Sometimes people don’t recognize that they are working with an accounting system that has gradually declined over time. They are not always aware that they could save a lot of time and money with an upgrade. As an external accountant or consultant, you don’t have to be a computer specialist to help your client. All you need to do is be aware of some simple signs.

Here is a list of things to look for. Hint: the client doesn’t necessarily have to go to the expense of a full conversion in order to get more from their accounting system. Sometimes, just a few hours of a consultant’s time is all it takes to make a big difference to the client.

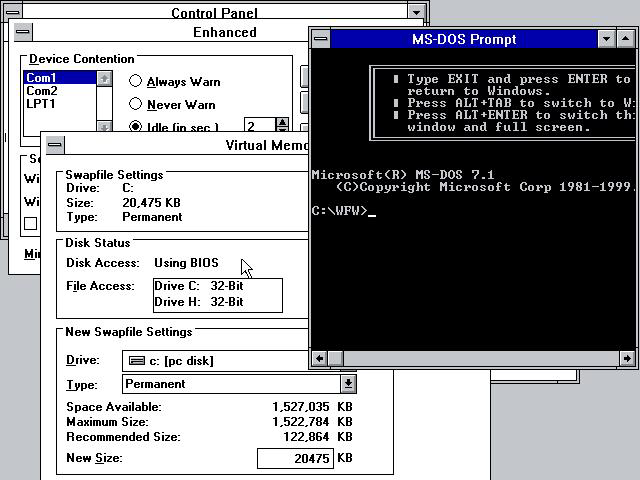

10. Old / Obscure Software

The last 10 years has seen a lot of consolidation in accounting systems. Software has become more flexible and parameter driven. The fact that your client is in a specialized industry no longer means that they need specialized software. Newer packages are cheaper and more flexible. For example, a small client was creating their invoices in a word processing system because they had not purchased the Accounts Receivable module.

They were booking the sales when the money was received from the customer. When their auditor recommended purchasing the AR module for their system, they found they could replace their whole system with Quickbooks or Sage (two popular systems) for less than the cost of the AR module for their older system. The bookkeeper was much happier with the newer, more user friendly software.

If you have never heard of the client’s software system, search for online reviews to see how popular and well supported it is.

9. No Accounting System Budget / Expense

If a company isn’t spending a little every year on its accounting system, for software upgrades, training new staff and keeping up to date with developments in the industry, then it is accumulating a deficit that may prove to be surprisingly large.

Software developers typically issue new versions each year, but your client may not see the value in automatically upgrading to the new version. That often leads to ignoring all updates. A good compromise is to recommend that the client never let their system fall more than two versions behind.

When a staff member leaves, there often isn’t time for them to train their replacement. Even when they do, they may not understand the system well enough to do a good job. They may know enough to get transactions through the system, but be unaware of key time savers or new features that will help their successor.

When analyzing your client’s expenses, a simple recommendation to put money into next year’s budget to upgrade the system or to get basic training for the accounting staff could help them get increased value.

8. Calculation Errors

Errors in reports, such as tax calculations, margin percentages, inventory turnover or foreign currency translation are a red flag for system set-up issues. If you find this kind of problem, go beyond fixing the immediate issue and start to ask about whether more of the accounting system should be reviewed.

Errors in calculations and totals can also be an indication that the reports are being produced from a secondary independent spreadsheet system. With modern packages, such systems can usually be incorporated into the main system, increasing accuracy and reducing duplicate data entry.

7. Manual Spreadsheets

If the system can’t produce a particular report, the tendency is to enter the information into Excel and create the report manually. Often these manual spreadsheets are created month after month instead of asking whether the system can be modified to produce the report automatically.

If your client’s reports all come in the form of spreadsheets, ask how long it took to prepare them. A reporting upgrade might save them a lot of time every month.

6. Reports Don’t Fit the Business

Businesses evolve. They add new product lines and locations. They reorganize their management. They change their focus. If the accounting system does not reflect these changes, the reports can become increasingly irrelevant. The client may believe that they are unable to change the accounting structure, but there may be utilities available from the developer the client is unaware of. If you see this situation, a little research may go a long way to helping your client get the information they need to run the business effectively.

5. Lack of Reports

When looking at your client’s financial package, ask yourself what reports you would want to see if you were in management. For example, look for reports by location and product line. Check if each manager gets a report that singles out their area of responsibility. Are there both summary and detail reports? If they are not there, ask why. Don’t be satisfied with the answer that the system can’t do it. If a report is necessary to manage the business, then the system needs to be able to produce it.

4. Late Month / Quarter / Year End

Consistently late reporting may be more of a procedures issue than a software problem, but it’s a sure sign that something needs to change. Look for the following red flags:

- Suspense accounts accumulating balances during the period that have to be reconciled,

- Waiting for information (e.g. bank statements),

- Transactions that are booked one way during the month, but have to be adjusted at month end,

- Differences in intercompany accounts,

- Complex allocations or variance calculations

To be actionable, reports need to get to decision makers quickly. If you see this kind of red flag, encourage the client to change their procedures so that transactions are recorded appropriately as they happen and / or move processes like bank reconciliation away from the month end and accrue an estimate. The increase in effectiveness will be worth the small decrease in accuracy.

3. Tensions between Managers

Manager should spend their time arguing about the future of the business, not the accuracy of the numbers. Tension over how the financial statements were prepared is a good sign that the accounting system needs analysis and a possible upgrade. Hint: if the financial reports affect the managers’ performance bonuses, then the information needs to be up to date and crystal clear.

2. Staff Complaints / Overtime

When accounting staff are having to put in long hours preparing manual reports or working around system limitations, they get frustrated and complain about the system in general. The often don’t realize that their concerns can be addressed.

Similarly, having to spend extra hours manually creating the same spreadsheet each month is frustrating, particularly when you are facing a reporting deadline and have other work that has to be done. A few detailed questions about what exactly is preventing their system from creating the kind of report they need may lead to a productive discussion about how the problem could be fixed.

It’s important to take people seriously and help them express their concerns in a way that allows specific action to be taken. Hint: as people tell you their concerns, write them down. Later, read back what you’ve written and ask them to confirm that is the issue. They will feel heard and you will have a clearer description of the issue.

And the number one sign that your client needs to upgrade their accounting system:

1. The CEO Doesn’t Know What’s Going On

A personal experience: when I was asked to review a client accounting system, I saw that the unit costs were much higher than client management claimed. The client should have been much more profitable than it was. The client’s accountant was proud of the amount of detail he was able to squeeze onto his one page reports, but when we reviewed the reports with the General Manager, the response was devastating to the accountant. The GM said, “I never use those reports. Too many numbers.”

Sometimes the problem is a lack of communication. The managers don’t know what the system is capable of and the accounting staff is unaware of management needs. Some well-placed questions can lead to a much happier client and a profitable engagement for the external accountant or consultant.

——————

Bill Kennedy is president of Energized Accounting, and is a Chartered Professional Accountant (CPA, formerly CA), Microsoft Certified Professional, Project Manager and former CFO of The United Church of Canada. He works primarily with Canadian charities to streamline accounting processes and produce readable, engaging financial reporting. He is an experienced implementer of Microsoft Dynamics GP (Great Plains) and NAV (Navision) as well as being a writer and blogger, with a focus on helping non-profits succeed.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Cloud Technology, Technology