Advisory

How Collaborative Accounting Can Help Grow Your Practice

Expectations from business owners and clients have changed. This is particularly true with accounting software and the impact on traditional write-up services.

Oct. 13, 2014

From the November 2014 Issue

Expectations from business owners and clients have changed. This is particularly true with accounting software and the impact on traditional write-up services. If you have ample engagements and profitability in tax and audit work, adding a new major practice area is probably far from your mind. If you have been focusing on niche market development, a generic offering will not make sense.

A properly done collaborative accounting offering should provide:

- High client value,

- High profitability,

- Balanced work load over most of the calendar year,

- Repeatable monthly revenue that can be performed by non-certified staff,

- Increased client retention,

- Increased value of your firm,

- Less tax deadline based work,

- Easier business tax return preparation,

- Increased client consulting engagements,

- More flexibility to you as a firm owner/partner.

That list is a pretty tall order, but if you have an interest, it can be done. Better yet, you can do collaborative accounting for specific niche markets and related, adjacent niche markets.

Where to Start?

A number of organizations and companies are promoting the collaborative accounting idea. Included in this list are the AICPA’s CPA2Biz unit, Payroll Vault, RootWorks, and The Sleeter Group that each provide strategic planning and tactical execution guidance. Product publishers that have been promoting this idea for some time include: AccountantsWorld, Intacct, Intuit with hosted QuickBooks or QuickBooks Online, Thomson formerly with CBS and now with ACS, Wave or Xero.

While fully recognizing that in most firms write-up has been looked down upon and with much disdain among most partners, the opportunity in this practice area can’t be ignored. Usually one or two partners are sufficient. Things are even better if you have a rain making partner, and one that loves operations as well as experienced people that prefer to setup procedures and follow them.

First, set a target market for your services. You might do this by looking at your existing client base, or you may choose an area where you have expertise and interest. For example, medical practices such as orthopedic clinics, pediatricians, chiropractors, veterinarians and others can give you a chance to specialize in your geography or at a regional or national level. Other industries such as construction are recovering nicely and specialty groups like electrical contractors or plumbing contractors can really use accounting help. In certain geographies, non-profit organizations provide a marvelous opportunity for you to specialize. In short, pick a market where you have a long-term opportunity. Look at your existing base of clients as a potential start.

Next, consider the services you intend to offer. We believe it is in your best interest to go very deep with clients including accounting, payroll, human resource and advisory work in specialty markets concerning business issues where your accounting expertise can shine. Your skills and client needs might include costing, pricing, internal controls, inventory management, supply chain, marketing or a broad range of other topics.

We know you need at least ten outside clients to be successful, but a target number of 50, 100 or more is not unreasonable. Consider building your pricing model based on a cookbook approach, so you can readily quote a flat monthly fee. Further, if your accounting work for a business will make tax return preparation simple, consider including the tax return preparation as part of quoted fee for service. You want the client to contact your firm for every need. You can either build your firm to meet the need or you can have a strong referral network for services needed by your client base that you don’t directly provide.

You can make your service offering as simple or complex as you like, but your client facing engagement should have simple, flat rate pricing that can be billed in advance through ACH entries with your local bank. Firms report to us that they are quite successful at charging $2,000, 3,000 and 4,000 per month even to small businesses. Frequently the winning argument is framed around replacing the bookkeeper or spouse in their business, getting compliance right and letting them focus on the business that they enjoy. Usually the small business owner will save money by paying your firm more in monthly fees AND they will have better accounting and payroll services.

Update your marketing information to provide a clear explanation of the services offered. Create a consistent, professional format of your offering. Make sure to include your web site in these revisions adding video explanations of your services. Over time, include solid client testimonials as referral information, too. Accumulate marketing lists through your local chamber, from reputable list sources and other referral networks that fit your target market.

Manage these efforts through CRM products like Results CRM, Sage CRM, Microsoft CRM, HighRise or comparable products. Note that a product like Results CRM interfaces two way with Constant Contact to ease email campaigns and also has a two way integration into QuickBooks. There are some niche offerings where Results CRM can be a product that both you and your clients can use.

Approach a few of your trusted clients with the new offering, and convert them from your traditional services model to your new collaborative accounting model. You’ll discover that you probably have a pretty large number of clients in your base that are willing to pay you more for this service than you were charging for a tax return. As noted above, many firms are finding that collaborative accounting is paying more than small compilation, review or audit engagements. Remember that you can staff this part of the practice with non-CPA, part time, work at home, and outsourced labor sources.

Consider the Solutions

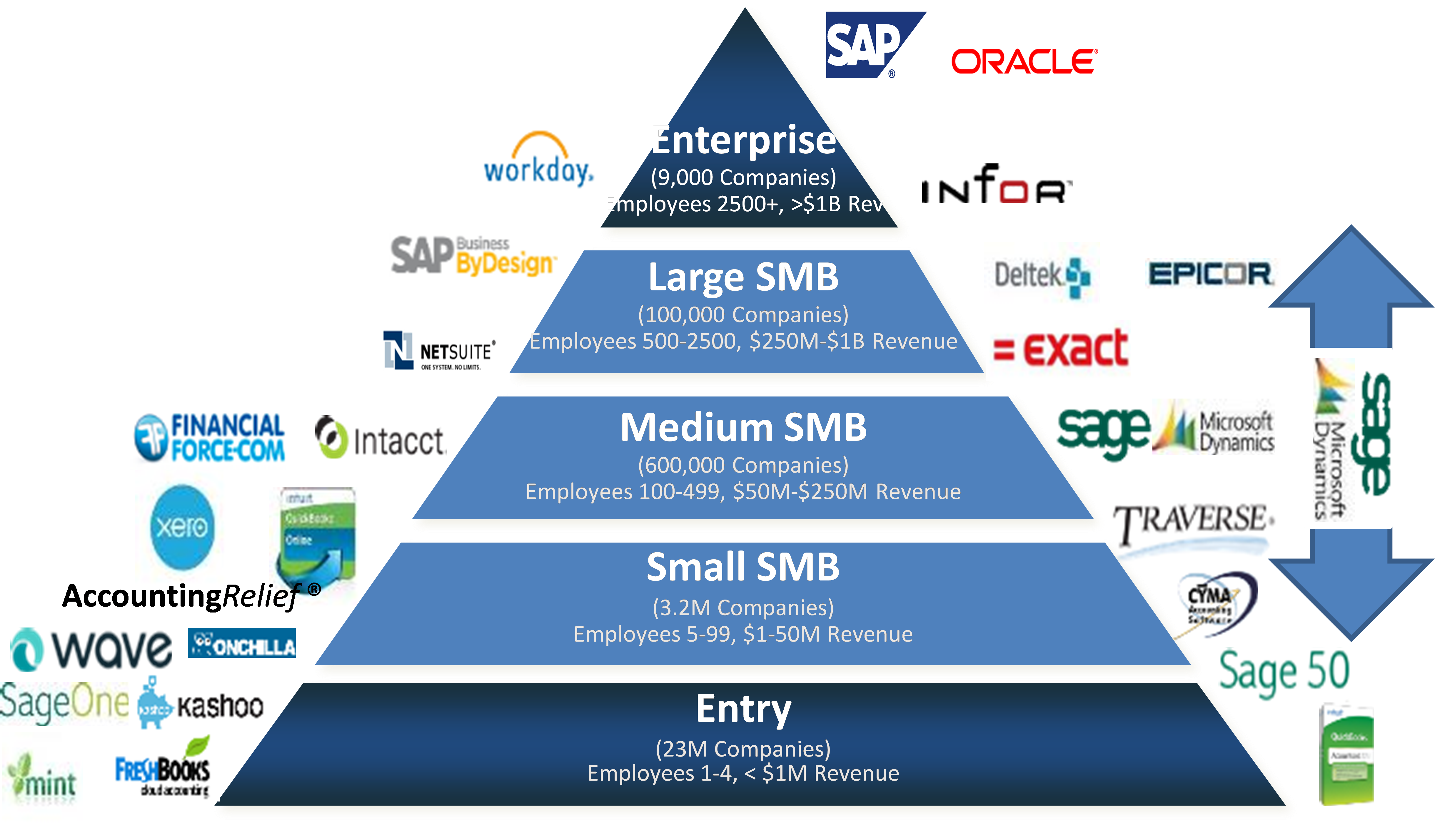

To have an effective collaborative accounting solution, the product must be available via the Internet, or as is commonly said today “in the Cloud”. There are approximately 300 accounting software products sold in the U.S. market. Around 40 products are sold that are Software as a Service (SaaS noted in options below) that run completely in a web browser. As a rule, the SaaS products will have fewer features than the traditional products offered by publishers during the last 20-30 years.

Most of the products that can be installed in-house are also offered in a hosted version today and can be accessed with cloud tools like Citrix. Further, the pricing of these traditional on premise products is usually available in two forms: monthly subscription or purchase with annual maintenance.

Entry level products today include:

- Accounting Power (SaaS) – a product offered through accounting firms that has good accounting capability including payroll.

- CYMA – notable for the payroll and human resources capabilities and low cost of ownership.

- Intuit QuickBooks and QuickBooks Online (SaaS) – both are U.S. market leaders in their respective categories. There is automation for integration into Online Tax, Lacerte and ProSeries.

- Sage 50 Pro, Premier and Quantum – Good inventory, costing, payroll and reporting capabilities make this product an attractive choice for slightly larger organizations that need more users.

- Thomson ACS – This is a complete solution that has a client portal, collaborative accounting and integration into the back end Tax product of UltraTax.

- Wave (SaaS) – a free SaaS product with good accountant access and a payroll option.

Small to Medium Business (SMB) products today include:

- Intacct (SaaS) – promoted by the AICPA’s CPA2Biz unit, this product has inventory, costing and third party integration as well as entry level accounting capability.

- Microsoft Dynamics GP, SL, NAV and AX – Microsoft has four different offerings with unique capabilities in each of the product lines. Dynamics GP is well known for general accounting, costing and inventory. The NAV and AX lines have the most customization capability.

- NetSuite (SaaS) – this publicly held company has good CRM and eCommerce integration in their offering. It also handles international currencies.

- Open Systems TRAVERSE – a product that has good personalization capabilities, and has specialties in a number of verticals including not for profit, services, distribution and flexible packaging.

- Sage 100, 300 and X3 – Sage has more installations in the U.S. market and globally than any other accounting software publisher. These products are frequently used in distribution and manufacturing and have broad third party support to fit many vertical markets.

- SAP Business By Design (SaaS) – a comprehensive, integrated financial and distribution product that offers a multi-perspective GL for unique reporting needs.

These examples are not recommendations, because we believe you need a reasonable system selection process to fit a product to your needs. However, CPA firms are finding great success with a number of different products. The key is to work on finding a fit for your market.

What To Do

If you determine your firm wants to enter this market, follow the steps above. Consider reaching out to an organization that can help you build your practice by providing some of the tools needed. Once you understand some of your options and the process, build an appropriate business plan model. Spend a few days in demonstrations of how the potential products fit your needs. Negotiate your license agreements, make the decision, and implement.

Vendors will do everything they can to shorten the sales cycle and get you to make a decision fast. This is to their advantage as a method to eliminate the competition. If a product is a good fit now, it will be a good fit later. Don’t overanalyze, but the worst mistake of all is not spending enough time on determining your client’s needs, how your practice can satisfy these needs and how you can build a repeatable operation.

Be thorough in your planning, and you will save a lot of time and mis-steps. Further, you will build a valuable service to your clients and enjoy more profitability along the way.