Small Business

Intuit and PayPal Expand Integration to Help Small Businesses Get Paid Faster

Intuit and PayPal expand their partnership to streamline payments in efforts to help small businesses get paid faster.

Oct. 28, 2016

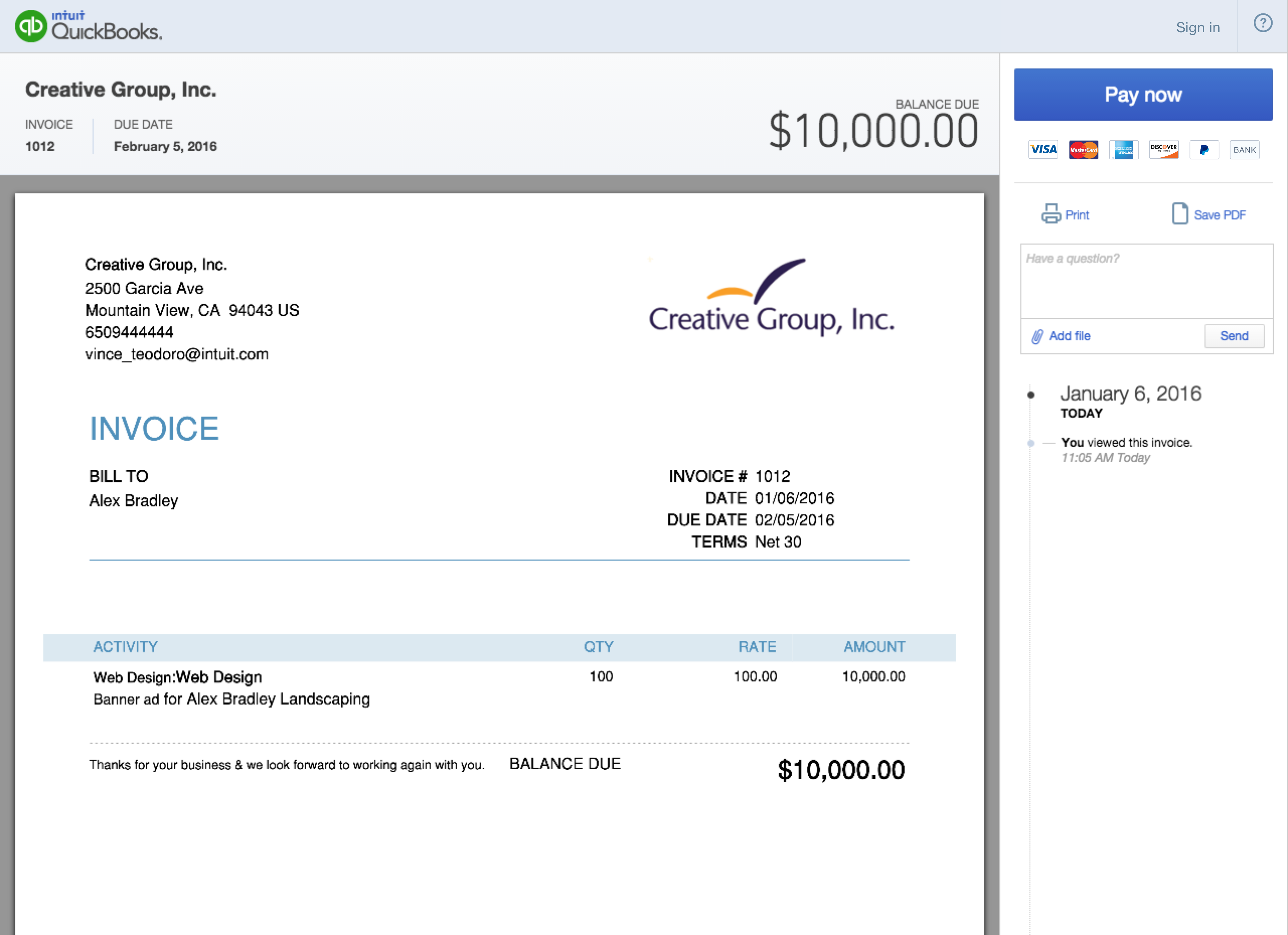

Earlier this week, Intuit and PayPal announced they were expanding their partnership to streamline payments in efforts to help small businesses get paid faster. The deeper integration, announced at QBConnect, will allow users to send invoices, accept payments through PayPal, and track the status of their invoices.

Intuit and PayPal both have worked hard to build technology that helps small business owners grow their business and successfully compete in their market. As such, many small businesses are customers of both, but until this week, have only been able to accept PayPal payments through QuickBooks Online with add-ons and plugins.

“Every once in a while, you see something that makes so much sense, you just have to move forward with it. PayPal is big among small business owners and many want to use it to accept payments. This integration seamlessly ties in with QuickBooks Online e-invoices to save customers time and gets them their money,” said Steve Fusco, Vice President & General Manager, North American Distribution, PayPal. “We rolled this integration out to customers in Australia the end of last year, and we found that thousands of QuickBooks Online invoices were getting paid twice as quickly when they were paid through PayPal.”

Getting paid twice as quickly is huge for the 64 percent of small businesses who currently have outstanding invoices that are 60+ days overdue. With this new integration, customers have more options to pay, including PayPal Credit or their PayPal Wallet balance. This gives PayPal’s small business customers more ready access to their cash flow.

In addition to getting paid faster, PayPal data is seamlessly imported into QuickBooks Online, so users can see their PayPal transactions, fees and customer data all in one place, eliminating the need for manual entry. Invoices are also automatically marked as paid whenever a customer pays using PayPal, making it easier for small businesses to track their unpaid invoices.

As technology continues to enable small businesses to compete on a global scale, customers will be looking for solutions that allow them to securely and painlessly pay for goods and services. Being able to accept payments through PayPal can expand a small business’ market to the approximately 192 million PayPal customers worldwide, who have come to know and trust the PayPal brand. Leveraging the PayPal brand, and solutions like PayPal One Touch, QuickBooks Online users are now enabled to spend less time chasing payments and more time building their brand and business.

“Both Intuit and PayPal are committed to helping our customers grow and succeed. With this extension of our partnership, we’re excited to empower small businesses with access to the tools they need to get paid faster,” said Fusco. “In minutes, small business owners can create an invoice in QuickBooks Online and customers can pay with credit cards, debit cards, and now, with PayPal. This is a huge win for small business owners and accountants who want to improve cash flow management and save time.”