IRS Extends 1095 Healthcare Reporting to March 2, 2017

The Internal Revenue Service (IRS) has issued a deadline extension for 2016 ACA reporting. Specifically, this notice extends the due date for furnishing to individuals the 2016 Form 1095-B, Health Coverage, and the 2016 Form 1095-C, Employer-Provided ...

Nov. 21, 2016

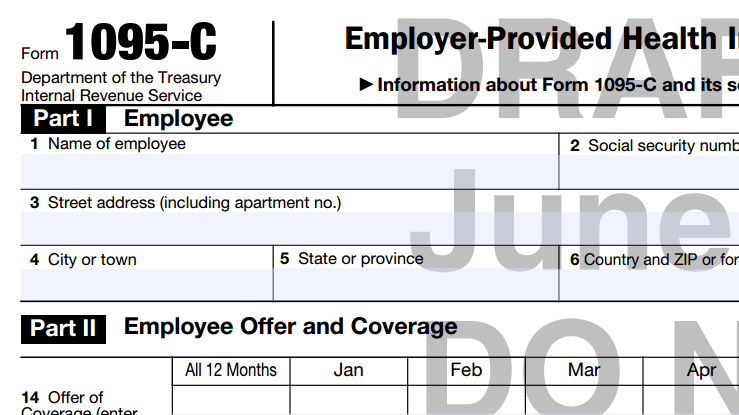

The Internal Revenue Service (IRS) has issued a deadline extension for 2016 ACA reporting. Specifically, this notice extends the due date for furnishing to individuals the 2016 Form 1095-B, Health Coverage, and the 2016 Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, from January 31, 2017, to March 2, 2017. In addition, this notice also extends good faith transition relief.

Greatland, a provider of tax software and management supplies, advises employers to take note of the extensions, but to continue preparations as if the deadline had not been extended, in order to better ensure compliance and avoid penalties. Greatland was one of the first companies in the nation to become IRS-certified to process and file ACA reporting forms for its clients and is fully equipped to help navigate clients through the second year of ACA filing. The IRS has also decided to keep the good faith transition relief in place for the second year to allow filers additional leniency to file properly.

The IRS has issued a 30-day extension for employers and issuers to provide individuals with forms reporting on offers of health coverage and coverage provided. The due dates for 1095-B and 1095-C deadlines are as follows: February 28, 2017 for paper 1095 forms filed to the IRS, March 2, 2017 for 1095 copies to be sent to recipients and employees and March 31, 2017 to e-file 1095 forms to the IRS.

This is the second year that employers and insurers must file Form 1095 to remain in compliance. Though the extension has been issued, Greatland urges business to file data as soon as it is ready, do not wait to file.

“While we expect this deadline change to have minimal impact to the far majority of our customers, we still are encouraging businesses to not wait until the last minute, which can lead to mistakes or missing the deadline, event with the extension,” said Bob Nault, Greatland’s CEO. “Failure to file 1095 forms for the 2016 tax year could be very costly for businesses. However, as the leading provider of wage, income and information reporting for more than 40 years, we expect and have the ability to easily react to changes in government regulations in order to support our customers through these changing regulations.”

Important notes about the deadline extension:

- ACA Reporting is still required for 2016

- The good faith transition relief from 2015 has been extended for 2016

- The ACA Reporting requirements for 2016 have not changed

The IRS has indicted it remains prepared to begin accepting ACA reporting in January, but due to feedback from businesses and insurers, it has decided to give additional time to complete necessary forms for the second year. This extension is intended to give employers and providers a chance to gather data, report information and report it correctly. It is important to note that reporting is still required for 2016 and the IRS implemented the extension to help those who might need more time. Programs such as Greatland’s Yearli products also support Form 1095 corrections to allow users to file corrected forms if mistakes are made.