Advisory

Tax Reform: Workers Need to Double Check Payroll Withholding

If your clients haven’t done so yet, they should review their income tax withholding and, when appropriate, make adjustments. Notably, the new Tax Cuts and Jobs Act (TCJA) lowers tax rates for individuals, effective for 2018 through 2025, so clients ...

Jul. 31, 2018

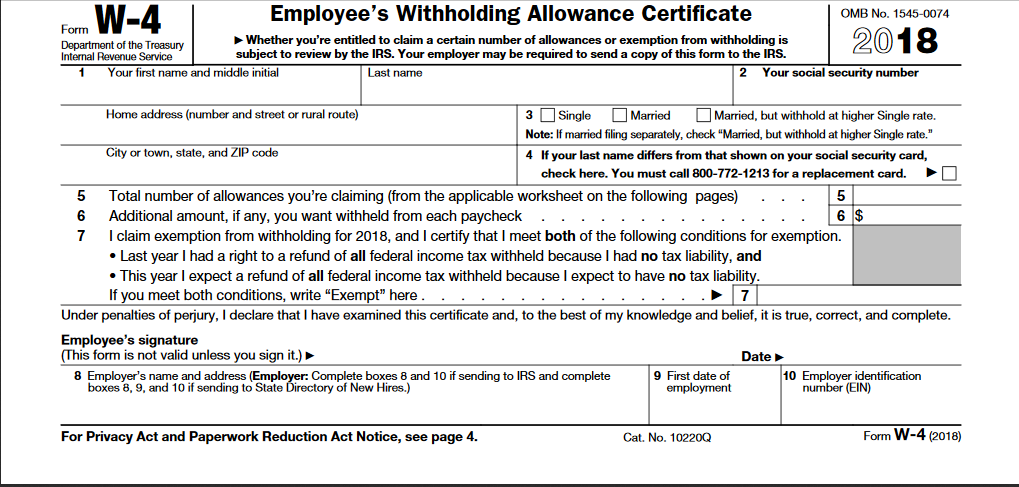

If your clients haven’t done so yet, they should review their income tax withholding and, when appropriate, make adjustments. Notably, the new Tax Cuts and Jobs Act (TCJA) lowers tax rates for individuals, effective for 2018 through 2025, so clients may presume they are overwithholding if they haven’t updated their W-4s this year.

But it’s not quite as simple as that. In fact, due to the combination of several key provisions included in the new tax law, some clients may be surprised to learn that they are actually underwithholding!

Generally, employees can satisfy their annual tax obligations by having enough tax withheld from their paychecks during the course of the year. However, if you fail to pay enough tax, including both withholding and any quarterly installments, the IRS may assess an underpayment penalty, unless a tax law exception applies.

Besides the reduction in tax rates for individuals, which the IRS immediately addressed in revised withholding tables issued earlier this year, the TCJA contains a number of provisions that affect withholding. Consider the following:

- The standard deduction, which is claimed in lieu of itemized deductions by some taxpayers, is essentially doubled to $12,000 for single filers and $24,000 for joint filers.

- Personal exemptions, including exemptions previously allowed for dependents like your children and other qualified relatives, are eliminated.

- The child tax credit (CTC), which was previously set at $1,000, is doubled to $2,000, of which $1,400 is refundable. The TCJA also creates a nonrefundable $500 credit for non-children dependents.

- The deduction for state and local taxes (SALT) is limited to $10,000 per year. This applies to any combination of (1) state and local property taxes and (2) state and local income taxes or sales taxes. Previously, SALT payments were fully deductible by itemizers.

- The deduction for mortgage interest is reduced for some taxpayers. The deduction for new acquisition debt is now limited to interest paid on the first $750,000 of debt, down from $1 million, while the deduction for interest paid on home equity debt, previously limited to interest paid on the first $100,000 of debt, is generally eliminated.

- The deduction for miscellaneous expenses — including tax and investment advisory fees and unreimbursed employee business expenses –is eliminated.

As a result of these changes, taxpayers who have itemized for years or even decades may be opting for the standard deduction this year. This could be reflected in a need to increase withholding. For example, someone in a high-tax state like California or New York who has previously claimed large deductions for SALT payments may realize a reduced tax benefit if they itemize or no tax benefit at all from these payments if they claim the standard deduction. Plus, the loss of personal exemptions can be significant.

Conversely, for some taxpayers, the higher standard deduction and CTC may more than offset the elimination of personal exemptions. These individuals may be advised to decrease their withholding.

The best option is to crunch all the numbers for any given situation. The IRS provides an online calculator at https://www.irs.gov/individuals/irs-withholding-calculator to do the heavy lifting. But be aware that this isn’t a simple process: To figure out the optimal withholding adjustments, you will need all the pertinent information, such as your current compensation, as well as information from last year’s return.

Practical suggestion: Give your clients a helping hand. Reach out to let them know you can provide assistance with their withholding calculations.