Technology

ACA Deadlines are Looming: How to Help Clients Comply

For the past three years enforcement of the ACA has been shaky at best. But employers are now beginning to experience the repercussions of noncompliance. The IRS has begun sending out ACA penalty Letter 226J to applicable large employers that didn’t ...

Jan. 29, 2018

The Affordable Care Act (ACA) is likely one of the most complicated pieces of legislation to affect employers in recent years, and recent attempts to repeal, replace, and alter the law have only made it worse. With confusion, however, comes opportunity—in this case, for accounting professionals to increase value to clients by becoming experts on ACA reporting and compliance.

For the past three years enforcement of the ACA has been shaky at best. But employers are now beginning to experience the repercussions of noncompliance. The IRS has begun sending out ACA penalty Letter 226J to applicable large employers that didn’t offer an affordable health care plan with minimal essential coverage to full-time employees in 2015. The fines can be costly, and a sure sign that employers need to get serious about their ACA compliance.

As trusted tax and accounting professionals, it’s likely more employers will turn to you for filing guidance this tax season. CPAs who are up-to-date on the latest regulations and deadlines are best positioned to help clients adhere to the law’s reporting requirements and avoid future penalties.

Here are five tips to help you better serve clients concerned about ACA compliance:

1. Monitor for upcoming deadlines and extensions

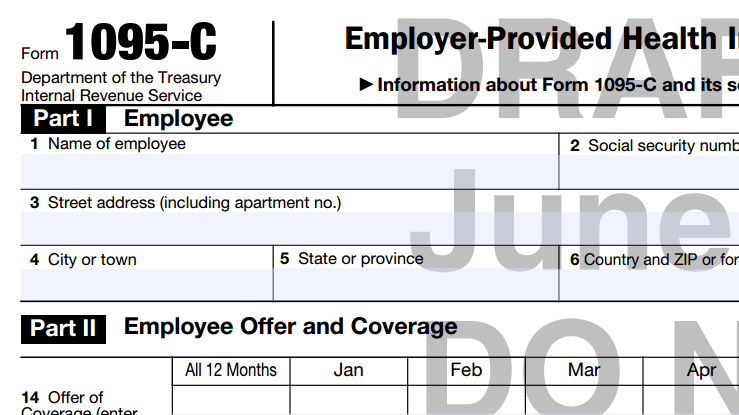

Distribution of 1095-Cs (and potentially 1095-Bs, if a client is self-funded) marks the beginning of ACA reporting. This year, the deadline for employers to complete and deliver the forms to employees has been extended from Jan. 31 to March 2. Though it’s important to communicate deadline changes to clients, the extension doesn’t mean the reporting process should slow down. CPAs should encourage clients to get their 1095-Cs out the door as early as possible so they have time to address any inconsistencies or errors they may find in the data. Companies still have to file Forms 1095-C and 1094-C to the IRS by Feb. 28 (if filing by paper) and April 2 (if filing electronically), so it’s best to get an early start.

2. Keep payroll and benefits data fresh

While this may seem like a no-brainer for a profession that revolves around record-keeping and number crunching, CPAs must be diligent in tracking clients’ employee data year-round, including name, address, employment status, and other personal information, as well as enrollment in employer-sponsored health care coverage. Bad data will impact your ability to ensure compliance, so communicate with clients regularly to stay aware of any changes and maintain a current and accurate record. Knowing client data is free of any errors will take the headache out of ACA reporting once deadlines roll around.

3. Look into technology solutions

CPAs can increase their value by identifying and vetting technology partners to help employers comply with ACA requirements. For instance, easy-to-use ACA reporting tools can streamline the preparation of 1095-Cs and IRS e-filing, and automated payroll technology can simplify hourly tracking of employees, removing the possibility of human error—a common culprit of reporting mistakes. The right solution not only frees up time and resources for clients, but also can help you succeed in your role as a financial advisor.

4. Archive and organize each filing year

Now that the IRS has begun sending out ACA penalty letters for 2015, it’s likely they’ll continue to collect penalties for subsequent reporting years. Safeguard your clients by helping them keep an organized record of all relevant personnel data, offers of health care coverage, and ACA paperwork. If the IRS ends up sending them a penalty letter, you’ll be more prepared to help them respond, and can do so much more quickly.

5. Follow health care news cycle

2017 was a dramatic year for health care, and the GOP’s efforts to weaken the ACA will likely continue this year and beyond. Stay abreast of the latest health care developments so you’re prepared to address client questions about how changes to the law impact their business and health care requirements. For instance, the repeal of the ACA’s individual mandate has no impact on employer reporting since the employer mandate is still in place. This tax season employers are again required to report on their offers of health care.

Employers already trust their accounting and tax professionals with some of their most precious data, so it comes as no surprise they would turn to you for help applying that data to navigate and comply with the ACA. Accounting professionals that seize the opportunity and bolster their services can increase value and become an indispensable partner for clients. By staying informed on reporting deadlines and implementing the above best practices, you can help clients ensure compliance and avoid fines.

——-

Anna Silva is Chief Business Development Officer for SyncStream Solutions.