Accounting

Employee vs. Independent Contractor: Do You Know the Rules?

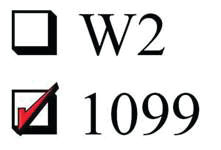

When you’re running a business and someone works for you or provides a service, you pay them. That’s easy. What isn’t always so easy is determining how you should treat those payments. Before you enter into a business relationship, it’s important to establish the type of relationship – is this person providing services as an independent contractor or an employee?

Aug. 12, 2014

When you’re running a business and someone works for you or provides a service, you pay them. That’s easy. What isn’t always so easy is determining how you should treat those payments. Before you enter into a business relationship, it’s important to establish the type of relationship – is this person providing services as an independent contractor or an employee?

The Internal Revenue Service recently updated its 20-question rule and the new checklist (which can be found on the IRS website at www.irs.gov/pub/irs-pdf/p15a.pdf) looks at the following 11 factors across three different categories to determine the degree of control and independence a worker has.

Behavioral control – Does the business have a right to direct and control how the worker does the task for which the worker is hired?

1. Instructions the business gives the worker. While the amount of instruction may vary by job, behavioral control may exist if the employer has the right to control how the work is performed. Generally, the business can control when, where and how an employee works, including specifying what tools and what equipment to use, where to purchase supplies and services, what workers to hire and what order or sequence to follow. Independent contractors usually control the terms of how and when their services are rendered.

2. Training the business gives the worker. Businesses usually train employees to perform services using a specific process, while independent contractors use their own methods.

Financial control – Does the business have a right to control the business aspects of the worker's job?

3. Extent of worker’s unreimbursed business expenses. Independent contractors are more likely to have unreimbursed expenses than employees. Fixed ongoing costs incurred regardless of whether work is being performed is a key factor. Keep in mind, however, employees may sometimes incur expenses related to services they perform for their business that are not reimbursed.

4. Extent of the worker's investment. Employees usually invest only their time in whatever work they are performing while an independent contractor heavily invests in the facilities and equipment they use when providing a service for someone else.

5. Extent to which the worker makes services available to the relevant market. Employees generally provide services to one entity – their employer. Independent contractors, on the other hand, usually advertise their services and are available to work for others simultaneously.

6. How the business pays the worker. Employees are usually paid a regular wage on a timely (hourly, weekly, yearly) basis, while independent contractors are paid per job, or other specifications outlined in the contract agreement. In some professions, such as law, independent contractors are paid hourly.

7. Extent to which the worker can realize a profit or loss. Independent contractors can make a profit or loss because they usually are responsible for the cost of doing business. Employers generally provide employees with a workplace and the tools, materials, equipment and supplies needed to work, so employees do not have an opportunity to make a profit or loss.

Type of relationship – What type of business relationship do the parties have?

8. Written contracts describing the relationship. The nature of the work relationship carries a greater weight than what the parties choose to call it. However, in situations of a close call, having a written contract can make a difference.

9. Employer-provided benefits. Businesses provide employees with benefits such as insurance, 401k and paid vacation while independent contractors must provide those benefits for themselves. In addition, independent contractors are responsible for paying all required taxes on their income, while employees share the tax liability with their employer.

10. Permanency. Employees are generally hired indefinitely while independent contractors are hired for a specific project or period.

11. Nature of services provided. When companies hire workers to provide services that are key aspects of their regular business activity, this usually indicates an employer-employee relationship. As such, businesses usually have the right to direct and control the worker’s work activities.

When classifying workers, it’s important to look at the big picture as misclassifying a worker can have huge tax and business ramifications. The biggest risk is the possibility of a worker reporting an anonymous claim to change classification. If this claim is approved, not only will your business be responsible for owed employment and social security taxes, but it is now also at an increased risk for IRS audits. Businesses are required to report wages above $600 paid to an independent contractor in one calendar year. If a worker submits a claim for misclassification, this reporting could trigger an IRS audit and potential penalties.

In some circumstances a business may have a valid reason for not treating a worker as an employee. In those instances, you may be relieved from having to pay employment taxes for that worker. In order to qualify for the relief, you must file all federal information returns on a basis consistent with your treatment of the worker and your business must not have treated any worker holding a substantially similar position as an employee for any periods beginning after 1977. Keep in mind that classifying an employee as an independent contractor simply to save time and avoid giving them benefits and paying employer taxes is not a valid reason. Publication 1976 provides more information.

The IRS also offers an optional program that provides businesses with an opportunity to reclassify their workers as employees for future tax periods for employment tax purposes with partial relief from federal employment taxes. Eligible employers can apply for the Voluntary Classification Settlement Program by filing Form 8952 and enter into a closing agreement with the IRS.

If you are unsure which classification a worker falls under, you can consult with an attorney or file Form SS-8 to receive clarification from the IRS. The IRS will review the facts and circumstances and determine the worker’s official status. This process, however, could take at least six months before a determination is received. Many businesses also find using a staffing firm helps them avoid potential misclassification issues. They are able to find skilled workers to help complete work, but the workers remain employees of the staffing firm.

As a reminder, it’s important to remember that there is no specific number of factors that classify someone as an employee or independent contractor. If you are having difficulty classifying a worker, it’s important to consult with a knowledgeable labor and employment law attorney.