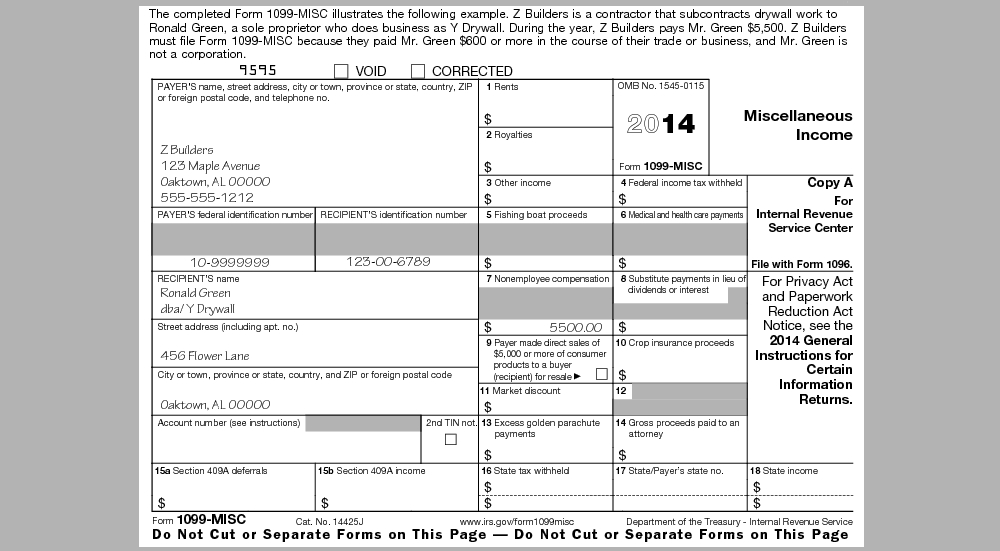

It is helpful for tax filers to review the specific boxes on Form 1099-MISC, so that both issuers of the form as well as recipients can know the requirements and also look for errors. This form is used for a number of payment types that are reported as income for the recipient.

The most frequent use of 1099-MISC is for reporting payments for services to independent contractors, and it is possible to receive more than one 1099-MISC if a recipient performed work for several business entities.

The top of the form has a box for any 1099-MISC that is a corrected copy, where the original form contained errors in amounts or identification of the recipient. The left hand side of the form is used for the payer’s and recipient’s names, addresses and tax identification numbers. There is also a box for Account Number if the payer identifies the recipient internally with a specific account.

[The 2014 tax year version of Form 1099-Misc is available for download from our website.]

The right hand side of the form deals with specific payment types being reported in the designated boxes.

- Box 1 is for rent paid from real estate properties, which is then reported as either investment or business income.

- Box 2 is for royalties from such properties as oil, gas and minerals, as well as royalties from patents.

- Box 3 is for other income that may fall outside the primary types listed and would also be included on the ‘Other Income’ line of Form 1040. Examples include prizes, awards or taxable damages from a lawsuit.

- Box 4 is for tax withheld on Indian gaming profits.

- Box 5 is for amounts received for work performed on a fishing boat where the owner considers you to be self-employed.

- Box 6 is for medical and health care payments made on your behalf.

- Box 7 is for all types of payments made for work services of non-employee independent contractors.

- Boxes 8 through 14 are for less common types of payments such as crop insurance proceeds and excess golden parachute payments.

- Box 15a and 15b are for listing nonemployee deferred income.

- Boxes 16-18 are for state and local income tax withheld by the payer, as well as the state number and state income.

Most issuers and recipients of 1099-MISC will primarily concerned with making sure that names and tax numbers are correct, as well as the exact amount of payments made. Any discrepancies will require filing of an amended form, or a statement of explanation attached to the recipient’s tax return.

———–

Erich J. Ruth is a technology expert at 1099 Fire, a developer of 1099 and W-2 compliance software.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes