Income Tax

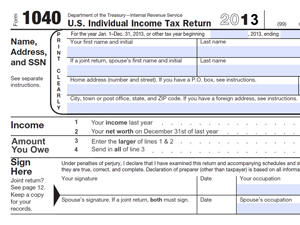

Printable Version of 2013 Income Tax Return – Form 1040 (Due April 15, 2014)

A printable version of the IRS Federal income tax return (Form 1040) can be viewed and printed from our website by clicking the download button at: http://cpapracticeadvisor.com/11297334.

Jan. 21, 2014

A printable version of the IRS Federal income tax return (Form 1040) for 2013 (to be filed by April 15, 2014) can be viewed and printed from our website by clicking the download button at: http://cpapracticeadvisor.com/11297334.

This is the official form for tax year 2013, as offered by the Internal Revenue Service. The official instructions are available at http://www.irs.gov/pub/irs-pdf/i1040.pdf.

U.S. citizens and foreign nationals with income in the U.S. are required to file an income tax return by April 15 of each year, for income from the previous year, except for when that day falls on a weekend or holiday.

While many Americans file their own taxes, and an increasing number are doing so electronically, CPA Practice Advisor provides this document primarily as an aid for individuals to use in estimating. We strongly encourage taxpayers to seek the services of a tax professional, such as a Certified Public Accountant or Enrolled Agent.

Both of these credentials show that a professional has extensive education specific to U.S. tax laws, and can aid in all stages of tax preparation, and handling communication with the IRS, for a fee that is often less than what they can help save taxpayers by finding strategic tax benefits and credits.