Accounting

Xero TaxTouch: New Schedule C App for the Gig Economy Entrepreneur Workforce

This workforce of independent contractors is estimated to be 54 million strong, according to a recent Freelancing in America study conducted by the Freelancers Union. That number includes temporary workers and business owners.

Mar. 04, 2016

Not long ago I took an Uber to the airport in New York City. In chatting with the driver, I mentioned that I am a tax accountant, and boy, did the questions flow.

This gentleman was in his first year as an Uber driver and had never before worked as a freelancer or contractor. What tax forms do I need to file? How much money should I be putting away for taxes? What are estimated taxes? Do I have to make estimated payments? How do I pay the taxes? How much income will be taxed? You mean I can reduce my income by some of my costs? How will the IRS know what those costs are? Is it okay if I go to H&R Block or do I need a CPA? The questions went on and on.

This entrepreneur doesn’t want or need a full-fledged accounting system. This might not be a full time job, and it might not be a permanent job. He doesn’t have a payroll and isn’t interested in preparing financial statements. He doesn’t know the cloud, as we think of it, from those white puffy things in the sky. What he needs is a Schedule C, plain and simple, and Xero, maker of cloud-based accounting software, is about to release a product that will do just that.

Xero TaxTouch (www.xero.com/taxtouch) is designed to appeal to the proliferation of ride sharing, food delivering, room supplying, personal assisting, do-it-yourself freelancers that have become a growing movement in our population, particularly among Millennials (between ages 18 and 34) who represent 45% of this on-demand economy according to a recent Xero survey. Not to be left out, 37% of Generation Xers (aged 35-50) are included in this new workforce, and, interestingly, 18% of survey respondents were Baby Boomers, many of whom are considered to be starting a second career.

This workforce of independent contractors is estimated to be 54 million strong, according to a recent Freelancing in America study conducted by the Freelancers Union. That number includes temporary workers and business owners. Removing those groups from the total, Xero estimates 11.4 million workers find freelancing opportunities by using popular online platforms including Uber, Upwork, Freelancer.com, and Thumbtack.

This on-demand or gig workforce, as it is frequently called, doesn’t necessarily represent full time workers. In fact, Xero survey results show that nearly half of the members of this group make less than $2,000 per year from on-demand work and another third make between $2,000 and $10,000. In addition to not being full time, this type of work is not necessarily permanent. “A number of individuals that are in between jobs are looking at these platforms to fill the gap in those periods where they don’t have work,” said Jamie Sutherland, general manager of US products and solutions at Xero. “They might be saving up for something, want the flexibility to start a job and end a job. A lot of respondents [in the Xero survey] had some other form of work.”

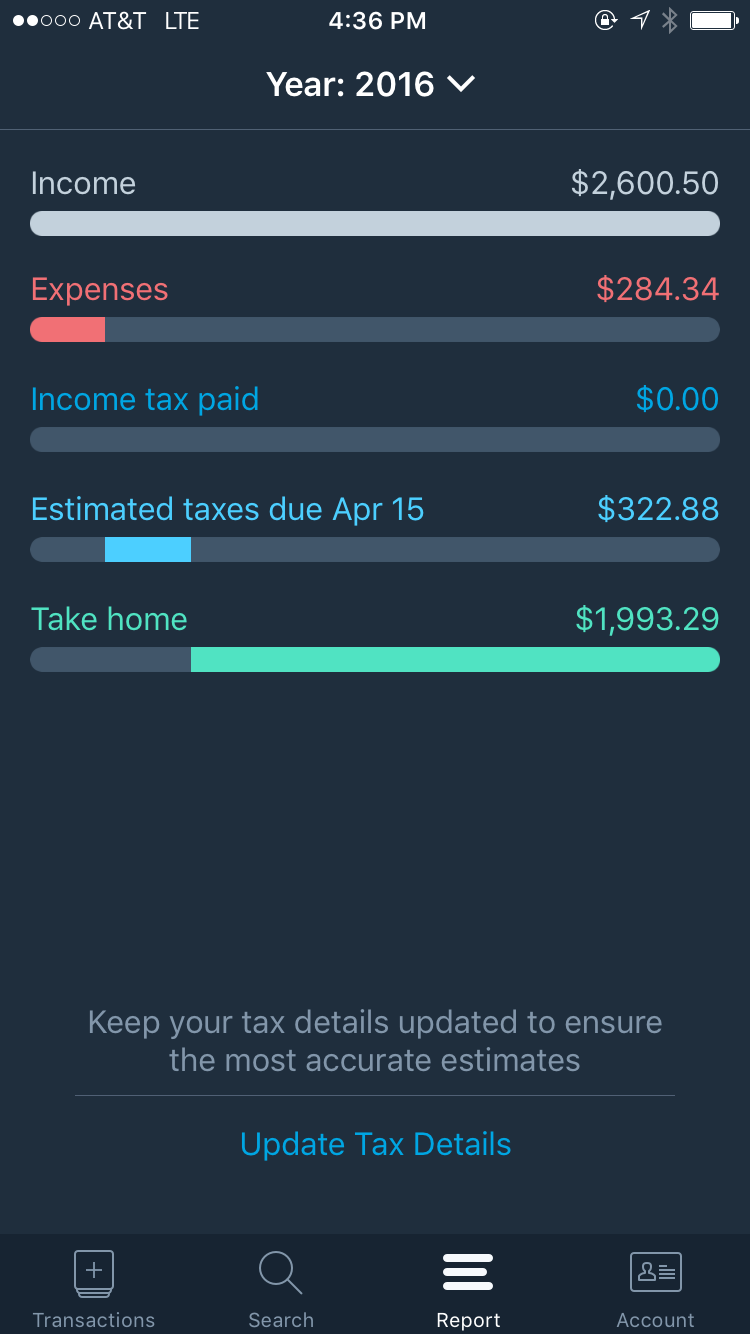

TaxTouch represents Xero’s first ever offering exclusively and specifically for freelancers, and, as far as I can tell, there is nothing quite like this on the market. The simple-to-use app allows a user to automatically download bank and credit card transactions from major U.S. banks and credit cards, and it provides an easy way to track business expenses and maximize business tax deductions, separate personal from business expenses paid from the same account, and monitor net earnings. With one tap, the app generates a report detailing Schedule C data, making it fast and easy for freelancers and their professionals to prepare tax returns.

TaxTouch maintains a running balance of estimated net income from the business, including a calculation for tax (combined income and self-employment) associated with the business, and it provides reminders and dollar amounts if and when quarterly estimated tax payments are due. The tax calculations are purely an estimate because of course various other items on a tax return come into play including income from other sources and filing status, but the app lets you input that kind of information on a separate screen to help fine tune the tax calculations, and also Xero always encourages that users of its products consult with accounting professionals, stated Sutherland.

Note that TaxTouch isn’t a tax return program. Tax returns can’t be filed from this program and that was never the intent. The program populates a Schedule C, Profit or Loss from Business, which can then be emailed. This video provides a quick demo of the product.

“The way Americans work is changing,” said Sutherland. “There is a proliferation of freelancers and contractors freelancing, doing side gigs, using online platforms to find work. What we discovered in our survey was a lack of understanding of how to [prepare a Schedule C] and also even that they were required to do it. Over 50% didn’t even know that they could deduct expenses. We know business and understand the space; we came up with the concept to solve their issues exactly around that.”

Xero TaxTouch has been developed for the U.S. market only. The price to use the program is $5.99 per month or $29.99 for the first year. Xero is offering the first three months for free, and the program will be available on iOS from the App Store on Tuesday, March 8, 2016.

Sutherland also mentioned that this on-demand workforce is a happy workforce. “It’s very apparent they really like what they are doing. Ninety-two percent said they would recommend the type of work they’re doing. If you have that much interest and happiness, we expect that to continue to grow at an accelerated pace.”

——–

Survey data:

Xero surveyed 311 individuals, all of whom had earned more than $400 in 2015 from the top on-demand freelance marketplaces. All participants own a smart phone.

Freelancers Union surveyed more than 7,100 U.S. working adults over age 18 between July 30, 2015 and August 14, 2015. Of those, 2,429 were freelancers and 4,678 were non-freelancers.