Home

Featured….

Thomson Reuters Plans AI Functions for All Professional Users

Ultra-Rich Should Pay More Taxes to Save Social Security, Poll Shows

U.S. Sales Tax Rate Changes Reach 10-Year High

Vertex Joins Oracle ISV Accelerator Program

Contributors….

Becky Livingston

Garrett Wagner

Richard D. Alaniz

Randy Johnston

Webinars and CPE….

Webast: Valuation Considerations in Emerging Markets – July 11, 2024

Webinar: Effortless Tax Prep and Workflow: Say Goodbye to Client Frustrations

Events….

Accounting

Xerocon 2024 Nashville: Aug. 14-15, 2024

The event will be hosted at the Music City Center, allowing Xero’s community of accountants and bookkeepers from across the U.S., Canada and beyond the chance to connect, as well as options for earning CPE credit.

Accounting

RightNOW Conference 2024

Top influencer keynotes, transformative tech insights and AI innovators converge to elevate the accounting profession at RightNOW 2024. May 14-16, 2024 | Austin, TX.

FTC Rule Bans Non-Compete Agreements

In response, the global tax firm Ryan filed a lawsuit in a Texas federal court the same day, challenging the rule on the basis that it, “… imposes an extraordinary burden on businesses seeking to protect their intellectual property (IP) and retain top talent …

How CPAs Can Compete in the AI Race

Here are a few principles every CPA firm can leverage to successfully compete with all firms in this dawning AI technology wave.

Accounting

Top 7 Reasons Why People Are Leaving Accounting Firms, According to PICPA

The Pennsylvania Institute of CPAs shares fresh data and insights on how accounting firms can better retain top talent.

Technology

Thomson Reuters Plans AI Functions for All Professional Users

CoCounsel will unify the entire customer experience and give customers a new way to access Thomson Reuters product capabilities through a single GenAI assistant with applications across Legal, Tax, Risk & Fraud, and Media.

Taxes

Ultra-Rich Should Pay More Taxes to Save Social Security, Poll Shows

Voters in seven swing states support billionaires tax and trimming benefits for the wealthy more than raising payroll taxes.

Sales Tax

U.S. Sales Tax Rate Changes Reach 10-Year High

It’s clear that tax departments will need to be nimble once again in 2024, adjusting to the situations outlined above along with other developments including legislative and regulatory changes.

Vertex Joins Oracle ISV Accelerator Program

The Vertex Accelerator offering has been steadily delivering a “near push-button” experience for more than 175 global customers looking to integrate Vertex tax solutions.

Small Business

U.S. Chamber of Commerce Sues FTC to Block Noncompete Agreement Ban

The lawsuit filed in federal court alleges that the FTC lacks the power to adopt sweeping rules such as the near-total ban on noncompetes.

Firm Management

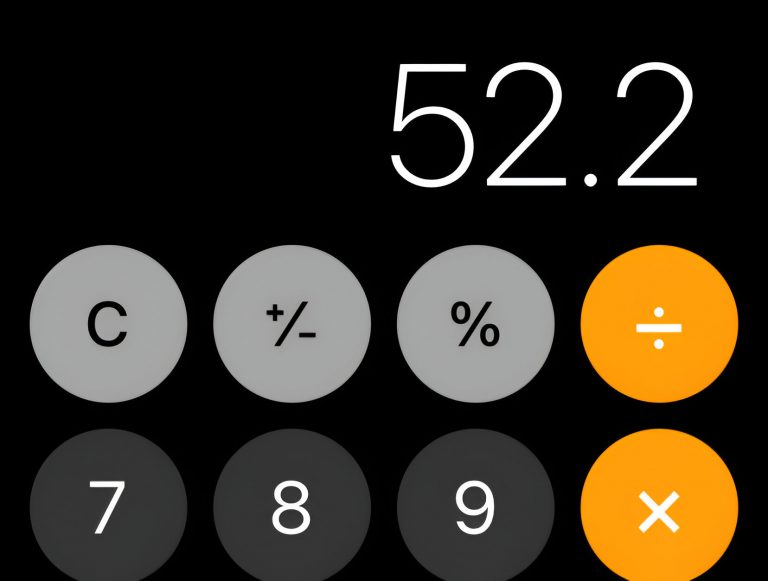

Number of the Day: 52.2

That number is the average age of a public accounting firm partner, down from 52.6 last year, according to INSIDE Public Accounting.

Sales Tax

Sovos Fortifies U.S.- Based DBNAlliance to Enhance Seamless Global Business Networks

Processing more than 11 billion transactions each year, Sovos’ membership is a substantial show of support for the DBNAlliance’s mission to rapidly deploy a framework of standards and

Taxes

IRS Forms New Office to Help People Settle Their Tax Disputes More Quickly

An arm of Appeals, the Alternative Dispute Resolution Program Management Office will look to revitalize existing ADR programs.

Taxes

Bipartisan Bill Would Force IRS to Fix Issues With Math Error Notices

The bill, introduced in both the House and the Senate, would require the IRS to spell out exactly what the error on the return is.

TIGTA Finds $3.5 Billion Tax Fraud Scheme

TIGTA investigators identified a scheme where individuals obtained Employer Identification Numbers, a unique nine-digit identifier required for tax purposes, and then used them to file business tax returns that improperly claimed…

Small Business

New Federal Rule Requires Airlines to Provide Cash Refunds for Canceled Flights

Prior to this rule, airlines were permitted to set their own standards for what kind of flight changes warranted a refund. As a result, refund policies differed from airline to airline, which made it difficult for passengers to know or assert their refund rights.

Accounting

AuditBoard Adds AI Capabilities

The application of AI represents a significant opportunity for teams managing risk to better connect data across functions, craft content, and proactively surface issues, risks, and insights.

Accounting

AICPA Launches Registered Apprenticeship for Finance Business Partners Program in Florida

The program’s growth into Florida continues the rapid advancement of the Registered Apprenticeship for Finance Business Partners.

Firm Management

FTC Rule Bans Non-Compete Agreements

In response, the global tax firm Ryan filed a lawsuit in a Texas federal court the same day, challenging the rule on the basis that it, “… imposes an extraordinary burden on businesses seeking to protect their intellectual property (IP) and retain top talent …

Payroll

U.S. Labor Dept. Expands Overtime Rules to 4 Million More Salaried Workers

The salary threshold will increase from its current $35,500 per year to $43,888 on July 1, 2024, then to $58,656 on Jan. 1, 2025.

Small Business

Small Business Optimism Hits an 11-Year Low as Inflation Worries Persist

Business owners are still navigating economic headwinds after COVID-19, the National Federation of Independent Business said.

Small Business

75% of Mid-Market Companies Say They Will Invest in AI Over Next 5 Years

The majority of mid-market businesses are planning to invest in machine intelligence to improve efficiency.

Firm Management

Minnesota Accounting Firm Joins CLA Global

Christianson PLLP joined has joined CLA Global Limited (CLA Global), an organization comprised of independent accounting and advisory firms.

Payroll

Another Option for When Employee Bonuses Don’t Work

“Cash bonuses are extrinsic motivators that fail to alter attitudes that underlie our core behaviors and beliefs. At best, bonuses only temporarily change behavior.”

Accounting

Rider University Starts First-of-its-Kind Apprenticeship for Accounting Grads

The new program allows recent accounting graduates to earn the required credits to obtain their CPA licensure at a reduced cost.

Accounting

ADM Says Former CFO to Resign After Accounting Probe

Vikram Luthar, who was placed on leave earlier this year amid an accounting investigation, has agreed to resign effective Sept. 30.

Payroll

Job Confidence Dips Among U.S. Workers

New LinkedIn data shows that Americans are feeling less secure in their jobs than in January, and the unemployed feel very pessimistic.

Small Business

Three in Four Family Businesses Expect to Grow This Year

Family businesses are growing—and many expect that to continue this year, despite financial concerns, Family Enterprise USA says.

Benefits

Walmart to Open More In-Store Medical Clinics

Walmart is slowly building a network of in-store clinics, believing it has a place in America’s health care system.

Payroll

Home Sales Decline in March

Sales of previously-owned homes in the U.S. fell in March from a one-year high, underscoring the lingering impact of high mortgage rates and elevated prices.

Small Business

Grocery Chains Try Small Store Approach in NYC

Trader Joe’s opened a relatively small store in March dubbed Pronto on 14th Street near Union Square in Manhattan.

Payroll

36% of Amercians Expect Debt when Planning Vacations

Of those who plan to travel this summer, more than 1 in 3 are willing to go into debt to pay for it, according to Bankrate.

Firm Management

How CPAs Can Compete in the AI Race

Here are a few principles every CPA firm can leverage to successfully compete with all firms in this dawning AI technology wave.

Auditing

EY Is the Busiest Among the Public Company Audit Firms

The Big Four firm audited 971 of the 6,607 public companies registered with the SEC in 2024, the most of any audit firm.

Financial Reporting

Survey Shows Divide Among Finance Pros When it Comes to the Future of Finance

60% of accounting and finance professionals surveyed say they identify as finance business partners, and 84% of those are extremely optimistic about the future of the profession.

IRS

If You Missed It, Here’s the IRS ‘Dirty Dozen’ Tax Scams List For 2024

The list serves as a reminder to remain vigilant about tax scams not only during tax season, but all year long, the IRS said.