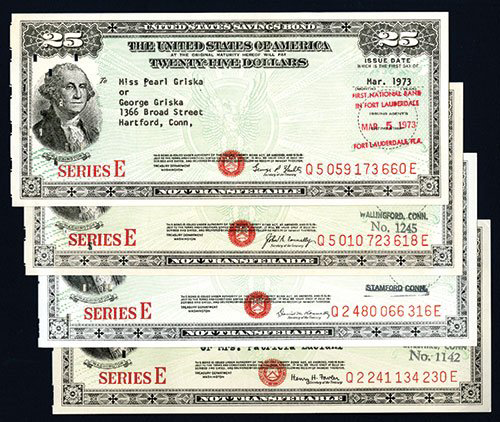

Clever Financial Strategy For Reporting Interest Earned On U.S. Savings Bonds

Currently over 50 million individuals own nearly $178 billion worth of U.S. Savings Bonds. Many don’t realize that savings bonds are subject to federal income taxes when they are either cashed in or reach final maturity, whichever comes first. The difference between the purchase price and the cash-in value is considered reportable interest. When savings bonds are cashed in, a 1099-INT is normally issued for any interest earned amount over $10. Savings Bonds are free from state and local taxes.