Accounting

W-2 and 1099 Systems Help Accountants and Businesses Stay Compliant

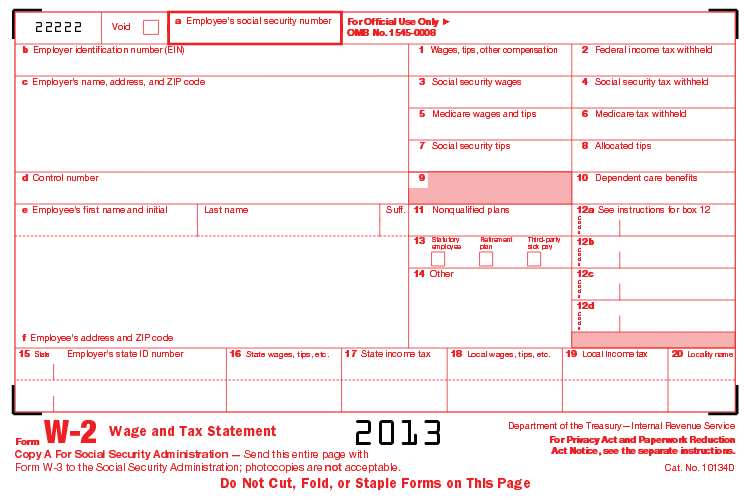

2013 Overview of W-2/1099 Preparation Software

Oct. 30, 2013

From the Nov. 2013 issue.

Another year is coming to an end, which means tax and accounting professionals and their clients have to prepare for the annual process of year-end wage and information reporting. W-2 and 1099 forms must be filed no later than January 31, making sure recipients will receive their individual forms in time to prepare their personal tax returns.

In addition to managing wages for regular employees and staff, businesses must also keep track of all monies paid to outside individuals and contractors. They are required to file a 1099-MISC for every person they have paid at least $600 for services, prizes and awards, medical and healthcare payments or other income payments.

Also, in addition to keeping track of money paid out, employers also need to stay informed of the latest updates and requirements for wage reporting. For many businesses, their tax and accounting professional is available to answer these questions and more. In addition, many of the companies that make W-2/1099 preparation software are also determined to provide their customers with the necessary resources, tools and information needed to make the reporting process as simple and easy as possible.

For example, under the Affordable Care Act, also known as ObamaCare, businesses are required to report the cost of health care coverage under an employer-sponsored group health plan. This requirement applies to businesses, tax-exempt organizations, and federal, state and local government entities, except for plans maintained primarily for members of the military and their families.

Many of the products included in this year’s review feature built-in electronic filing capabilities, service bureau print and mail options, data import and rollover options. Vendors that offer printing and mailing services allow users to send copies of the completed forms to recipients without the hassle of dealing with stamps and envelopes. Other useful features include data accuracy checks and the ability to type directly onto a standard form, ensuring the right information is entered in the right place.

Each year, new products are released and old ones are revised, giving users countless possibilities. As with anything, the year-end wage and information reporting needs of each firm and their clients will vary from one to the next. Tax and accounting professionals and their clients should review any program before making a final selection to ensure the program has all of the features and capabilities they need to manage their process. As shown in this year’s reviews, there’s bound to be something for everyone.

This year's review includes both traditional (installed) computer programs, as well as cloud-based solutions. You can read the full review of each of these systems on our website at www.CPAPracticeAdvisor.com/11188294.