Thomson Reuters – Planner CS

Oct. 06, 2011

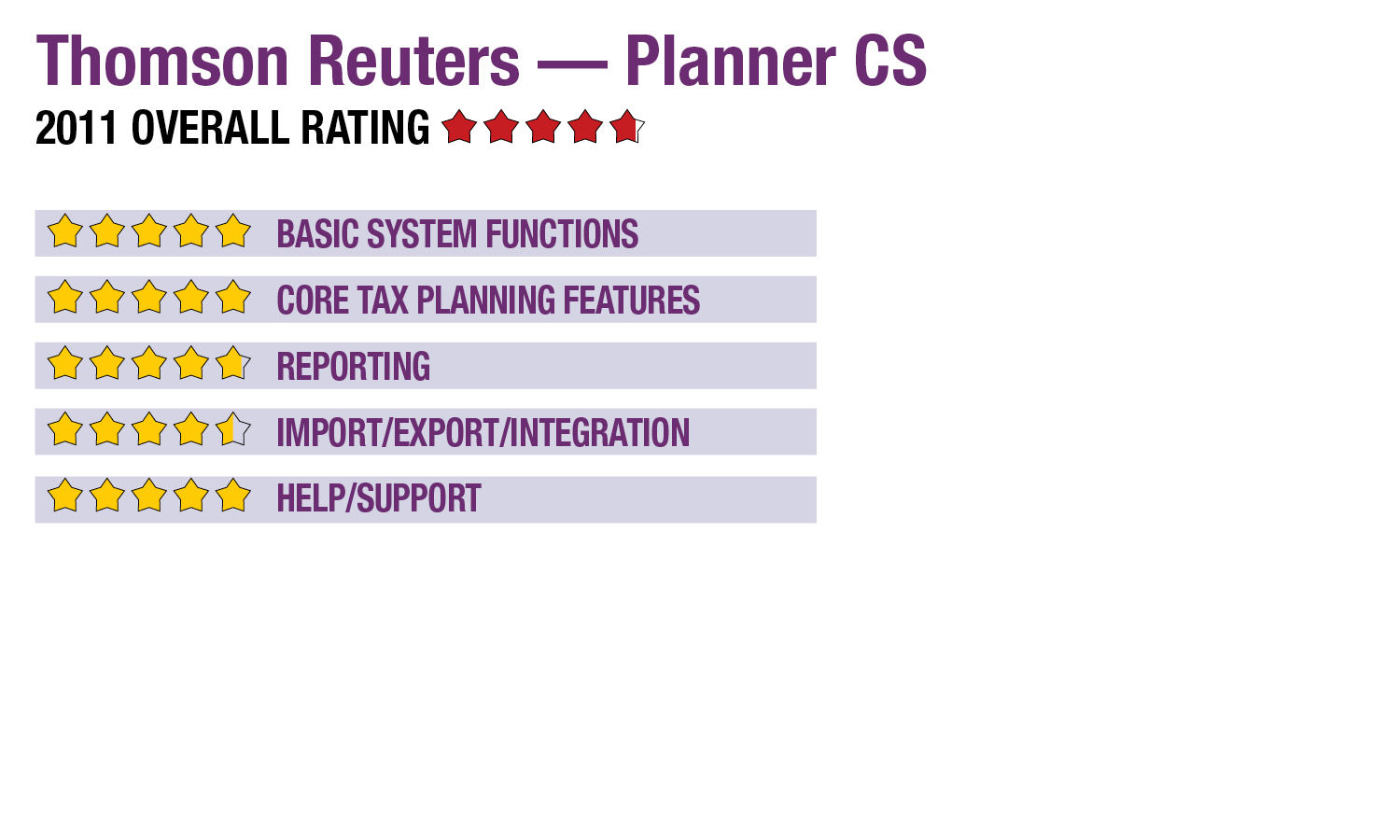

2011 Overall Rating 4.75

Best Fit

With tight integration among the tax preparation, research, document management, portals and other solutions from Thomson Reuters, Planner CS is best suited to users of the vendor’s CS Professional Suite, but can also be valuable as a stand-alone system.

Strengths

- Includes tax code for federal & all income taxing states

- Special Watch Window & Results Finder Tools

- Seamless integration with tax, document management, portals

- Comprehensive calculations & analysis features

- Unlimited years of projections

- Excellent customizable reporting

Potential Limitations

- Limited data output formats

Summary & Pricing

Planner CS is an exceptional scenario-based tax planning solution, with features and tools that are capable of handling the most complex high income clients. The system is built upon a solid base of federal tax law, as well as code for all income-taxing states. With tight integration among the tax preparation, research, document management, portals and other solutions from Thomson Reuters, Planner CS is best suited to those users, but can also be a valuable addition as a stand-alone planning program. Pricing starts at $655 for the federal-only system, with states addable as needed.

Product Delivery Methods

_X_ On-Premises

_X_ SaaS

___ Hosted by Vendor

Basic System Functions 5

Core Tax Planning Features 5

Reporting 4.75

Import/Export/Integration 4.5

Help/Support 5