Small Business

Small Businesses Report Higher Increase in Revenue than Taxes

Now that tax season is over for almost all individual filers, except those who filed returns, it's a good time to look at how small businesses fared with their taxes.

Apr. 21, 2014

Now that tax season is over for almost all individual filers, except those who filed returns, it's a good time to look at how small businesses fared with their taxes.

Most small businesses in the U.S. are privately-owned by individuals who file a Schedule C with their 1040, so SurePayroll's latest Small Business Scorecard focused on small business taxes, finding that 57 percent of small business owners reported paying more in taxes this year. Fortunately, 60 percent also said they saw increases in revenue. SurePayroll is a provider of online payroll and human resources management solutions for small businesses.

According to the survey, one third of small businesses grew revenue by more than 15 percent in 2013, while about one fifth reported a tax increase of more than 15 percent.

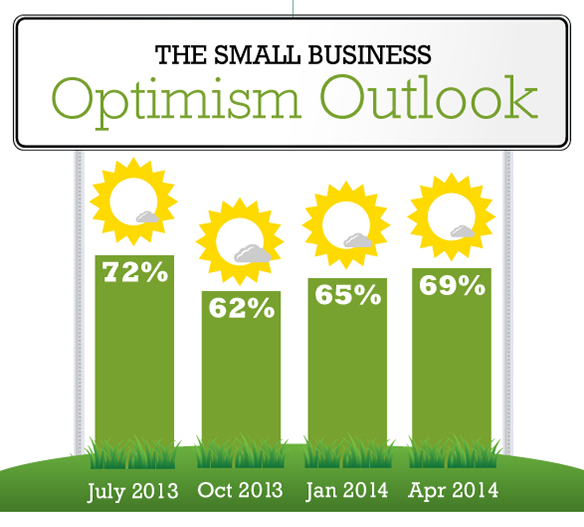

The report also shows that small business optimism remains high, with 69 percent of small business owners saying they are optimistic about the economy as it relates to their business. However, hiring continues to remain mostly flat or slightly down, dropping 0.1 percent nationwide. Hiring was down 0.3 percent in the Midwest and Northeast; up 0.1 percent in the West; and flat in the South.

The average paycheck followed a similar trajectory, staying flat nationwide; dropping 0.1 percent in the Midwest, Northeast and West; and increasing 0.1 percent in the South.

The Scorecard data has continued to indicate during the last year that small businesses are using a lean model to grow revenues without adding new staff. It’s a bit of a double-edged sword, as increased hiring would obviously be a boost to the economy, yet strong revenues are a testament to small business ingenuity.

Are Small Businesses Shifting to Alternative Lenders?

Further findings from the survey included a look at non-bank alternative lenders, such as OnDeck and Kabbage. Small businesses who have used these types of alternative lenders, instead of big banks, have been overwhelming satisfied – 86 percent said they had a good experience and would use them again. Moving forward, of those seeking to secure capital, 36 percent said they would use an alternative lender; 45 percent would use a bank; and 7 percent would go to friends and family.

This is a fairly dynamic shift from two years ago when 60 percent used banks; 14 percent used friends and family; and only 13 percent went to alternative lenders.

Is There Value in Facebook Advertising?

More than half of small business owners (53 percent) told us they see value in advertising on Facebook. The social media giant has been working to make its platform more useful for small businesses. One in three said they are currently using Facebook for advertising.