Accounting

Small Business Owners Confident on Finances, Revenue Growth

More small business owners say their company’s current financial situation is good, yet their outlook for the next year has not changed significantly, according to a new survey.

Aug. 13, 2014

More small business owners say their company’s current financial situation is good, yet their outlook for the next year has not changed significantly, according to a new survey.

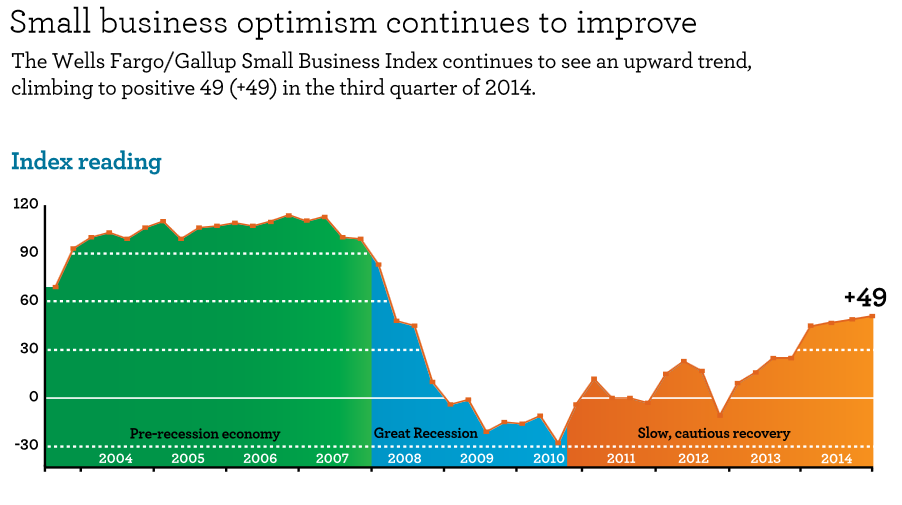

The latest Wells Fargo/Gallup Small Business Index score increased slightly to positive 49 (+49) in July, up two points from positive 47 (+47) in April. The score, which measures small business optimism, has increased six of the last seven quarters. Small business optimism is now at its highest point in more than six years, however it remains well below pre-recession levels.

The present situation – how business owners rate current conditions for their businesses – is the main contributor to increased optimism in the latest survey. The present situation score is now at a positive 18 (+18), up four points since the April survey and 14 points from the same period a year ago. Specific factors that contribute to the improvement include:

- Small business owners are feeling better about their current business financial situation, with 62 percent rating it as very or somewhat good, up from 57 percent in the second quarter 2014.

- More business owners report their company’s revenues have increased, with 43 percent indicating revenues are up in the past 12 months compared with 36 percent in April.

- Cash flow over the past 12 months also is at a six-year high. In the survey, 55 percent of business owners report their cash flow has been very or somewhat good over the past year, up from 50 percent in the second quarter of 2014.

- Ease of obtaining credit in the past 12 months is up significantly – 32 percent of small business owners say that it has been very or somewhat easy to obtain credit in the past 12 months.

At the same time, the future outlook for business owners in the July survey was relatively unchanged, down two points to positive 31 (+31) from positive 33 (+33) in the second quarter. In three surveys conducted in 2014, the percent of business owners who think their businesses’ cash flow, financial situation and revenue would improve over the next 12 months has not moved significantly. The percent of business owners who expect to increase capital spending in the year ahead is the same as those who plan to decrease (25 percent).

“The latest Index scores show small businesses have made gradual progress since the economic downturn –with modest improvement in the economy, healthier small businesses are growing revenue and have stronger cash flow today,” said Lisa Stevens, head of Small Business for Wells Fargo. “However, we know many businesses still face challenges in the marketplace and it’s reflected in the survey results. Many continue to wait for more improvement in their businesses and the economy before they express confidence in the year ahead.”

Business owners report that the biggest challenge they face is attracting customers and finding business (13 percent), followed closely by government regulations (11 percent), financial stability of their business (11 percent) and the economy (11 percent).

When it comes to generating new business, small business owners said the toughest part is marketing and advertising (14 percent), and competition (13 percent). Ten percent of business owners said the costs of running a business make it difficult to attract customers and grow. Another 10 percent said making product improvements or having the latest products is the biggest challenge to growing sales.

Small Business Use of Technology

In the latest Wells Fargo/Gallup Small Business Index, business owners were asked about the impact and use of technology in their businesses, and their responses show that many business owners are using mobile technology and social media to run and market their businesses, and communicate with customers.

Some of the key findings include:

- Website: Small business owners have become increasingly likely to report having a business website – now at 59 percent compared to 54 percent in 2011.

- Personal computer/tablet: Nearly four in 10 use a tablet and about one-third are using cloud-based computing software to run their businesses.

- Social media: Among all small business owners surveyed, social networking sites are used in a variety of ways to help grow their business, including connecting with customers (37 percent), marketing and promotion (34 percent), building an online reputation (34 percent) and advertising (33 percent).

- Online/mobile banking: Seventy-two percent of business owners use a desktop or laptop to do their banking. And 40 percent use their mobile device to conduct banking related to their small business. Among business owners who use mobile banking, 44 percent said they use their smartphone/tablet to monitor cash flow for their business; 16 percent use it for mobile deposits; and 14 percent use it to pay bills. Those business owners who don’t use mobile banking said their preference for doing banking in person (40 percent) and security concerns (23 percent) were the top reasons.

Small Business Index Key Drivers

Wells Fargo, together with Gallup, surveys small business owners quarterly across the nation to gauge their perceptions of their present situation (past 12 months) and future expectations (next 12 months) in six key areas: financial situation, cash flow, revenues, capital spending allocation, hiring, and credit availability.

Wells Fargo/Gallup Small Business Index Scores: Q2 2013 – Q3 2014

| Overall Index Score | Present Situation | Future Expectations | |

|---|---|---|---|

| Q3 2014 (surveyed July 2014) | 49 | 18 | 31 |

| Q2 2014 (surveyed April 2014) | 47 | 14 | 33 |

| Q1 2014 (surveyed January 2014) | 45 | 16 | 29 |

| Q4 2013 (surveyed October 2013) | 24 | 7 | 17 |

| Q3 2013 (surveyed July 2013) | 25 | 4 | 21 |

| Q2 2013 (surveyed April 2013) | 16 | 2 | 14 |

The Index consists of two dimensions: 1) Owners’ ratings of the current situation of their businesses and, 2) Owners’ ratings of how they expect their businesses to perform over the next 12 months. Results are based on telephone interviews with 603 small business owners in all 50 United States conducted July 7-11 2014. The overall Small Business Index is computed using a formula that scores and sums the answers to 12 questions — six about the present situation and six about the future. An Index score of zero indicates that small business owners, as a group, are neutral — neither optimistic nor pessimistic — about their companies’ situations. The overall Index can range from -400 (the most negative score possible) to +400 (the most positive score possible), but in practice spans a much more limited range. The margin of sampling error is +/- four percentage points. The highest Index reading was positive 114 (+114) in the fourth quarter of 2006, and the lowest reading was negative 28 (-28) in the third quarter of 2010.

Wells Fargo serves approximately 3 million small business owners across the United States and loans more money to America’s small businesses than any other bank (2002-2012 CRA government data). To help more small businesses achieve financial success, in 2014 Wells Fargo introduced Wells Fargo Works for Small BusinessSM – a broad initiative to deliver resources, guidance and services for business owners – and a goal to extend $100 billion in new lending to small businesses by 2018. For more information about Wells Fargo Works for Small Business, visit: WellsFargoWorks.com.