Accounting

How Per Diem Rates Can Simplify Travel Expense Reporting

The IRS has just announced new federal per diem travel rates for Fiscal Year 2015 (FY 2015), which spans October 1, 2014 through September 30, 2015. Unlike many other previous years, when per diem rates were typically bumped up just a dollar or two or not

Sep. 23, 2014

[This is part of a series of articles on protecting

deductions for travel and entertainment (T&E) expenses.]

The IRS has just announced new federal per diem travel rates for Fiscal Year 2015 (FY 2015), which spans October 1, 2014 through September 30, 2015. Unlike many other previous years, when per diem rates were typically bumped up just a dollar or two or not at all, the rate for high-cost areas was boosted by $8, while the low-cost area rate increased by $2 (IRS Notice 2014-57).

These per diem rates are the ones established by General Service Administration (GSA) for travel by federal government employees, but regular employers can use them too. This enables employers and employees to account for business travel expenses without all the usual recordkeeping hassles.

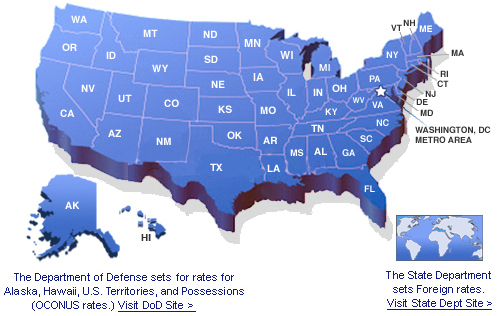

Here’s how it works: Prior to the start of the tax year, the GSA sets the applicable per diem rates for destinations for the 48 states in the continental U.S and the District of Columbia (the so-called “CONUS” rates); for areas outside the continental United States (Hawaii, Puerto Rico and U.S. possessions (known as the “OCONUS” rates); and for foreign countries. In addition to the standard rates for specific destinations, certain high-cost areas are specified (see chart). All the other destinations are treated as low-cost areas if this high-low alternative is used.

For FY 2015, the per diem rate for high-cost areas is $259, (up from $251 in FY 2014), consisting of $194 for lodging and $65 for meals and incidental expenses (M&IE). The per-diem for all other localities is $172 (up from $170 in FY 2014), consisting of $120 for lodging and $52 for M&IE.

Invariably, there are a number of minor modifications to the list of high-cost areas each year. For FY 2015, the changes include the following:

- San Mateo/Foster City/Belmont, CA, Sunnyvale/Palo Alto/San Jose, CA, Glendive/Sidney, MT, and Williston, ND were added;

- The timeframes for Sedona, AZ, Napa, CA, Vail, CO, Fort Lauderdale, FL, Miami, FL, and Philadelphia, PA were modified, and

- Yosemite National Park, CA, San Diego, CA, and Floral Park/Garden City/Great Neck NY were removed from the high-cost list (Source: Thomson Reuters).

This method can simplify the lives of employers and employees alike, but there’s one big bugaboo: The per diem rate method can’t be used for an employee who owns more than 10% of the company or a self-employed individual. In either case, you must keep all the records normally required for business travel.

Finally, be aware that calendar-year companies can choose to keep using the FY 2014 rates and switch over to FY 2015 rates on January 1, 2015 or they can start using the FY 2015 rates right now.

=——————–=

Which Cities Make the List?

Here’s the updated list of high-cost areas for FY 2015. Note that a “key city” may include surrounding areas.

State – Key City

- Arizona Sedona (Mar. 1 – May 31)

- California Monterey (July 1 – Aug. 31)

- Napa (Oct. 1 – Nov. 30; Feb. 1 – Sept. 30)

- San Francisco

- San Mateo/Foster City/Belmont

- Santa Barbara

- Santa Cruz (June 1 – Aug. 31)

- Santa Monica

- Sunnyvale/Palo Alto/San Jose

- Colorado Aspen (Dec. 1 – Mar. 31; June 1 – Aug. 31)

- Denver/Aurora

- Steamboat Springs (Dec. 1 – Mar. 31)

- Telluride (Dec. 1 – Mar. 31; June 1 – Sept. 30)

- Vail (Dec. 1 – Mar. 31, July 1 – Aug. 31)

- District of Columbia Washington, D.C.

- Florida Boca Raton/Delray Beach/Jupiter (Jan. 1 – Apr. 30)

- Fort Lauderdale (Jan. 1 – Mar. 31)

- Fort Walton Beach/De Funiak Springs (June 1 – July 31)

- Key West

- Miami (Oct. 1 – Mar. 31)

- Naples (Jan. 1 – Apr. 30)

- Illinois Chicago (Oct. 1 – Nov. 30; Mar. 1- Sept. 30)

- Louisiana New Orleans (Oct. 1- June 30)

- Maine Bar Harbor (July 1 – Aug. 31)

- Maryland Baltimore City (Mar 1 – Nov. 30; Mar. 1- Sept. 30)

- Cambridge/St. Michaels (June 1 – Aug. 31)

- Montgomery and Prince George’s Counties

- Ocean City (June 1 – Aug. 31)

- Massachusetts Boston/Cambridge

- Falmouth (July 1 – Aug. 31)

- Martha’s Vineyard (July 1 – Aug. 31)

- Nantucket (June 1 – Sept. 30)

- Montana Glendive/Sydney

- New Hampshire Conway (July 1 – Aug. 31)

- New York Glen Falls (July 1 – Aug. 31)

- Lake Placid (July 1 – Aug. 31)

- New York City

- Saratoga Springs/Schenectady (July 1 – Aug. 31)

- Tarrytown/White Plains/New Rochelle

- North Carolina Kill Devil (June 1 – Aug. 31)

- North Dakota Williston

- Pennsylvania Philadelphia (Oct. 1 – Nov. 30, Mar. 1 – June 30, Sept. 1 –

- Sept 30

- Rhode Island Jamestown/Middletown/Newport (Oct. 1- Oct. 31; May 1- Sept. 30)

- South Carolina Charleston (Mar. 1 – May 31)

- Texas Midland

- Utah Park City (Dec. 1 – Mar. 31)

- Virginia Arlington and Fairfax Counties

- Virginia Beach (June 1 – Aug. 31)

- Washington Seattle

- Wyoming Jackson/Pinedale (July 1 – Aug. 31)

Source: http://www.irs.gov/pub/irs-drop/n-14-57.pdf