Accounting

SMB Optimism Index Increased Slightly in July

Small business optimism increased marginally in July.

Aug. 13, 2013

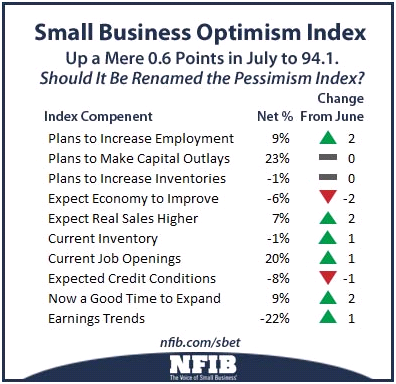

Small business optimism increased marginally in July, with NFIB’s monthly index showing only half-a-point (0.6) uptick for a total reading of 94.1. This month’s report continues the historically weak trend of owner confidence. However, while the two labor market indicators remained weak, both improved and are beginning to return to normal numbers.

Even with the slow improvement, uncertainty about the future still remains prevalent among jobs creators. Nine percent of respondents think that now is a good time to expand their businesses.

“In an attempt to ‘make lemonade’ from the lousy bushel of lemons the administration has handed the small-business community, owners gave the July optimism index the great distinction of being the fourth highest reading since December 2007 – when the economy slipped into official recession,” said NFIB chief economist Bill Dunkelberg. “But let’s not get too excited: The level is still well below the average reading of 100 in the prior 35 years and still half a point below the December 2007 reading.”

The July indicators are as follows:

- Job Creation. July was another slow month for jobs among NFIB’s 350,000 owners, with the average increase in employment coming in at a negative 0.11 workers per firm, the third negative monthly reading in a row. Owners have stopped reducing employment, but they have not resumed hiring.

- Hard to Fill Job Openings. Twenty percent of all owners reported job openings they could not fill in the current period, a potentially good omen for the unemployment rate. Fifteen percent reported using temporary workers, up 3 points from June. The healthcare law provides incentives to increase the use of temporary and part-time workers and June saw an increase of 360,000 part-time jobs accompanied by a loss of 240,000 full-time jobs.

- Sales. The net percent of all owners reporting higher nominal sales in the past three months compared to the prior three months improved a point, rising to a negative 7 percent. The net percent of owners expecting higher real sales volumes rose 2 points, to 7 percent of all owners. These expectations remain depressed and are not the kind that will generate a lot of new employment or new orders for inventories.

- Earnings and Wages. Reports of positive earnings trends improved 1 point in July to a negative 22 percent, restoring them to May’s numbers. Four percent of owners reported reduced worker compensation and 19 percent reported raising compensation, yielding a seasonally adjusted net 14 percent reporting higher worker compensation (unchanged). A net 11 percent plan to raise compensation in the coming months, up 5 points.

- Credit Markets. Credit continues to be a non-issue for small employers, five percent of whom say that all their credit needs were not met in July, unchanged from June and May, and the lowest reading since February 2008. Thirty percent of owners surveyed reported all credit needs met, and 52 percent explicitly said they did not want a loan.

- Capital Outlays. In July, the frequency of reported capital outlays over the past six months fell 2 points to 54 percent, 7 points below the average spending rate through 2007. The percent of owners planning capital outlays in the next three to six months was, again, unchanged at 23 percent. Reports of outlays fell almost across the board, painting a weaker spending picture than the month prior.

- Good Time to Expand. In July, 9 percent characterized the current period as a good time to expand facilities (up 2 points). The net percent of owners expecting better business conditions in six months was a net negative 6 percent, 2 points worse than June’s reading.

- Inventories. The pace of inventory reduction continued in June, with a net negative 10 percent of all owners reporting growth in inventories, a 3 point decline from June. For all firms, a net negative 1 percent (up 1 point) reported stocks too low, a historically “lean” reading. Plans to add to inventories were unchanged from June; the net percent of owners planning to add to inventories remained a negative 1 percent of all firms.

- Inflation. Fourteen percent of the NFIB owners surveyed reported reducing their average selling prices in the past three months (up 2 points), and 17 percent reported price increases (down 2 points). The net percent of owners raising average selling prices was 4 percent, down 4 points. As for prospective price increases, 16 percent plan on raising average prices in the next few months (down 3 points), and 3 percent plan reductions (unchanged). A net 15 percent plan price hikes, down 3 points. Overall the inflation picture is fairly benign.

The report is based on the responses of 1,615 randomly sampled small businesses in NFIB’s membership, surveyed throughout the month of July.