Sage Software — FAS 100

Nov. 02, 2011

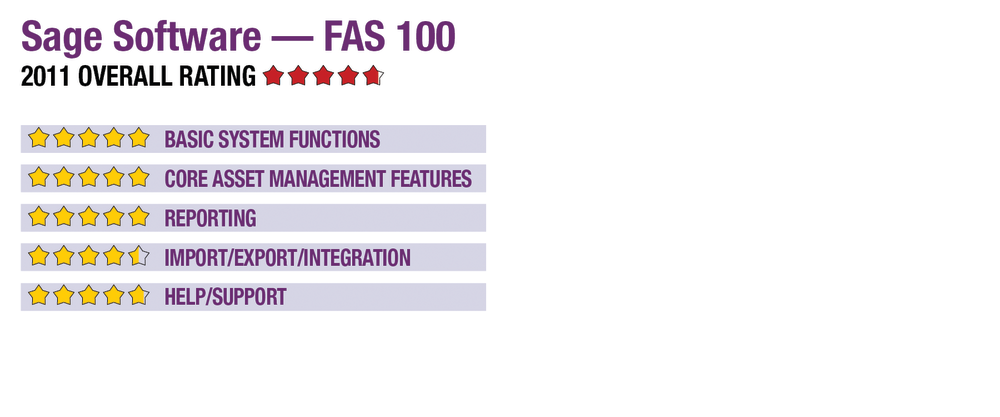

2011 Overall Rating 4.75

Best Fit

Mid-sized or larger organizations, or professional firms managing the assets of such entities, who have increasingly complex asset depreciation needs and departmental management requirements.

Strengths

- Excellent customization & assistive features

- Global edit capabilities

- Support for all asset types & disposal needs

- Strong reporting options & output formats

- Optional barcode scanning for physical audits/inventory

Potential Limitations

- Live support is free during initial use, but then requires a support subscription.

Summary & Pricing

The redesigned interface for Sage FAS is exceptionally user-friendly, with simple customization and drag-and-drop functionality. The new Assistance Center further eases program use. The FAS 100 system offers comprehensive asset management, depreciation and tracking capabilities, with strong reporting for firms that manage entities with fewer than 20,000 assets. Pricing starts at $2,385 for FAS 100; FAS 50 starts at $1,495.

Product Delivery Methods

_X_ On-Premises

___ SaaS

___ Hosted by Vendor

Basic System Functions 5

Core Asset Management Features 5

Reporting 5

Import/Export/Integration 4.5

Help/Support 4.75