Are You Offering 8949 Verification Services to your Clients?

By offering 8949 verification services, tax professionals could realize more opportunities to expand their clientele and business.

Oct. 17, 2012

As tax season nears, there’s a lot of talk about the issues that many tax professionals and their clients face, such as the changes to tax reporting. New requirements have changed the way brokers and investors file forms with the IRS.

Under the new law, brokers are required to report cost basis information on the 1099-B form. Likewise taxpayers must file a Schedule D and the new 8949 form. However, there discrepancies may exist between what brokers report and what investors report. This is largely in part due to changes in reporting, such as how cost basis is determined. For example, previously it was common practice to decide which stock was sold, after the sale had taken place. The new law requires that investors decide what they are selling no later than the settlement date of sale. These changes apply to the reporting of securities purchased January 1, 2011 or later and stocks purchased January 1, 2012 or later. It will apply to mutual funds, effective January 1, 2014.

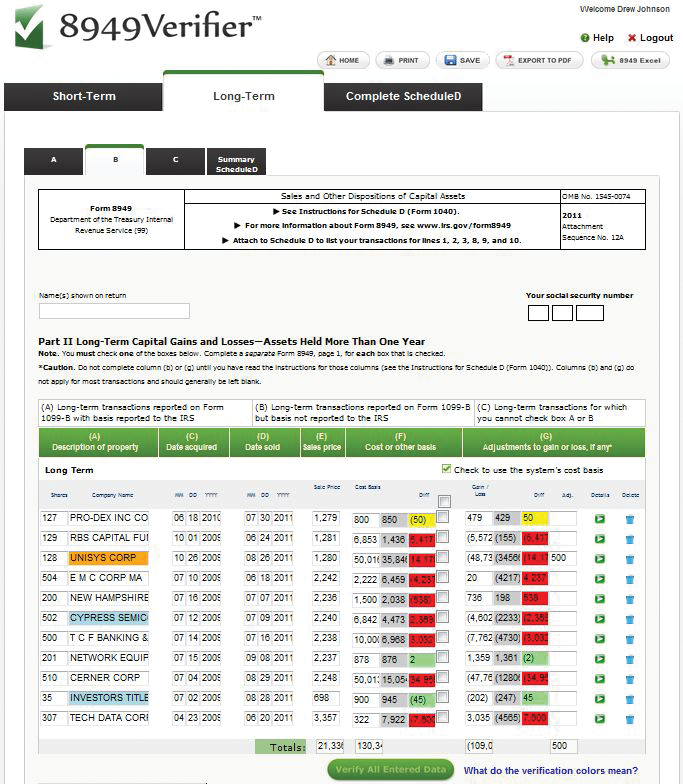

Tax professionals and their clients continue to face issues arising from reconciling 1099-B and 8949 forms. One company, NetWorth Services, offers a solution to help professionals complete and verify their clients’ 8949 forms. 8949 Verifier is powered by the company’s Netbasis, a cost basis calculation solution.

8949 Verifier works directly with Netbasis to verify the information entered into the 8949 form. The solution uses Netbasis’ cost basis calculations to determine the deviation from comparative benchmark figures and color codes the client’s tax form accordingly. The red, orange, yellow and green codes alert professionals to the level of variance present as well as the occurrence of a wash sale.

In addition to color-coded alerts, 8949 features simple upload capabilities using CSV format and a virtual 8949 form, making it easy for professionals to verify the data is entered correctly. Fields include client’s name, social security number, company’s name, description of shares, date bought, date sold, sale price and cost basis. The solution contains data and information dating back to 1925 and uses it to check the cost basis. Users also have access to training materials and tutorials as well as scripts and email templates to use with clients.

The level of accuracy that 8949 Verifier provides could help professionals expand the services provided to clients. Instead of offering simple filing services, which are available through DIY software, tax professionals can offer 8949 verification and completion. In addition, there is an opportunity for professionals to consult year-round with their clients concerning the methodology used in selling stocks and address other investment issues, avoiding surprises that may arise at tax-time.

“According to the Celent White Paper, “Cost Basis Reporting: Additional Revenue for Tax Professionals,” there is $450 million worth of potential revenue being left on the table,” said Nico Willis, President and CEO of NetWorth Services. “Tax professionals need to take advantage of this by offering their services in an area that isn’t being served. 8949 Verifier makes it easy for professionals to add 8949 verification to their list of services available.”

The addition of the 8949 form, as well as changes to the reporting process, made for a challenging tax season this past year. As questions and issues continue to arise, there is no doubt that an opportunity has been created for tax professionals to better serve their clients in a new way.