model development, strategic planning and day-to-day operations for SurePayroll, the Online Alternative and a wholly owned subsidiary of Paychex. Alter joined SurePayroll in 2000 after more than five years with McKinsey and Company, where he was a founder and leader in the Service Operations Practice. Prior to receiving his MBA from the Harvard Business School, Alter worked in various sales positions at IBM. He holds a bachelor’s degree in economics from Northwestern University.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs