Firm Management

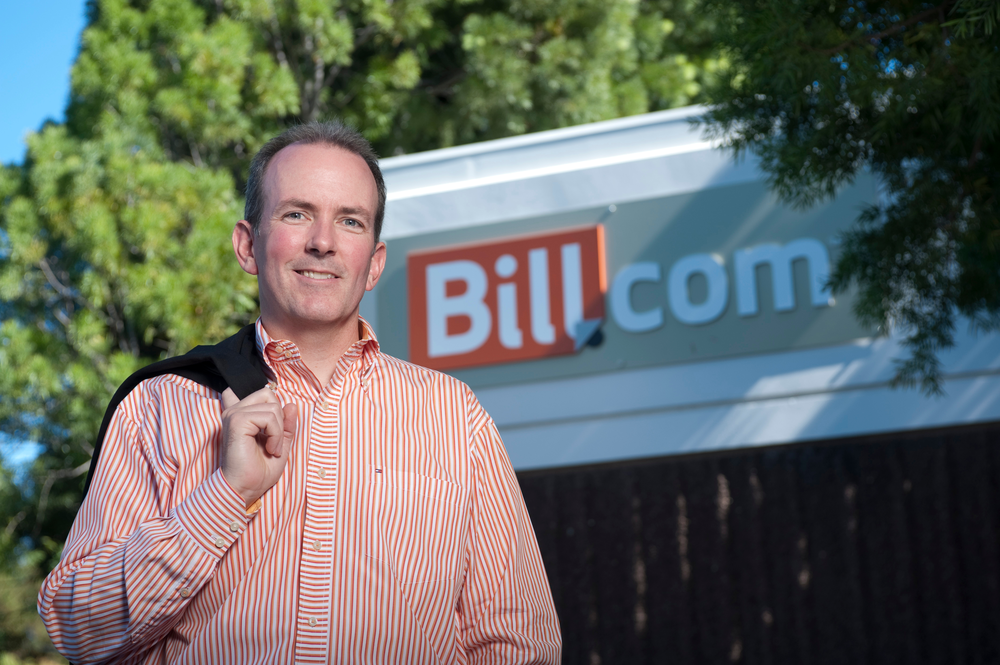

René Lacerte – Insights from a Fourth-Generation Entrepreneur

There is a good lesson here for small firms. It’s been my experience that many firms are challenged in the areas of hiring the right people and applying the appropriate level of leadership to allow staff to expand business. Instead, many small firm owners build their business around their individual skill set and then wonder why their business model depends so heavily on them.

Nov. 26, 2012

René Lacerte – Insights from a Fourth-generation Entrepreneur

After assuming the role of Executive Editor at CPA Practice Advisor in 2009, I had the great pleasure of meeting René Lacerte at an accounting trade show. I struck up a conversation with him and positive rapport was immediate.

Over the next four years, we became trusted colleagues and good friends. René is clearly one of those leaders who has a profound understanding of technology, the accounting profession, and business in general, which makes him an excellent selection for our spotlight executive series.

At the time René and I met, he explained how he had just removed himself from day-to-day management of his then online payroll company, PayCycle. He also explained that he was simultaneously launching a new business—Bill.com.

With the mindset of a true entrepreneur, René first identified specific issues and then developed the solutions to solve those issues; launched his companies; hired qualified, good-culture-fit employees; and provided the needed leadership that allowed his staff to grow the business.

There is a good lesson here for small firms. It’s been my experience that many firms are challenged in the areas of hiring the right people and applying the appropriate level of leadership to allow staff to expand business. Instead, many small firm owners build their business around their individual skill set and then wonder why their business model depends so heavily on them.

I recently sat down with René and talked with him about his background, how he has grown his two companies, and what he sees as the future of technology in the accounting profession.

Darren: René, tell me a little about your background.

René: I’m a fourth-generation entrepreneur, so it runs in my blood. Since the late 1950s, the majority of my family’s businesses have offered services for accountants and small businesses. I grew up learning about the challenges of managing cash flow, often around the kitchen table from my father and grandfather.

After getting a bachelor’s degree in economics and a master’s in industrial engineering, I worked at Price Waterhouse as a staff accountant and then a consultant. I remember that the recruiting partner made the comment that the language of business is accounting.

That made perfect sense to me. I learned a ton at Price Waterhouse, but then that genetic itch to build something of my own overtook me. For a bit, I satisfied this itch by working for my parent’s payroll company, Certa Data Corporation. By the late 90s, I was working for Intuit where I was responsible for the bill payment, bill presentment, and payroll initiatives.

This only fueled my desire to start my own company, so I left Intuit in 1999 to launch PayCycle, which became the #1 online payroll solution (and was acquired by Intuit in 2009).

During my PayCycle years, I experienced the frustration of managing cash flow using manual, spreadsheet-dependent processes that often led to a lot of human error. I wanted to build a business, not battle spreadsheets, so with this newfound insight, I launched Bill.com to solve the problems I experienced running PayCycle.

Darren: Why did you decide to create solutions for the accounting profession and its clients?

René: As I mentioned earlier, I grew up in a family that offered services to accountants. The night I was born, my mom was sorting punch cards for one of the largest accounting firms in Washington D.C., so I was quite literally born into it.

Ultimately, though, I love finance and helping people improve internal efficiencies. Also, I want to provide the profession with the right technology to support them in adding even more value to their services.

Darren: Where did you get the idea to deliver PayCycle through accounting firms?

René: This is a great question. I remember the day we came up with this. It was at the Los Altos office. We had just learned that our original strategy for PayCycle had some legal issues, and that meant we needed to change course.

I went for a walk with my co-founder Martin Gates to discuss options. While walking, we discussed how many firms perform payroll because they felt they had to in order to keep a client…not because they wanted to. We discussed the power of the Internet and how it would allow firms to become mini-payroll service firms. We were very excited. That day, I visited my accountant and started our first focus group.

Darren: Today there are many web-based solutions. Of course, you were using the Web as a delivery platform years ago. How did you know 10 years ago that this was the way to go?

René: I realized the power of the Web in 1995 while at Intuit. We were reviewing Checkfree, and I realized that services were way more powerful than software, and that the Internet was the ultimate platform. As I launched PayCycle, I further realized that cloud services were so much more than anytime-anywhere access.

The Internet brought about the democratization of services that were previously reserved for accountants and businesses with lots of money. The cloud was a game changer—leveling the playing field.

Darren: After exiting PayCycle, you immediately started Bill.com. Where did you get the idea for this service?

René: PayCycle was growing fast and I had lots of bills to pay. The early lessons offered by my family became very clear—mainly that cash is king, and I needed to stretch out the payables and pull in the receivables.

The process at PayCycle was manual and slow. Every Friday, our office manager brought me a stack of checks with invoices attached. Often documents were missing, approvals were non-existent, and bills were paid late. I started to brainstorm for a solution to address these pain points. That solution was Bill.com.

Darren: What were your biggest challenges in getting Bill.com to where it is today?

René: Bill.com defines a new category of service focused on cash flow command and control. Being a new category, it has been a challenge to communicate the value. We are not accounting or bookkeeping.

We are not bill paying or invoicing. Yet, we do all these things directly or indirectly. This makes it difficult for people to understand and take the leap to adopt Bill.com. Add in that the profession is only just adopting cloud technologies, and that adds to our challenge.

Darren: What is your vision of how accounting firms should be using Bill.com, and how do you see that evolving over the next few years?

René: With Bill.com, accounting firms have more controls, built in audit trails, complete transparency for every transaction, and the ability to collaborate with their customers. I believe that as accountants continue to adopt Bill.com, they will find they can offer more strategic insight to clients while also alleviating clients of the complexities of accounting.

This represents a huge opportunity for firms. Moving forward, as more and more firms experience the power of the cloud, they will bring in more small business clients. The result will be more collaboration among firms, clients, and vendors—and accountants will be at the center of that collaboration.

Darren: At what point to you see more firms being cloud-based opposed to desktop-based?

René: I believe that businesses follow consumers. As consumers use more cloud apps, such as banking, social, email, or general search, they will expect similar functionality in working with their accountant. Let’s take online bill payment as an example. I think it is safe to say that most consumers are using online bill payment for some if not all of their bills.

People are starting to ask: Why do I have to write a check at the office? Why can’t I pay vendors electronically? That pressure is building, and I believe that in the next three to five years we see a massive change over. Further, I believe that in the next five to ten years more work will be performed in the cloud then on the desktop.

Darren: Do you think clients will push firms to move to a collaborative environment or do you think accountants will be the primary source to move clients along the collaborative path?

René: It takes both to make collaboration work. I do think clients will push somewhat. However, in the short term, I think it is the early adopter—whether that’s the firm or the client—that will do the pushing. We have accountants that push all their businesses to collaborate using Bill.com, and we also have business clients that push their accountants to us.

Darren: You are very close to the accounting profession. What advice would you give a practitioner on positioning their firm for the future?

René: One of the key lessons I’ve learned over the years is that you either lead or you follow. The cloud is a major technology innovation that allows accountants to lead their clients. The cloud supports real-time collaboration and enables firms to position themselves as leaders and strategic advisors, so it’s imperative for accounting professionals to seek out and implement the technology that moves their processes to the cloud.

Darren: You live and work in the heart of Silicon Valley. How does your location impact the strategic direction of Bill.com?

René: Technology moves really fast here. There are so many opportunities to learn from investors, peers, and other companies, and I believe that it gives us a unique advantage. There are many venues to share learning about strategy, technology, and management techniques, so you really absorb a great deal of education by default.

For example, the social nature of many consumer companies definitely influences how we think about collaboration and social at Bill.com. Also, at the core of Silicon Valley, is the belief that failure is not just okay, but it’s a good thing. This means that leaders here take risks, try new ideas, and genuinely enjoy the journey.

This impacts us in many ways. Most obvious to us is in the people we hire. They expect the management team live up to the culture of Silicon Valley. So, we work hard to ensure that we do.

Darren: What’s the biggest challenge you see facing accountants and their firms today?

René: I think the biggest challenge is making the migration from the static, non-collaborative tools to the dynamic, collaborative tools that are readily available. For example, every accountant should have an extremely user-friendly portal to share tax documents with clients.

The tools are out there, but it means switching processes and learning new things. That is always hard. The good news is that companies like Bill.com are focused on making that transition very easy.

Darren: What’s the biggest technology business trend that you see from where you sit?

René: I think the social trend is just getting started. While I don’t spend as much time being “social” as others, I understand the power of it. Social media has become a part of the fabric of society in a very short timeframe.

At Bill.com, we create collaboration with employees, accountants, customers, and vendors. This is, in a way, the social side of business. I believe the value in social collaboration is immense, and we are just seeing the beginning.

Darren: What do you see as the biggest consumer trend?

René: Again, my answer is social. More broadly, I would say that the cloud is creating the democratization of information never imagined before. Social on the consumer level is the democratization of your personal life.

Social on the business level is the democratization of your business life. That means transparency when you want, with whom you want, and how you want.