Sales Tax

2014 Review of Sales Tax Systems for Small Businesses

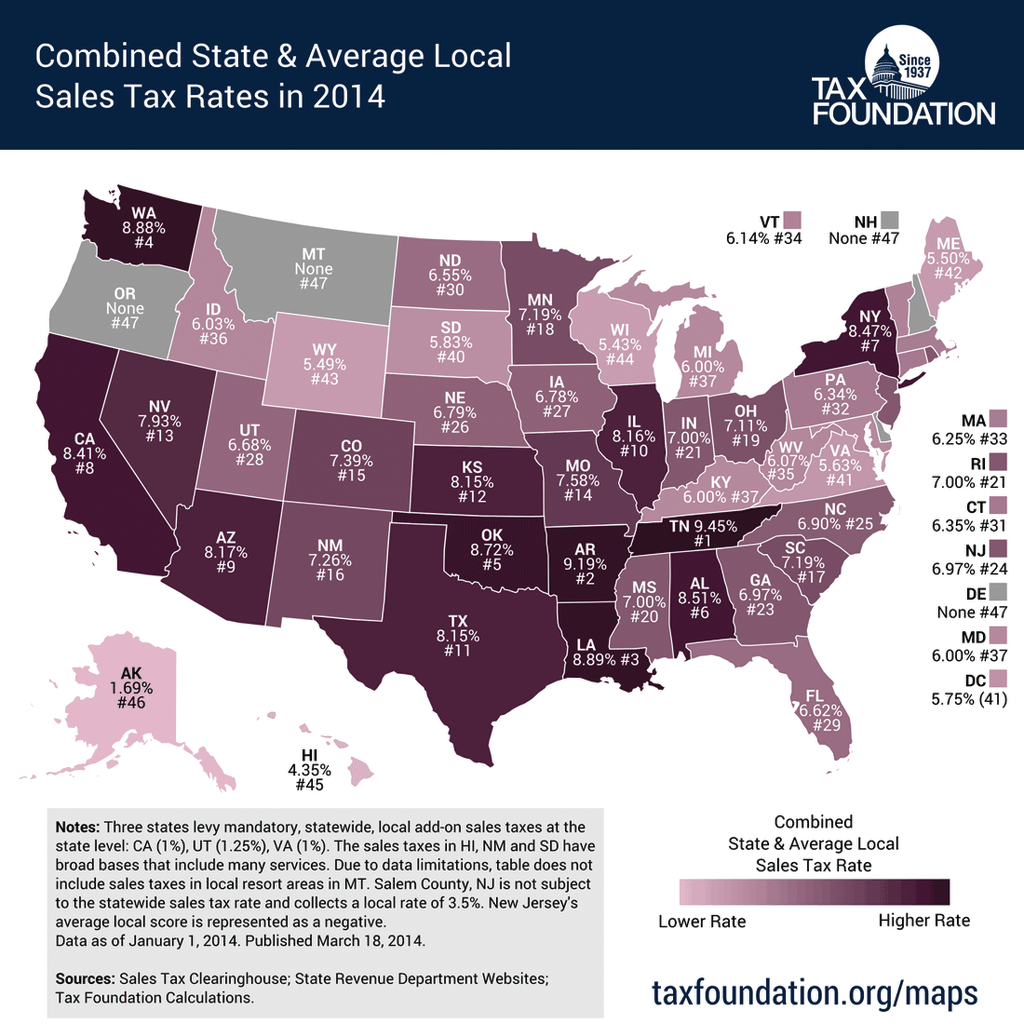

Sales and use tax is a key source of government funding in most states. Unlike property tax and state income tax, however, the legislators and regulators have adopted a patchwork of different rules which affect the taxability of the items. In addition to dealing with statewide tax rates in 45 states, 38 states levy sales taxes based on the borders of cities, counties, and special districts.

Jun. 11, 2014

Sales and use tax is a key source of government funding in most states. Unlike property tax and state income tax, however, the legislators and regulators have adopted a patchwork of different rules which affect the taxability of the items. In addition to dealing with statewide tax rates in 45 states, 38 states levy sales taxes based on the borders of cities, counties, and special districts.

These borders are often created through thousands of selective annexation, gerrymandering, and the ongoing actions of voters and local elected officials. For example, in my home state of Tennessee, livestock feed sold to farmers is tax exempt, while dog food and people food are both taxable. The borders of cities are a crazy quilt that is the result of political whims through history, and different tax jurisdictions (and rates) may apply to different locations for a single business location. Because of these challenges, sales and use tax compliance is one of the most significant challenges for many businesses.

Our review of sales and use tax compliance solutions is broken down into two segments:

- Rates and Forms Tools, which provide users with current tax rates and interactive forms for most US jurisdictions, but do not allow electronic filing of data.

- Sales Tax Preparation Solutions, which are designed to calculate and prepare sales and use tax returns. These applications will generally be used by firms and small businesses who would like to prepare their own sales tax returns.

- Integrated Sales Tax Rate Engines are databases which use address data and geolocation to identify and calculate sales tax rates on transactions entered into the Company’s ERP application. These tools require a significant amount of configuration so they can produce accurate tax calculations for each transaction. As a result, these systems are normally limited to midsized or larger organizations with complex tax requirements and difficult tax calculations.

Comparing the solutions is a challenge, as one of the offerings is a tool for filling out forms suitable for any taxpayer, and a different offering in the same review is used almost exclusively by multistate and multinational organizations with billions of dollars in sales.

The challenge for the practitioner is not finding a solution which will meet the needs of a Fortune 500 company, nor is it finding a tool to fill out forms. There will always be tools like this which are either “too big” or “too small” for the needs of small and midsized businesses. The hard part of software selection in this segment is finding the “Goldilocks” solution – that is, the one that is “just right” for the needs of the firm and the client.

Because we reviewed such a wide range of systems, we did not assign our traditional “star” ratings, but have instead tried to communicate strengths and limitations for each package so that the reader can use these comments to help them determine which solutions are most appropriate for the needs of their firm and their clients.

We reviewed the following solutions:

Rates and Forms Tools

- Bloomberg BNA Sales & Use Tax Forms & Rates

Sales Tax Preparation

- Avalara TrustFile Sales & Use Tax

- CCH Sales Tax Returns Online

- CFS Tax Software CA & NY Sales Tax Preparer

Integrated Sales Tax Rate Engines

- Avalara AvaTax Calc

- CCH CorpSystem Sales Tax SaaS Core/PLUS/PRO

- Thomson Reuters OneSource Indirect Tax (sidebar only)

One interesting area where Avalara, CCH, and others are extending their products is to incorporate exemption certificate management tools. These portals allow outsiders to submit an image of their scanned exemption certificate to the organization, which is reviewed by a human, and is tagged with an expiration date by an employee. When that certificate expires, the company is prompted to request a new certificate, and the system tracks when the new file is received.

Storing this data online makes it possible for state departments of revenue (when permission from the taxpayer is granted) to review the exemption certificates for customers from the comfort of their own office cubicles instead of having to go on-site to see the items.

While sales tax rules and regulations are not becoming any easier, the tools for helping clients comply with the law are becoming much more robust. Read our review summaries below and the detailed reviews on our website at www.cpapracticeadvisor.com and gain insight which you can use when evaluating alternative solutions.