Tax Credit Exchange Platform Offers Businesses a Transparent Marketplace for Buying and Selling Credits

The Online Incentives Exchange makes it easy for businesses to buy, sell and track tax credits on a single platform.

Feb. 12, 2013

When available and applicable, tax credits are very useful for businesses when it comes to lowering their tax liabilities. Until recently, there wasn’t an option that provided businesses with a clear picture of the market value and availability of these credits. By offering a transparent exchange platform, The Online Incentives Exchange has created a solution that makes it easier for businesses to buy, sell and track tax credits.

The OIX allows companies to buy tax incentives for as low as 80 cents on the dollar, based on the current demand shown in the marketplace. Through the exchange, companies are able to sell their credits that would otherwise be unusable because the company doesn’t have a tax liability in the state they earned the credits in. The OIX allows businesses to buy credits, saving money on their taxes that they can then reinvest into their company.

“We are committed to helping taxpayers reduce their liability in a legal and safe way by helping them buy credits off a reputable exchange from a reputable seller,” said Danny Bigel, founder and CEO of The OIX. “States are excited about this because the companies that are creating jobs can now get these tax credits and invest more money to create more jobs.”

The OIX was created in October 2012 for companies doing business in Louisiana and plans to spread to other states offering tax incentive programs starting in the second quarter of this year. Businesses must be a member of The OIX to access the exchange and membership is currently only open to corporations. Interested companies submit a request for membership and undergo a thorough vetting process, which includes background checks and checking company information for accuracy against that on file with state agencies. Each credit submitted for sale also undergoes a rigorous vetting process. While membership and bidding is free, sellers are charged a transaction fee once a sale is completed.

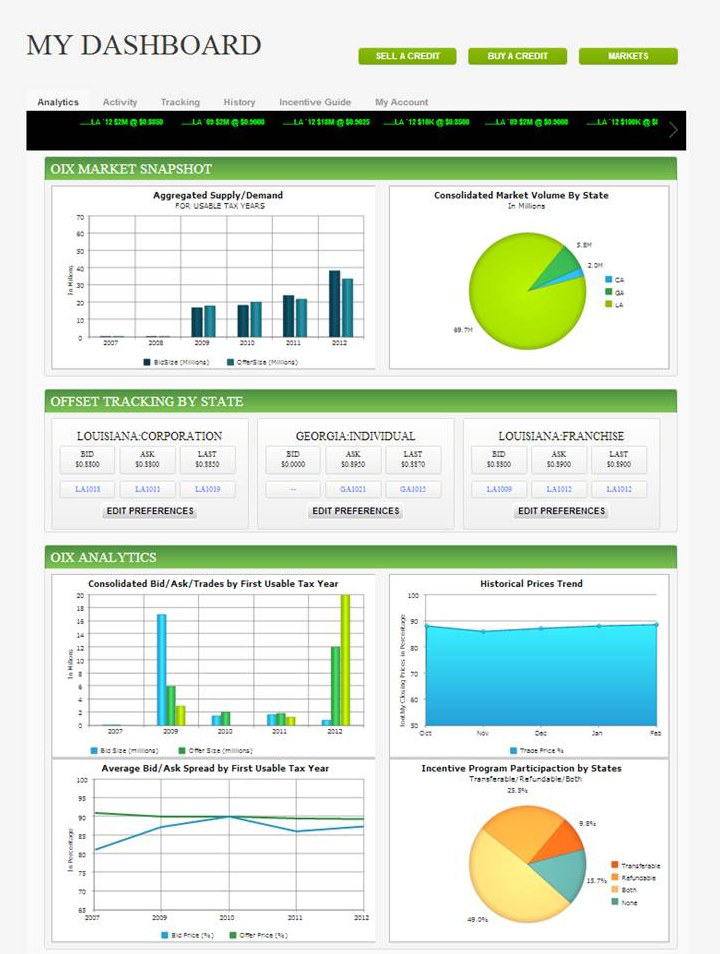

In addition to helping businesses lower their tax liability, The OIX is designed to help tax and accounting professionals provide better service to their clients by giving them access to tax credits and incentives that can be sold or bought to increase growth. The dashboard on the home screen allows members to track credits in real-time. Users can choose up to three states to track credits in and set customized notifications, allowing them to monitor the marketplace across the country.

“Our fundamental goal is to bring awareness to businesses and taxpayers that as long as states create incentives to help create jobs and as long as these incentives are transferrable or refundable, there needs to be a transparent and efficient marketplace to perform the transactions. We are providing that transparent marketplace with The OIX.”