The Journey from the Desktop to the New World

2012 was quite a year for the “maturing” of new world technologies in small business accounting, but to be clear, the “new world” is still in the future for most firms and clients.

Dec. 18, 2012

2012 was quite a year for the “maturing” of new world technologies in small business accounting, but to be clear, the “new world” is still in the future for most firms and clients. If you’re trying to straddle both worlds, you still have to keep abreast of products used by current clients while looking ahead to navigate your firm to success.

It’s not that there is anything wrong with this old world, except the old-world product designers never anticipated most of the technologies that today’s businesses must address. For example, Ecommerce, mobile, and paperless. The emergence of “chunkification of business processes,” zero-data-entry, and collaborative accounting services, has driven the accounting profession to focus on how it changes virtually everything about how we will run our practices in the coming years.

But before we get into my new-world tips, here are a few comments about QuickBooks 2013. For a deep dive into the features, see The Sleeter Group’s blog QuickBooks and Beyond, where Charlie Russell has posted a 17-part series of in-depth articles on QuickBooks 2013.

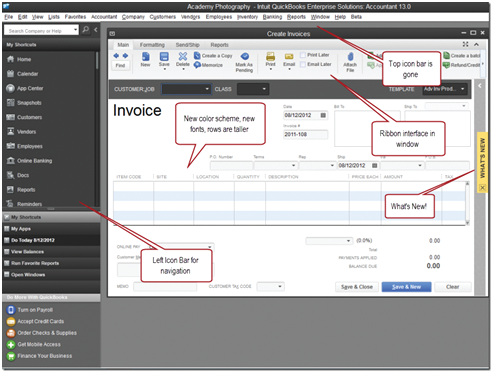

The most significant changes in QuickBooks 2013 include a completely redesigned interface, including new layouts, ribbons, customizable toolbars, a new color scheme, and several new features in the customer and vendor lists. Also, the QuickBooks Accountant version now allows accountants to electronically “send” journal entries to clients and import batches of data from Excel.

Overall, QuickBooks 2013 is a great improvement, not so much for the features, but for the new design that presents a consistent look and feel across the whole product. For people familiar with previous versions, there will be some adjusting to do at first, but in the long run, we believe those users will adapt and even prefer the new interface.

So, as QuickBooks Desktop editions (including Pro, Premier, Accountant, and Enterprise), continue to dominate today’s marketplace, the new world is drawing more attention of small business every day. Intuit sees this reality and is making even larger investments in the growing popularity of QuickBooks Online. At the same time, relatively new companies such as Xero are quickly grabbing new customers at the low end of the market, and building an impressive reputation in the global accounting community.

For some entertaining reading on the journey into the new world, check out the recent post by my good friend Chuck Vigeant. In his post, Election Results and the Pro-Advisor Community, Chuck pontificates about how the Intuit ProAdvisor community, Cloud Computing, and the change demographics of the US Electorate are intertwined in interesting ways. He talks about the emergences of “The New Entrepreneur,” who has a much shorter-term focus on building a business than in previous generations.

Anyway, on to the new world….

Imagine you could start your firm all over again.

- Would you buy servers, LANs, firewalls, and expensive software that only runs on Windows PCs? Would you buy dozens of file cabinets to store paper-based records? Would you buy high-volume copy machines, and high-speed printers?

- What about the phone system? Would you buy long-distance plans, or use hosted VOIP systems with forwarding to cell phones, speech to text messaging, and voicemail forwarding by email?

- Would you invest in a large client reception area? If you do, is it because you assume your clients will bring in their records, meet you in person, and pick up their printed financial statements and tax returns?

I find it amazing how many of my answers to the questions above are different today than they were even five years ago.

The firm that is just starting out has a many advantages over established firms because there are no legacy systems and processes to maintain or support. So those of us who do have legacy systems should urgently focus on how we can upgrade our practices and processes to thrive in the new world.

Although you may not be able to start all over again, here are 10 things that will help you in the new world of Internet, mobile, and collaborative client accounting.

1. Go Paperless and get your clients paperless.

My fellow columnist, Randy Johnston and Dr. Bob Spencer run a web site called www.totallypaperless.com that is filled with education and recommendations for taking your firm and your clients to a paperless environment.2. Use online meetings with clients including recording client consulting sessions. GoToMeeting.com, Google+ Hangouts.

Online meetings will dramatically enhance the client/accountant relationship. If you’re not doing them yet, make it a priority to begin meeting with your clients using these technologies.3. Get your clients’ QuickBooks hosted, or convert them to an online accounting program such as QuickBooks Online, Xero, Wave Accounting or Intacct.

The key is to get the client’s data centralized in a secure cloud-based data center, where both accountant and client can have anytime/anywhere access to the same data. And storing client data in the cloud is paradoxically MUCH SAFER than storing in your client’s servers and desktops. That may raise the hairs on the back of your neck at first, but if you choose a reputable cloud provider, you can increase the security of client data.4. Use Google Docs for collaborative document creation with clients and colleagues.

Whenever you have to collaborate on documents, spreadsheets, or presentations, GoogleDocs provides a free cloud-based system that allows you to securely share documents and collaboratively edit their contents.5. Using Dropbox, Box.com, Skydrive, Sharefile, or Google Drive to share files with colleagues and clients.

For secure transfer of documents between multiple computers, or between colleagues, these tools provide incredible value. Stop attaching documents to emails, and start using one of these sharing services.6. Use OneNote or Evernote to organize all of those bits of important information that you need to remember.

OneNote, which is included with Microsoft Office provides an electronic notebook that can be shared among all users within your network. You can use it with your on-premises windows servers, or use Office 365 to centralize your data in the cloud. Evernote is a similar product preferred by many users who do not “live” in the Microsoft Office world.7. Use Bill.com to take AR, AP, and Cash Forecasting to the cloud.

Bill.com completely streamlines your AP, AR, and Cash Management processes in a secure, paperless, cloud environment. No matter what type of business you’re in, Bill.com will dramatically improve your processes, improve internal controls, and reduce costs for paying vendors and receiving payments from customers.8. Learn what CRM and project management tools are going to help you in your practice. Method CRM, Results CRM, Zoho CRM.

CRM should be at the center of every business. Use CRM to track and nurture customer relationships.9. Using LiveScribe to produce full reports of client meetings including audio recording of the conversations.

The LiveScribe pen is an amazing tool for recording meeting notes, including synchronizing your note pad with an audio recording of the conversations.10. Use Dashboarding tools to develop deeper engagements with clients. QQube, Profitsee, WebKPI, Corelytics.

Dashboards are what your clients really want you to provide for them. Using any of several tools, you can create a whole new type of service for your clients. Give clients actionable intelligence from their accounting data and help them interpret the data in periodic consulting sessions.