Firm Management

How Payroll and HR Can Be Profitable for Accounting Firms

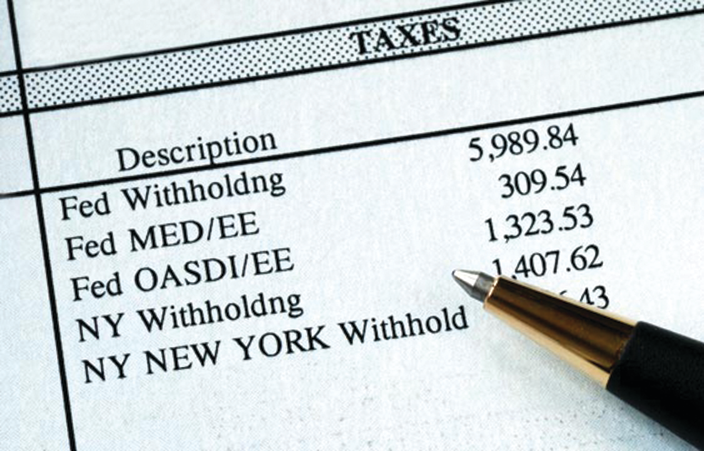

Payroll is not a four letter word. Human Resources (HR) is an additional opportunity to help clients and tie them closer to your firm and services. While many CPA firms use outsourced services for payroll and HR, technology has made providing these services easier and more profitable.

Sep. 12, 2014

Payroll is not a four letter word. Human Resources (HR) is an additional opportunity to help clients and tie them closer to your firm and services. While many CPA firms use outsourced services for payroll and HR, technology has made providing these services easier and more profitable.

By the time salaried workers are identified, hours worked and PTO are gathered and data entry has been completed much of the task is done. Yet many of us give up the profitability and control because of the perceived consequences of a four letter word: risk.

Consider that clients that are using three or more services from you are less likely to consider changing professionals. If your firm only does compliance work, then at best you typically only offer two services. You may have a consulting group that works on merger and acquisition or a litigation support group that assists on court actions, but once the tax and audit work is done, so are you.

This publication, and myself as an author and consultant, have spent many hours and much writing on the benefits of a collaborative accounting practice. If you are doing collaborative accounting, payroll and HR can extend these services for more profitability. Even if you aren’t doing collaborative accounting, payroll and HR can give you a year-round profit stream that provides marketing opportunity as your firm is in contact with clients on a recurring, regular basis.

Consider how you’d like your payroll and HR service offering to work:

- Completely outsourced to a provider,

- Partially outsourced to a provider,

- Completely in-house.

Considerations to maximize profitability and to minimize internal firm stress include:

- Charging for services before they are provided with recurring ACH billing,

- Handling all transactions electronically through a portal,

- Providing a way for the client to do the data entry,

- Requiring the information for a payroll run at least 48 hours in advance of processing,

- Setting up all employees, even the non-banked, to receive payment electronically,

- Maintaining a self-service portal for employees and employers,

- Pricing competitively to win the service, but not necessarily the lowest. Remember you have value from being local and understanding the business.

- Set up consistent procedures,

- Cross train team members to provide the service,

- Have at least an annual review of your offering with the client.

Consider the Solutions

There are a number of software publishers that have exceptionally good offerings. Based on limited space in this article, we won’t cover every good offering. We are simply listing good examples. For additional choices, review these sources: http://www.cpafirmsoftware.com/software-solutions/11-solutions/105-payroll-products and http://www.accountingsoftwareworld.com/industry-solutions/human-resources.

Completely outsourced – These providers tend to carry all of the workload and risk of payroll. There typically is substantial sophistication in the application to handle many different situations. Examples include:

- ADP – http://www.adp.com/solutions.aspx

- HKP – http://hkpayroll.com/

- Intuit – http://payroll.intuit.com/payroll-services/fullservice-payroll

- myPay – http://cs.thomsonreuters.com/mypaysolutions/

- Paychex – http://www.paychex.com/articles/payroll-taxes/five-reasons-to-outsource-payroll

Partially sourced – These providers give you tools that allow you to process payroll efficiently, often through a browser, and provide supplemental services as needed.

- ADP – http://www.adp.com/solutions/small-business.aspx

- Intuit – http://payroll.intuit.com/payroll-services/enhanced-payroll/

- Paychex – http://www.paychex.com/articles/payroll-taxes/five-reasons-to-outsource-payroll

- Payroll Relief – http://www.accountantsworld.com/solutions/payroll-relief

In-house – These provider’s tools are installed in-house, and updated frequently. These are more traditional payroll processing systems updated for today’s needs.

- Adaptasoft – http://www.adaptasoft.com/

- CYMA Payroll and HR – http://www.cyma.com/cyma-accounting-modules/payroll/

- Intuit – http://accountants.intuit.com/payroll-payments/

- Optimum Solutions – http://www.optimum-solutions.com/

- Paycom – http://www.paycom.com/

- Paycor – http://www.paycor.com/

- Payroll CS – http://cs.thomsonreuters.com/payrollcentral/

- Sage HRMS – http://na.sage.com/us/sage-hrms

I have reviewed all of the providers listed plus many more. During the last three years, there have been notable changes and improvements in the software. Each payroll offering has unique features or capabilities. You need to consider what is most important to you. Examples include: 1) Price per employee/check, 2) Integration to accounting software, 3) Availability of HR module or capability, 4) Auto deposit, 5) Speed of entry, 6) Portal, etc. Make your own list of what is important to your firm. Do not assume that a product will necessarily calculate everything correctly for the jurisdiction, locality or industry of your clients. Ask!

What To Do

Conceive your business offering first, and then look for a tool that helps with that offering. You will find ideas and resources from the vendors. Look for groups that have successfully built payroll practices such as Payroll Vault or Honkamp Payroll. Ask what makes these practices profitable and valuable.

To be successful with payroll, you need to have enough clients to make it worthwhile. For most firms, ten clients are the minimum number to play, but 30 to 50 or more make this section of the practice more profitable, repeatable, and less disruptive. Further, if you are preparing your practice for sale, an active payroll and HR practice makes the firm more valuable than having compliance services alone. Is payroll and HR something than CAN make you more profitable while providing better client service?