BNA, Inc. — BNA Tax and Accounting Center

Nov. 03, 2011

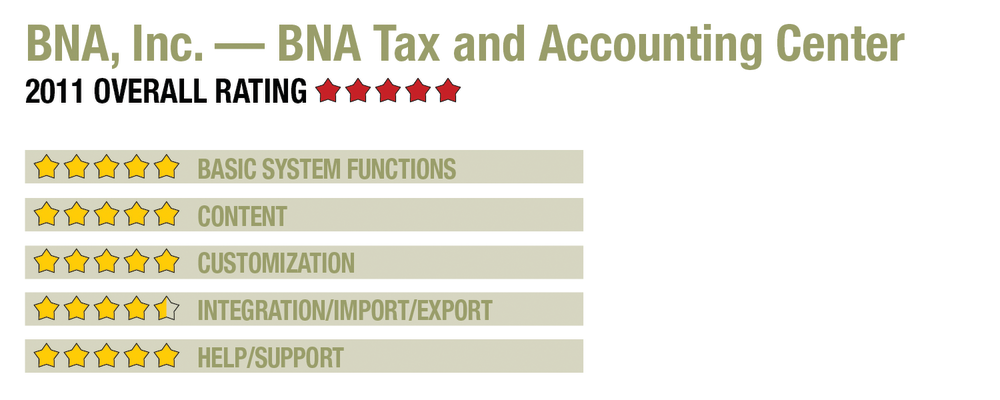

2011 Overall Rating 5

Best Fit

Tax, accounting and legal professionals who want the practitioner view as well an an editorial view of tax law.

Strengths

- Research portfolios authored by respected practitioners & educators

- Clean, easy-to-use interface

- High level of program & newsletter customization

Potential Limitations

- No native integration with third-party tax preparation products

SUMMARY & PRICING

BNA is a leader in research, news and guidance for tax, accounting and legal professionals. BNA Tax and Accounting Center includes a comprehensive set of research tools and covers a variety of tax, planning and accounting topics. The core function rests on the BNA Portfolios, each authored by respected leaders and experts within their respective practice areas. These portfolios are exclusive to BNA subscribers and offer a distinctive advantage over other research options. The portfolios, coupled with a clean and easy-to-navigate platform, make BNA Tax and Accounting Center a quality choice for tax, accounting and legal professionals. Pricing is dependent upon the number of users, but a single-user login starts at about $800 for a basic library and about $3,000 for a library including the U.S. Income Portfolios.

BASIC SYSTEM FUNCTIONS 5

CONTENT 5

CUSTOMIZATION 5

INTEGRATION/IMPORT/EXPORT 4.5

HELP & SUPPORT 5